Carlisle's (CSL) Q2 Earnings Beat Estimates, Sales Decline Y/Y

Carlisle Companies Incorporated CSL reported mixed second-quarter 2023 results, wherein the bottom line beat the Zacks Consensus Estimate while the top line missed the same.

Carlisle’s adjusted earnings were $5.18 per share, which beat the consensus estimate of adjusted earnings of $4.73 per share by 9.5%. The bottom line decreased 15.8% on a year-over-year basis, due to lower sales.

Inside the Headlines

In the reported quarter, Carlisle’s revenues came in at $1,525.9 million, down 14.2% year over year. This decrease was attributable to a 13.9% decline in organic revenues and a negative impact of 0.1% from unfavorable changes in foreign exchange rates.

The top line missed the Zacks Consensus Estimate of $1,599 million by 4.6%.

CSL started reporting results under three segments from second-quarter 2023, namely Carlisle Construction Materials (CCM), Carlisle Weatherproofing Technologies (CWT) and Carlisle Interconnect Technologies (CIT).

The quarterly segmental results are briefly discussed below.

Revenues from CCM totaled $947.5 million, decreasing 14.9% year over year. The same represented 62.1% of total revenues. Organic revenues declined 14.9% due to channel destocking and unfavorable weather. Adjusted EBIT was $280.8 million for the quarter. Our estimate for the quarter was $256.0 million.

CWT revenues, representing 23.6% of total revenues, were $359.5 million, down 19.9% year over year. Our estimate for segmental revenues was $368.5 million. The result was due to an 19.6% decline in organic revenues on account of residential demand weakness and project delays. Forex headwinds impacted sales 0.3%. Adjusted EBIT was $58.8 million for the quarter. Our estimate for the quarter was $39.4 million.

CIT revenues, accounting for 14.3% of total revenues, were $218.9 million, up 3% year over year. Our estimate for segmental revenues was $226.7 million. Organic revenues grew 3.2% owing to continued strength in the aerospace end market. However, forex headwinds impacted sales 0.2%. Adjusted EBIT was $22.3 million for the quarter. Our estimate for the quarter was $17.7 million.

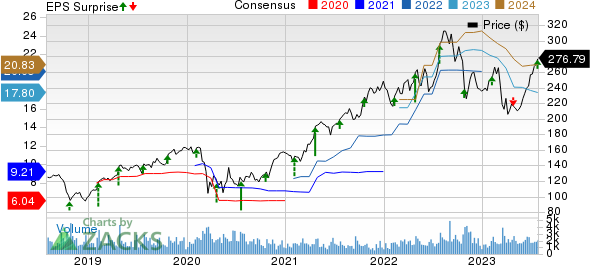

Carlisle Companies Incorporated Price, Consensus and EPS Surprise

Carlisle Companies Incorporated price-consensus-eps-surprise-chart | Carlisle Companies Incorporated Quote

Operating Margin Details

In the reported quarter, Carlisle’s cost of sales decreased 14.9% to $995.7 million. It represented 65.3% of net sales.

Selling and administrative expenses decreased 1.3% to $189.5 million. The same represented 12.4% of net sales. Research and development expenses totaled $13.1 million in second-quarter 2023, up 19.1% year over year.

Operating income was $327.6 million, down from $403.6 million in the year-ago quarter. The margin declined 120 basis points to 21.5%.

Balance Sheet and Cash Flow

While exiting the second quarter, Carlisle had cash and cash equivalents of $379.3 million, compared with $388.7 million at the end of fourth-quarter 2022. Long-term debt (including the current portion) was $2,584.2 million, compared with $2,582.9 million at the end of fourth-quarter 2022.

In the first six months of 2023, Carlisle used net cash of $55.9 million in operating activities, against $36.9 million cash generated in the year-ago period.

In the same period, Carlisle rewarded its shareholders with a dividend payout of $77.2 million, increasing 36.2% year over year. The amount spent on share buyback totaled $250 million, up 42.9% year over year.

Outlook

In 2023, Carlisle expects revenues to decline in the low-double-digits range from the year-ago reported figure, compared with a decline in the mid-single-digit range predicted earlier. For the CCM segment, revenues are anticipated to decline in the low-teens range due to channel destocking in 2023. CWT segment’s revenues are expected to decline in the low-teens range due to the weakening of the residential market.

Revenues from the CIT segment are expected to increase in the mid-single digit range, driven by the growing demand in Commercial Aerospace markets.

The company expects the adjusted EBITDA margin to decrease approximately 50 basis points, year over year.

Zacks Rank & Stocks to Consider

CSL currently carries a Zacks Rank #3 (Hold). Some better-ranked companies are discussed below:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

GEF delivered a trailing four-quarter earnings surprise of 7.7%, on average. GEF’s earnings estimates have increased 13.4% for fiscal 2023 in the past 60 days. Its shares have risen 5.4% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank #2 (Buy). CAT’s earnings surprise in the last four quarters was 14.3%, on average.

In the past 60 days, estimates for Caterpillar’s earnings have increased 1.3% for 2023. The stock has gained 37.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report