Carlyle (CG) Stock Soars on Q4 Earnings Beat, Upbeat Targets

The Carlyle Group Inc.’s CG shares jumped 8.6% in response to the better-than-expected fourth-quarter 2023 results and solid 2024 financial targets. Further, the company announced a bigger share repurchase program for this year.

CG reported post-tax distributable earnings per share of 86 cents, surpassing the Zacks Consensus Estimate of 75 cents. However, the bottom line declined from $1.01 in the year-ago quarter.

Results benefited from an increase in segment fee revenues and lower expenses. Further, an increase in assets under management (AUM) balance acted as a tailwind. However, a fall in realized performance revenues was the undermining factor.

Net loss attributable to Carlyle was $692 million against net income of $127.2 million in the prior-year quarter.

For 2023, post-tax distributable earnings of $3.24 per share beat the Zacks Consensus Estimate of $3.14 but declined 25% year over year. Net loss attributable to Carlyle was $608.4 million against net income of $1.2 billion in 2022.

Revenues & Expenses Fall

Segmental revenues were $896.4 million in the quarter under review, decreasing 15.4% from the year-ago quarter. However, the top line beat the Zacks Consensus Estimate of $848.6 million.

For 2023, total segmental revenues declined 22.7% to $3.41 billion. However, the top line surpassed the Zacks Consensus Estimate of $3.35 billion.

Total segment fee revenues grew 6.5% year over year to $595.3 million. A rise in fund management fees drove the increase. We had projected the metric to be $565.1 million.

Realized performance revenues plunged 43.9% to $257.7 million. Our estimate for the metric was $253.6 million.

Total segment expenses plunged 21.1% to $493.7 million. A decline in total compensation and benefits resulted in the fall. Our estimate for the metric was $561.5 million.

Total AUM Rise

As of Dec 31, 2023, total AUM was $426 billion, up 14% from the prior-year quarter. We had expected the metric to be $390.7 billion.

Fee-earning AUM for the reported quarter was $307 billion, up 15%. We had anticipated the metric to be $277.4 billion.

2024 Financial Targets

Management expects Fee-Related Earnings (FRE) to be $1.1 billion and FRE margin to be in the range of 40-50%.

Further, the company targets more than $40 billion in inflows.

The company enhanced its share repurchase capacity to $1.4 billion.

Conclusion

Carlyle’s efforts to scale investment platforms and expand operations in the real-estate credit space are likely to stoke top-line growth. Going ahead, solid AUM balance and fund management fees are likely to support its organic growth. However, a challenging operating environment is a near-term headwind.

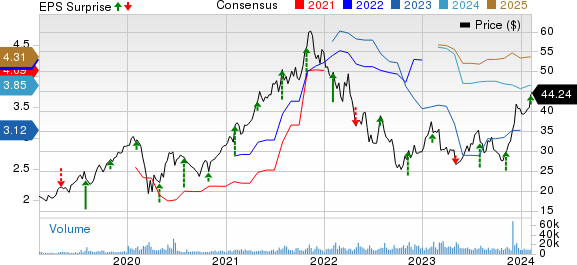

Carlyle Group Inc. Price, Consensus and EPS Surprise

Carlyle Group Inc. price-consensus-eps-surprise-chart | Carlyle Group Inc. Quote

Currently, CG carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Asset Managers

BlackRock, Inc.’s BLK fourth-quarter 2023 adjusted earnings of $9.66 per share handily surpassed the Zacks Consensus Estimate of $8.84. The figure reflects an increase of 8.2% from the year-ago quarter.

BLK’s quarterly results benefited from a rise in revenues and higher non-operating income. Further, AUM balance witnessed an improvement owing to net inflows. However, higher expenses acted as a dampener.

Invesco’s IVZ fourth-quarter 2023 adjusted earnings of 47 cents per share handily surpassed the Zacks Consensus Estimate of 38 cents. The bottom line grew 20.5% from the prior-year quarter.

Results benefited from an increase in AUM balance on decent inflows. However, a rise in operating expenses and lower revenues were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Carlyle Group Inc. (CG) : Free Stock Analysis Report