Carl Icahn Takes Over $1.6 Billion Loss on Embattled Hertz

Carl Icahn (Trades, Portfolio), founder of Icahn Capital Management and board chairman of Icahn Enterprises LP (NASDAQ:IEP), disclosed this week that he sold out of Hertz Global Holdings Inc. (NYSE:HTZ) at a significant loss according to GuruFocus Real-Time Picks, a Premium feature.

The investor takes activist positions through three investing vehicles: Icahn Partners, American Real Estate Partners and Icahn Management. Regarding his style, Icahn buys companies that are not glamourous and usually out of favor, going against the consensus trends. GuruFocus tracks the Icahn Management equity portfolio, which also contains the stocks owned by Icahn Partners.

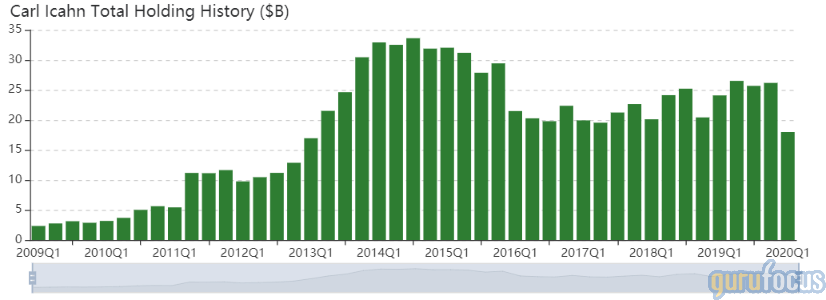

As of the March quarter-end, Icahn's $18 billion equity portfolio contained 19 stocks with a 6% turnover. The sale of 55,342,109 shares of Hertz trimmed 1.90% of the equity portfolio.

Transaction background and details

Icahn said in a statement on Tuesday that he has been an investor and supporter of Hertz since 2014, establishing a 7.76 million-share stake in the Estero, Florida-based company during the third quarter of that year. The investor escalated his position in Hertz to 55,342,109 shares with an aggregate purchase price of over $1.8 billion according to a March filing.

Due to the coronavirus outbreak, which as of Thursday had infected over 1.69 million people and resulted in over 100,000 casualties in the U.S. according to John Hopkins University statistics, demand for travel dramatically declined during the past several months as states enacted shelter-in-place orders. Icahn noted that Hertz "encountered major financial difficulties" stemming from the decline in travel and supported the board's "conclusion to file for bankruptcy protection."

A transaction analysis using GuruFocus' My Portfolios feature computes a loss of approximately $1.645 billion on the investment. Despite selling his equity stake "at a significant loss," Icahn said his sale does not mean he no longer has faith in the company. He believes that the Chapter 11 reorganization plan can help resurrect Hertz; further, Icahn intends to follow the reorganization "closely" and "access different opportunities to support Hertz in the future."

Company's financial strength and profitability metrics suggest inevitable financial distress

Figure 1 illustrates a snapshot of Hertz's summary page, highlighting the company's low financial strength and profitability.

Figure 1

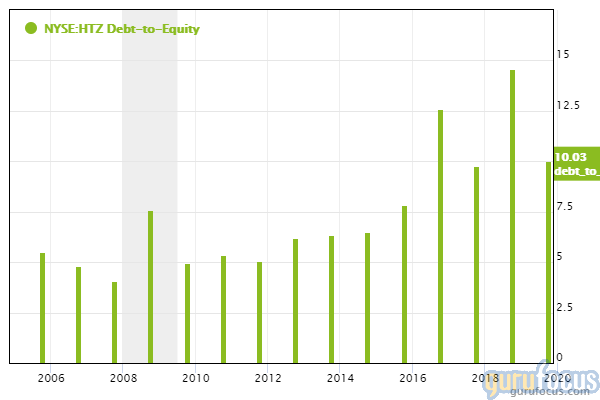

As Figure 1 illustrates, GuruFocus ranks Hertz's financial strength a low 3 out of 10 on several red flags, which include a low Altman Z-score of 0.5 and interest coverage and debt ratios underperforming over 96% of global competitors. Additionally, Hertz' interest coverage of 0.68 is significantly below Benjamin Graham's safe threshold of 5 while its debt-to-Ebitda ratio of 5.59 exceeds Joel Tillinghast's warning threshold of 4. Adding insult to injury, Hertz's cash-to-debt ratio of 0.05 suggests the inability to pay debt using just cash on hand.

Hertz's profitability ranks 4 out of 10, weighed down by returns underperforming over 70% of global business service companies and a three-year average revenue decline rate of 4.60%, a rate that underperforms 80.73% of global peers. The combination of weak balance sheet and income statement ratios contributes to a near-90% probability of financial distress over the next year according to the Campbell, Hilscher and Szilagyi model.

See also

Icahn's top five holdings as of the March quarter include a 53% equity portfolio weight in his company Icahn Enterprises and a weight between 5% and 7% in each of CVR Energy Inc. (NYSE:CVI), HP Inc. (NYSE:HP), Herbalife Nutrition Ltd. (NYSE:HLF) and Occidental Petroleum Corp. (NYSE:OXY).

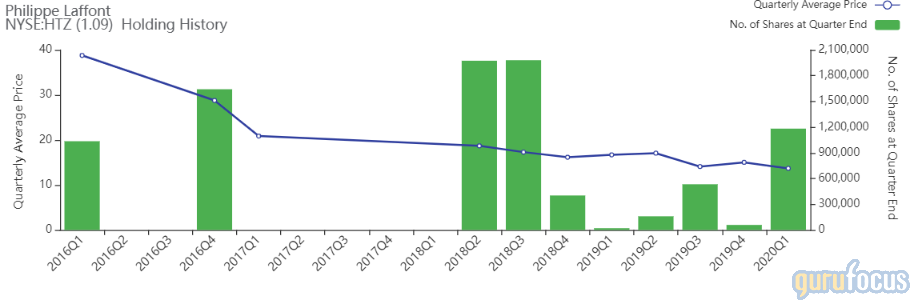

Gurus who are still clinging onto Hertz as of the March quarter include Jim Simons (Trades, Portfolio)' Renaissance Technologies, Mario Gabelli (Trades, Portfolio)'s GAMCO Investors Inc. (NYSE:GBL) and Philippe Laffont (Trades, Portfolio)'s Coatue Management.

Disclosure: The author has no positions in the stocks mentioned. Except for Icahn's sell in Hertz, the mention of stocks in this article reflect the holdings as of the March quarter and do not include any trades the gurus might have made in April or May.

Read more here:

Seth Klarman's 5 Largest Holdings as of the March Quarter

Francis Chou Slims 4 Positions in the 1st Quarter

Warren Buffett's Top 5 Holdings as of the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.