Carl Icahn's Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

Renowned investor Carl Icahn recently submitted his 13F report for the second quarter of 2023, which concluded on June 30, 2023. Known for his aggressive investment style and activist approach, Icahn has built a reputation for identifying undervalued companies and pushing for changes to unlock value. His investment philosophy revolves around deep fundamental analysis and a focus on companies with strong cash flows and potential for operational improvements.

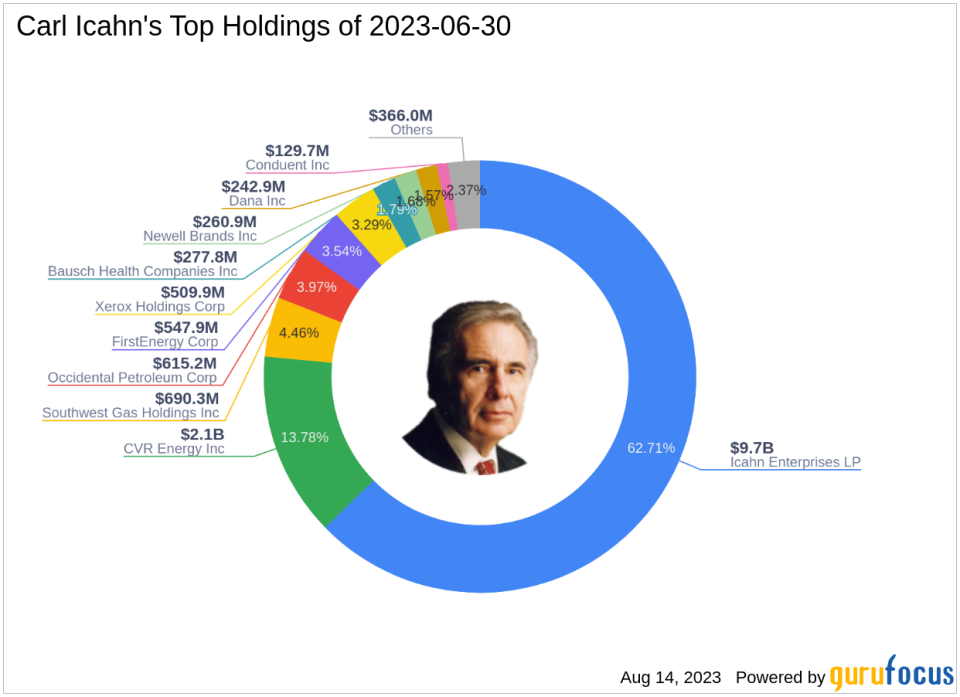

Portfolio Overview

The filing revealed that Icahn's portfolio contained 15 stocks with a total value of $15.48 billion. The top holdings were IEP (62.71%), CVI (13.78%), and SWX (4.46%).

Key Trades of the Quarter

The following were Icahn's top three trades of the quarter:

Newell Brands Inc (NAS:NWL)

Icahn reduced his investment in Newell Brands Inc by 4,553,883 shares, impacting the equity portfolio by 0.22%. The stock traded for an average price of $10.68 during the quarter. As of August 14, 2023, NWL had a price of $10.58 and a market cap of $4.38 billion. The stock has returned -46.99% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, NWL has a price-book ratio of 1.32, a EV-to-Ebitda ratio of 88.66, and a price-sales ratio of 0.50.

Icahn Enterprises LP (NAS:IEP)

During the quarter, Icahn purchased an additional 34,496,953 shares of Icahn Enterprises LP, bringing his total holding to 334,494,577 shares. This trade had a 6.47% impact on the equity portfolio. The stock traded for an average price of $36.64 during the quarter. As of August 14, 2023, IEP had a price of $24.16 and a market cap of $9.51 billion. The stock has returned -47.78% over the past year. GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 4 out of 10. In terms of valuation, IEP has a price-book ratio of 2.80, a EV-to-Ebitda ratio of -23.11, and a price-sales ratio of 0.66.

FirstEnergy Corp (NYSE:FE)

Icahn reduced his investment in FirstEnergy Corp by 4,876,979 shares, impacting the equity portfolio by 0.89%. The stock traded for an average price of $39.25 during the quarter. As of August 14, 2023, FE had a price of $36.86 and a market cap of $21.13 billion. The stock has returned -5.93% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, FE has a price-earnings ratio of 46.66, a price-book ratio of 2.01, a EV-to-Ebitda ratio of 11.65, and a price-sales ratio of 1.64.

In conclusion, the Q2 2023 13F filing provides valuable insights into Carl Icahn (Trades, Portfolio)'s investment strategy and portfolio adjustments. Despite the challenging market conditions, Icahn continues to actively manage his portfolio, making strategic investments and divestments based on his deep fundamental analysis and value-oriented approach.

This article first appeared on GuruFocus.