Is Carlisle (CSL) Priced Right? A Comprehensive Guide to Its Valuation

Carlisle Companies Inc (NYSE:CSL) has seen a daily gain of 8.56% and a three-month gain of 16.65%. With an Earnings Per Share (EPS) of 13.91, we aim to answer the question: is the stock fairly valued? This article provides a detailed valuation analysis of Carlisle (NYSE:CSL). Read on to understand the intrinsic value of the company and make informed investment decisions.

Company Overview

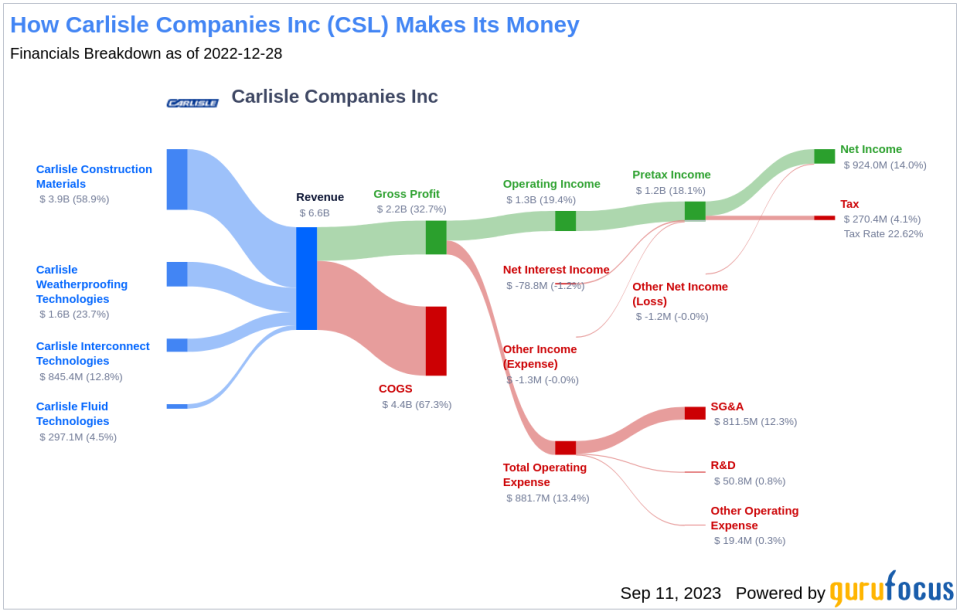

Carlisle Companies Inc is a diversified holding company specializing in the manufacture and sale of engineered rubber and plastic products. The company operates through three segments: Carlisle Construction Materials, Carlisle Interconnect Technologies, and Carlisle Fluid Technologies. Its product portfolio spans commercial roofing systems, wires, cables, connectors, industrial liquid finishing material, and more. The majority of its revenue comes from the Carlisle Construction Materials segment, with over half of the total revenue generated in the United States. With a current stock price of $272.87 and a market cap of $13.60 billion, we will compare this to the GF Value to assess if the stock is fairly valued.

Understanding the GF Value

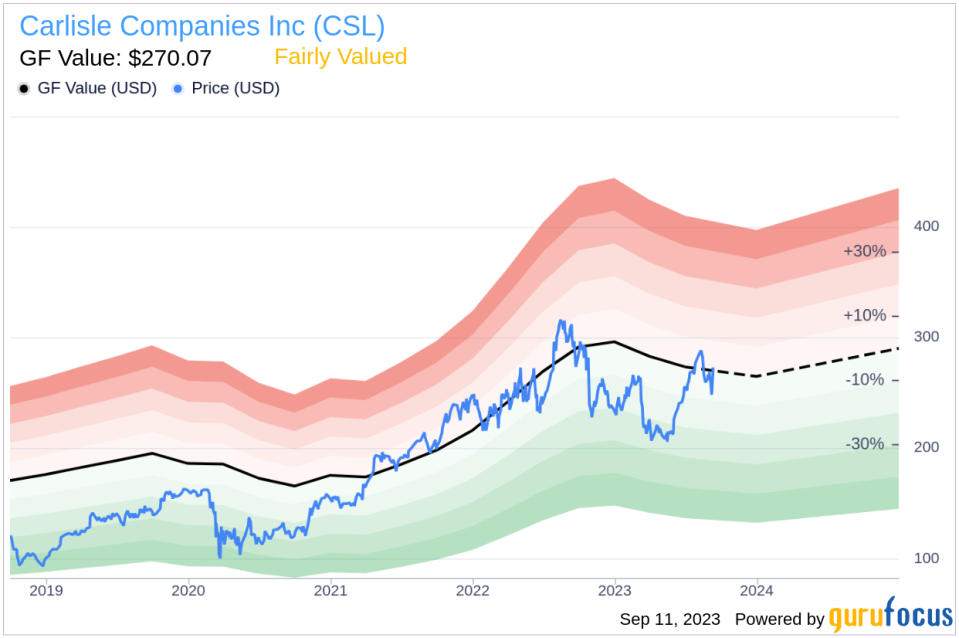

GF Value is a unique measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line gives a visual representation of the stock's ideal fair trading value. If the stock price significantly deviates from the GF Value Line, it indicates potential overvaluation or undervaluation, which could impact future returns.

As per our analysis, Carlisle (NYSE:CSL) is believed to be fairly valued. The stock's current price aligns with our estimate of the fair value at which the stock should be traded. Therefore, the long-term return of Carlisle stock is likely to be close to the rate of its business growth.

Discover companies that may deliver higher future returns at reduced risk.

Financial Strength Analysis

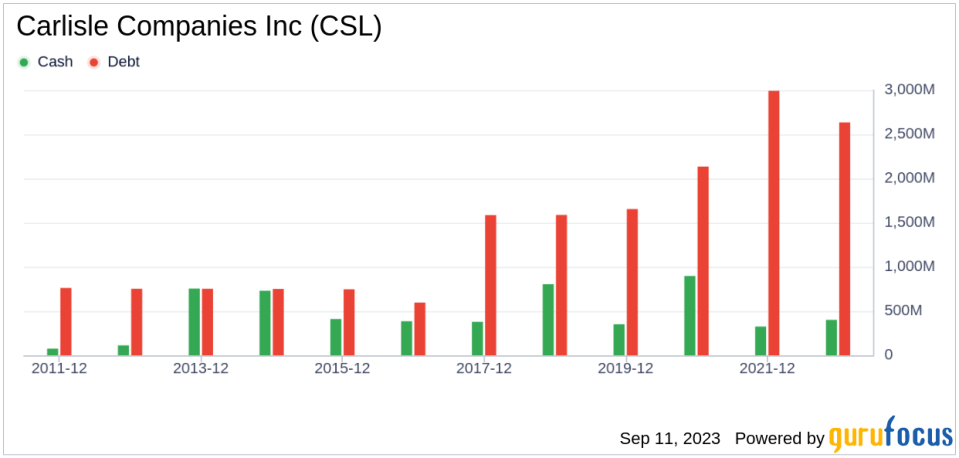

Investors must consider a company's financial strength to avoid the risk of permanent capital loss. Key indicators such as the cash-to-debt ratio and interest coverage can provide valuable insights into a company's financial health. Carlisle has a cash-to-debt ratio of 0.15, ranking worse than 80.22% of companies in the Construction industry. Its overall financial strength is 6 out of 10, indicating fair financial health.

Profitability and Growth

Consistent profitability over the long term reduces the risk for investors. Carlisle's profitability ranks 9 out of 10, indicating strong profitability. The company has been profitable for 10 out of the past 10 years. Over the past twelve months, Carlisle had a revenue of $6 billion and an operating margin of 17.74%, ranking better than 89.96% of companies in the Construction industry.

Company growth is a crucial factor in valuation. Carlisle's 3-year average annual revenue growth is 17.2%, ranking better than 82.52% of companies in the Construction industry. Its 3-year average EBITDA growth rate is 25.6%, ranking better than 80.62% of companies in the Construction industry.

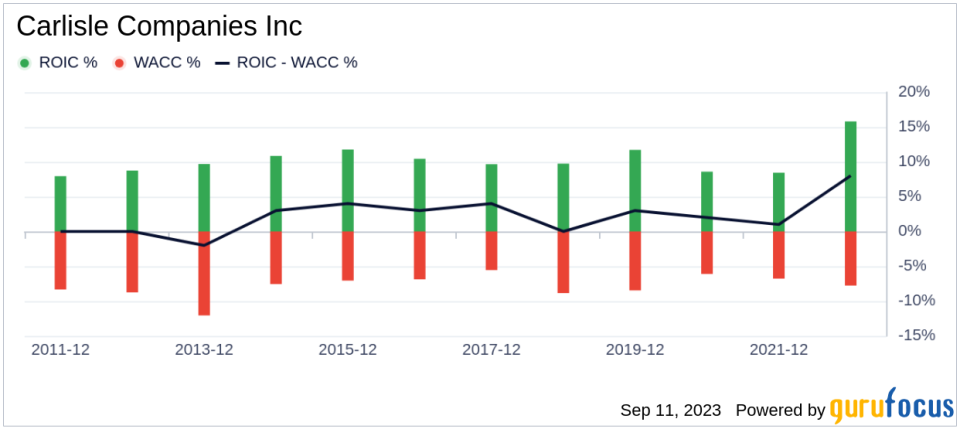

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. Carlisle's ROIC is 13.1 while its WACC came in at 9.07, indicating value creation for its shareholders.

Conclusion

In conclusion, Carlisle (NYSE:CSL) is believed to be fairly valued. The company has fair financial strength and strong profitability. Its growth ranks better than 80.62% of companies in the Construction industry. For more insights into Carlisle's performance, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.