Carlisle (CSL) Q1 Earnings Miss Estimates, Sales Decline Y/Y

Carlisle Companies Incorporated CSL reported lackluster first-quarter 2023 results, wherein both the top and the bottom line missed the Zacks Consensus Estimate.

Carlisle’s adjusted earnings were $2.57 per share, which lagged the consensus estimate of $2.62 per share by 1.9%. Our estimate for first-quarter adjusted earnings was $3.56. The bottom line decreased 39.7% on a year-over-year basis, due to lower sales.

Inside the Headlines

In the reported quarter, Carlisle’s revenues came in at $1,178.8 million, down 21.2% year over year. This decrease was attributable to a 29.6% decline in organic revenues and an impact of 0.6% from unfavorable changes in foreign exchange rates.

The top line missed the Zacks Consensus Estimate of $1,215 million by 6.5%. Our estimate for net sales in the reported quarter was $1,353.9 million.

CSL reports results under four segments, namely Carlisle Construction Materials (CCM), Carlisle Weatherproofing Technologies (CWT), Carlisle Interconnect Technologies (CIT) and Carlisle Fluid Technologies (CFT).

The quarterly segmental results are briefly discussed below.

Revenues from CCM totaled $576 million, decreasing 34.6% year over year. The same represented 48.9% of total revenues. Our estimate for segmental revenues was $808.8 million. Organic revenues declined 34.2% due to inclement weather prolonging inventory destocking in the channel. Unfavorable changes in foreign exchange rates impacted revenues by 0.4%.

CWT revenues, representing 26.9% of total revenues, were $316.6 million, down 11.8% year over year. Our estimate for segmental revenues was $308 million. The result was due to an 11.3% decline in organic revenues on account of volume declines, primarily due to softer residential markets. Forex headwinds impacted sales by 0.5%.

CIT revenues, accounting for 18.1% of total revenues, were $213.5 million, up 15.4% year over year. Our estimate for segmental revenues was $175.2 million. Organic revenues grew 15.7% owing to the strengthening aerospace end market. However, forex headwinds impacted sales by 0.3%.

CFT revenues, reflecting 6.1% of total revenues, were $72.7 million, up 2.3% year over year. Our estimate for segmental revenues was $61.9 million. Organic revenues increased 6.5% on positive pricing across the business and volume growth in the Americas and China. The results were partially offset by an impact of 4.2% from unfavorable changes in foreign exchange rates.

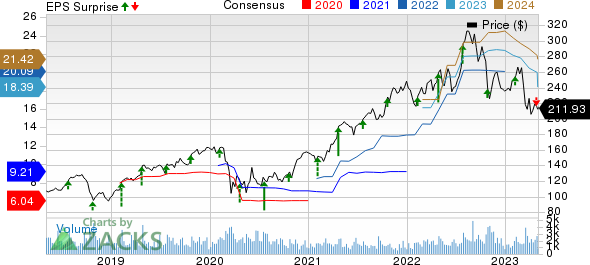

Carlisle Companies Incorporated Price, Consensus and EPS Surprise

Carlisle Companies Incorporated price-consensus-eps-surprise-chart | Carlisle Companies Incorporated Quote

Operating Margin Details

In the reported quarter, Carlisle’s cost of sales decreased 17.2% to $832.1 million. It represented 70.6% of net sales, compared with 67.2% in the year-ago quarter.

Selling and administrative expenses decreased 7.1% to $188.6 million. The same represented 16% of net sales, compared with 13.6% in the year-ago quarter. Research and development expenses totaled $15.5 million, up 26% in the first quarter 2023.

Operating income was $141 million, down from $277.3 million in the year-ago quarter. However, the margin declined 650 basis points to 12%.

Balance Sheet and Cash Flow

While exiting the first quarter, Carlisle had cash and cash equivalents of $423.9 million, compared with $400 million at the end of fourth-quarter 2022. Long-term debt (including the current portion) was $2,583.9 million, compared with $2,583.3 million at the end of fourth-quarter 2022.

In the first three months of 2023, Carlisle generated net cash of $149.6 million from operating activities, compared with $44.3 million in the year-ago period.

In the same period, Carlisle rewarded its shareholders with a dividend payout of $38.9 million, increasing 35.5% year over year. The amount spent on share buyback totaled $50 million, down 60% in the first quarter 2023.

Outlook

In 2023, Carlisle expects revenues to decline in the mid-single-digit range from the year-ago reported figure, compared with the low single-digit range predicted earlier. For the CCM segment, revenues are anticipated to decline in the high-single-digit range due to channel destocking in the first quarter of 2023. CWT segment revenues are expected to decline in the low-double-digit range due to the weakening residential market.

Revenues from the CIT segment are expected to increase in the high-single-digit range, driven by growing demand in Commercial Aerospace markets. The CFT segment is anticipated to grow in the high-single-digit range on the back of product introductions and positive pricing.

The company expects the adjusted EBITDA margin to decrease approximately 100 basis points, year over year.

Zacks Rank & Stocks to Consider

CSL currently carries a Zacks Rank #4 (Sell). Some top-ranked companies from are discussed below:

Ingersoll Rand Inc. IR presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

IR’s earnings surprise in the last four quarters was 8.5%, on average. In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 3.3%. The stock has rallied 11.1% in the past six months.

Parker-Hannifin Corporation PH presently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 9.1%, on average.

In the past 60 days, estimates for Parker-Hannifin’s fiscal 2023 (ending June 2023) earnings have increased 0.5%. The stock has gained 13.6% in the past six months.

Allegion plc ALLE presently carries a Zacks Rank of 2. ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have increased 4.1% for 2023. The stock has gained 7.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report