Carlisle Companies Inc (CSL) Reports Record Q4 Adjusted EPS, Despite Revenue Dip

Adjusted EPS: Record Q4 adjusted EPS of $4.17, a 29.5% increase YoY.

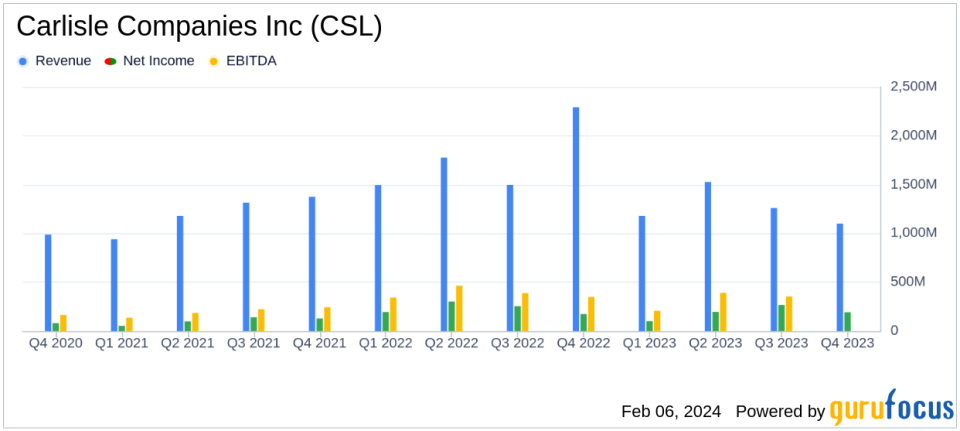

Revenue: Q4 revenues slightly down by 1.9% YoY to $1.1 billion.

Operating Margin: Expanded by 440 basis points YoY to 22.5%.

Share Repurchases: $900 million worth of shares repurchased in the year.

2024 Outlook: Anticipates mid-single-digit revenue growth and expanding EBITDA margins.

Capital Allocation: Strategic focus on building products businesses for higher returns.

On February 6, 2024, Carlisle Companies Inc (NYSE:CSL) released its 8-K filing, announcing its financial results for the fourth quarter of 2023. Despite a slight year-over-year decline in revenue, the company achieved record fourth-quarter results, with a significant increase in adjusted earnings per share (EPS) and expanded operating margins.

Carlisle Companies Inc is a diversified holding company with a focus on manufacturing and selling engineered rubber and plastic products through its subsidiaries. The company operates through three segments: Carlisle Construction Materials (CCM), Carlisle Interconnect Technologies (CIT), and Carlisle Fluid Technologies. With a strong presence in the United States, the company's portfolio includes commercial roofing systems, wires, cables, connectors, and industrial liquid finishing materials, catering to sectors such as construction, transportation, aerospace, defense, and medical.

Financial Performance and Challenges

The fourth quarter saw Carlisle's revenues reach $1.1 billion, a slight decrease of 1.9% compared to the previous year. This was attributed to a 2.3% drop in organic revenue, partially offset by strategic acquisitions and favorable foreign exchange rates. Despite the revenue dip, the company's operating income surged by 21.1% to $253.6 million, and income from continuing operations increased by 25.3% to $191.7 million. The adjusted EBITDA margin improved by 440 basis points, reflecting stronger sales and profitability in the CCM and CWT segments, aided by favorable weather conditions, solid contractor backlogs, and improved operating efficiencies.

Carlisle's financial achievements are particularly noteworthy in the context of the construction industry, where efficient capital allocation and operational excellence are critical for success. The company's ability to expand its operating margin in a challenging economic environment underscores its commitment to the Carlisle Operating System (COS) and its strategic focus on high-return building products businesses.

Key Financial Metrics

Key financial highlights from the income statement include a robust 33.4% increase in diluted EPS from continuing operations, which rose to $3.91. Adjusted EPS for the quarter was even higher at $4.17, marking a 29.5% increase from the previous year, driven by higher margins and share repurchases. The balance sheet reflects a strong liquidity position, with $576.7 million in cash and cash equivalents and $1.0 billion available under the revolving credit facility.

From the cash flow statement, operating cash flow from continuing operations for the year ended December 31, 2023, was $1.0 billion, an increase of $96.8 million from the prior year. Free cash flow from continuing operations also saw a significant rise, increasing by $144.3 million to $925.9 million, primarily due to a reduction in working capital uses.

"We are pleased to report that Carlisle had a strong finish to 2023 with record 4th quarter adjusted EPS of $4.17, an increase of 29.5% year-over-year, and adjusted EBITDA margin of 26.4% improving 440 basis points year-over-year on 1.9% lower sales," said Chris Koch, Chair, President, and Chief Executive Officer of Carlisle.

Analysis and Outlook

Carlisle's performance in the fourth quarter demonstrates the company's resilience and strategic execution. The sale of CIT marks a pivotal step in Carlisle's transformation into a pure-play building products company, which is expected to further streamline operations and enhance shareholder value. Looking ahead to 2024, Carlisle anticipates continued revenue growth and margin expansion, supported by a strong backlog of roofing projects and the benefits from prior-year customer destocking.

The company's Vision 2030 strategy, which includes an adjusted EPS target of $40, reflects its commitment to long-term growth and value creation. With a superior capital allocation philosophy and a focus on innovation, Carlisle is well-positioned to navigate potential macro-economic risks and continue delivering above-market growth and superior returns on invested capital (ROIC).

For value investors and potential GuruFocus.com members, Carlisle Companies Inc's disciplined approach to capital allocation, robust financial performance, and strategic positioning in the building products sector make it a compelling company to follow.

Explore the complete 8-K earnings release (here) from Carlisle Companies Inc for further details.

This article first appeared on GuruFocus.