Carl Icahn's Bold Exit from Xerox Holdings Corp with a 3.29% Portfolio Impact

Insights into the Activist Investor's Latest 13F Filings for Q3 2023

Renowned for his contrarian investment approach, Carl Icahn (Trades, Portfolio), an activist investor known for his significant influence on public companies, has revealed his latest moves in the third quarter of 2023. Icahn, who operates through various investment vehicles including Icahn Partners, American Real Estate Partners, and Icahn Management LP, focuses on acquiring undervalued assets, often emerging from bankruptcy, to revitalize and sell for profit. His investment philosophy is rooted in skepticism of consensus thinking, favoring out-of-favor industries and companies for their turnaround potential.

Key Position Increases

During the quarter, Icahn made notable increases in his holdings, with two stocks standing out:

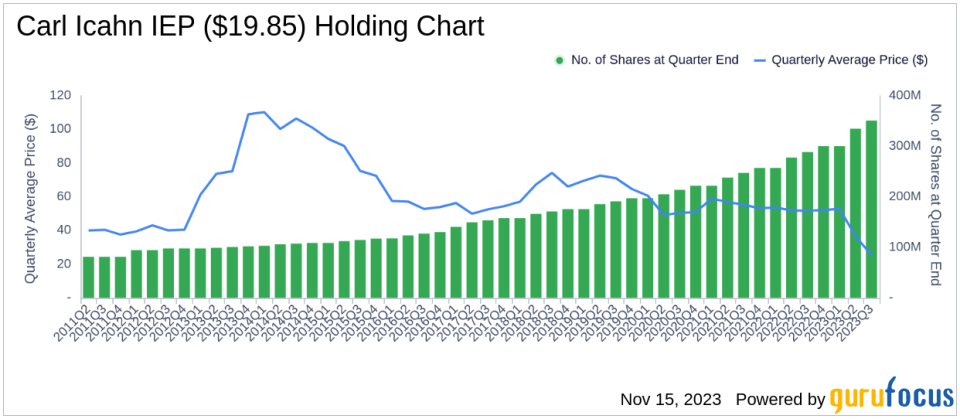

Icahn Enterprises LP (NASDAQ:IEP) saw an addition of 16,324,527 shares, bringing the total to 350,819,104 shares. This move marks a 4.88% increase in share count and a 2.67% impact on the current portfolio, valued at approximately $6,939,210,000.

Southwest Gas Holdings Inc (NYSE:SWX) experienced an increase of 177,923 shares, totaling 11,022,604 shares. This adjustment signifies a 1.64% increase in share count, with a total value of $665,880,000.

Summary of Sold Out Positions

Icahn's portfolio adjustments included a complete exit from one holding:

Xerox Holdings Corp (NASDAQ:XRX): The sale of all 34,245,314 shares resulted in a 3.29% impact on the portfolio.

Key Position Reductions

Reductions were also part of Icahn's Q3 strategy, with significant changes in two stocks:

Newell Brands Inc (NASDAQ:NWL) was reduced by 24,045,019 shares, leading to an 80.19% decrease in shares and a 1.35% impact on the portfolio. The stock's average trading price was $9.95 during the quarter, with a three-month return of -25.40% and a year-to-date return of -39.89%.

CVR Energy Inc (NYSE:CVI) saw a reduction of 4,506,337 shares, a 6.33% decrease, affecting the portfolio by 0.87%. The average trading price for the quarter was $34.16, with a three-month return of -6.73% and a year-to-date return of 9.02%.

Portfolio Overview

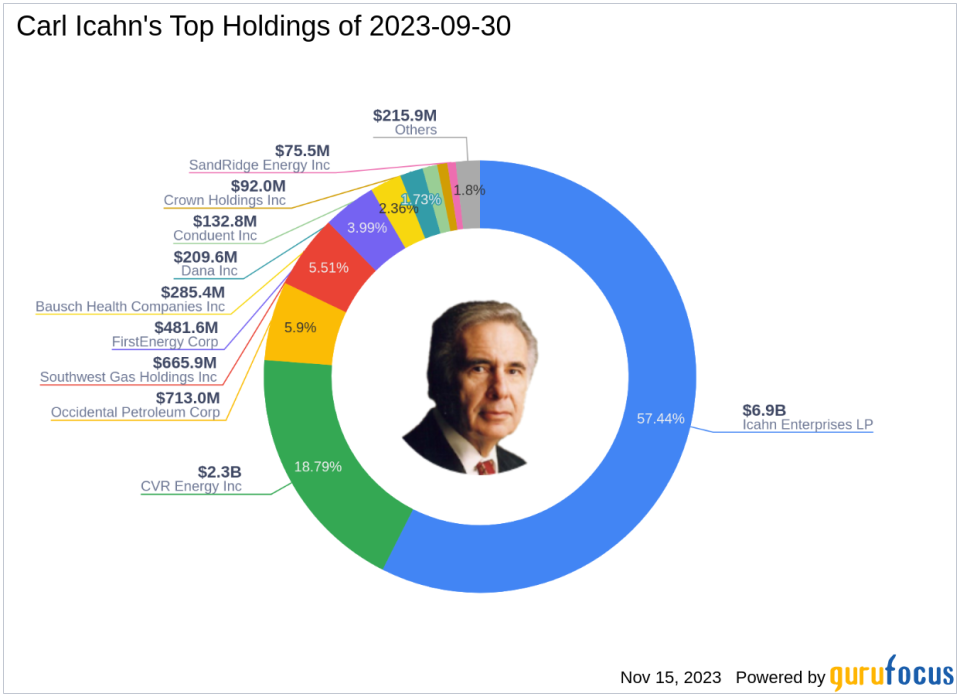

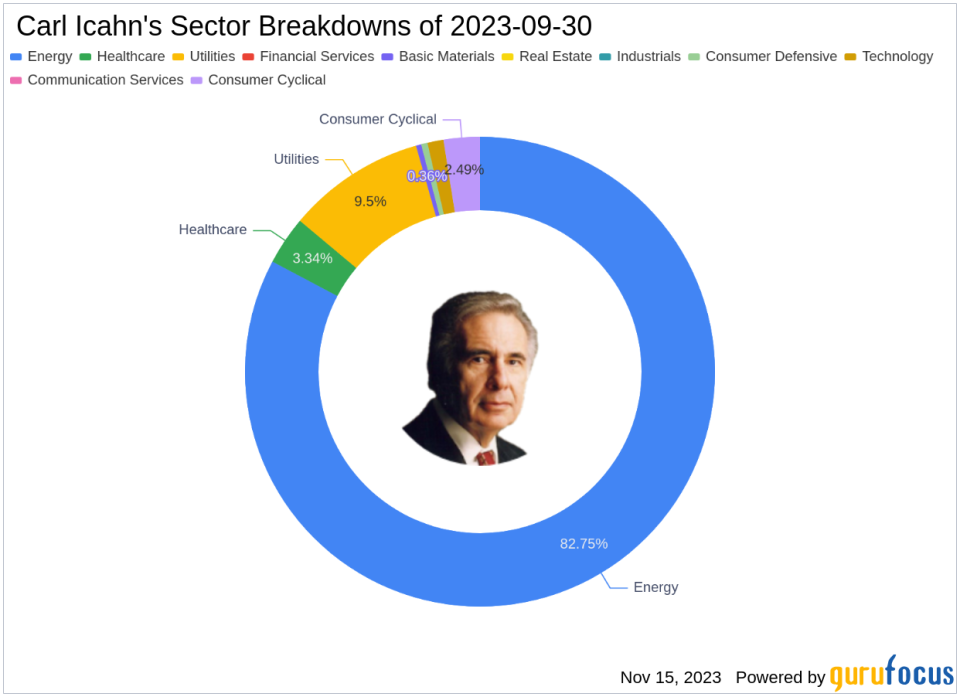

As of the third quarter of 2023, Carl Icahn (Trades, Portfolio)'s portfolio comprised 14 stocks. The top holdings were 57.44% in Icahn Enterprises LP (NASDAQ:IEP), 18.79% in CVR Energy Inc (NYSE:CVI), 5.9% in Occidental Petroleum Corp (NYSE:OXY.WS), 5.51% in Southwest Gas Holdings Inc (NYSE:SWX), and 3.99% in FirstEnergy Corp (NYSE:FE). The investments are primarily concentrated across seven industries: Energy, Utilities, Healthcare, Consumer Cyclical, Technology, Consumer Defensive, and Basic Materials.

The strategic exits and entries in Icahn's portfolio reflect his unique investment philosophy and active management style. As value investors analyze these moves, they gain insight into the thinking of one of the industry's most influential figures, potentially informing their own investment decisions. For more detailed analysis and updates on guru investors, visit GuruFocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.