Carlyle Group Inc. Acquires Stake in Soleno Therapeutics Inc.

Carlyle Group Inc. (Trades, Portfolio), a renowned investment firm, recently expanded its portfolio with the acquisition of 1,227,317 shares in Soleno Therapeutics Inc. This article provides an in-depth analysis of the transaction, the profiles of both entities, and the potential implications of this investment.

Details of the Transaction

On August 8, 2023, Carlyle Group Inc. (Trades, Portfolio) added 1,227,317 shares of Soleno Therapeutics Inc. to its portfolio. The shares were acquired at a price of $5.13 each, resulting in a total investment of approximately $6.3 million. This transaction increased Carlyle Group's holdings in Soleno Therapeutics by 2.15%, making it a significant addition to the firm's portfolio. The firm now holds a 12.30% stake in Soleno Therapeutics, representing 0.22% of its total portfolio.

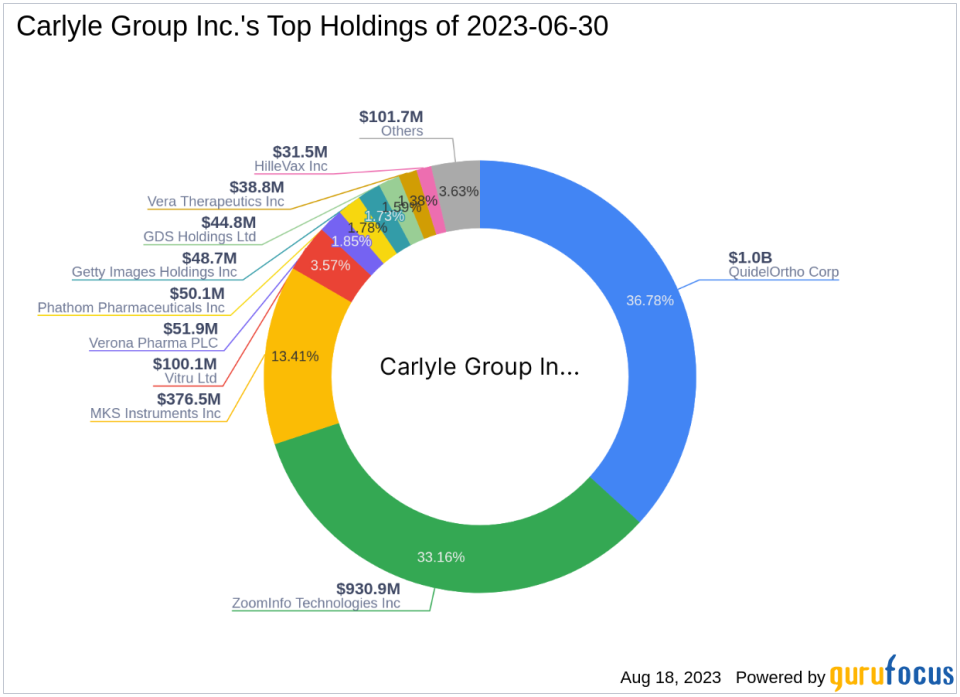

Profile of Carlyle Group Inc. (Trades, Portfolio)

Carlyle Group Inc. (Trades, Portfolio), based in Washington, DC, is a global investment firm with a diverse portfolio of 26 stocks. The firm's top holdings include MKS Instruments Inc(NASDAQ:MKSI), QuidelOrtho Corp(NASDAQ:QDEL), Verona Pharma PLC(NASDAQ:VRNA), ZoomInfo Technologies Inc(NASDAQ:ZI), and Vitru Ltd(NASDAQ:VTRU). With an equity of $2.81 billion, Carlyle Group Inc. (Trades, Portfolio) primarily invests in the technology and healthcare sectors.

Overview of Soleno Therapeutics Inc.

Soleno Therapeutics Inc. (NASDAQ:SLNO), a US-based biotechnology company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases. The company, which went public on November 13, 2014, has a market capitalization of $43.465 million and a current stock price of $4.35.

Analysis of Soleno Therapeutics Inc.'s Stock

As of the date of this article, Soleno Therapeutics Inc.'s stock has a PE percentage of 0.00, indicating that the company is currently operating at a loss. The stock's GF valuation cannot be evaluated due to insufficient data. Since its IPO, the stock has declined by 98.88%, but it has gained 98.63% year-to-date. Despite the stock's recent gains, it has lost 15.2% of its value since the transaction date.

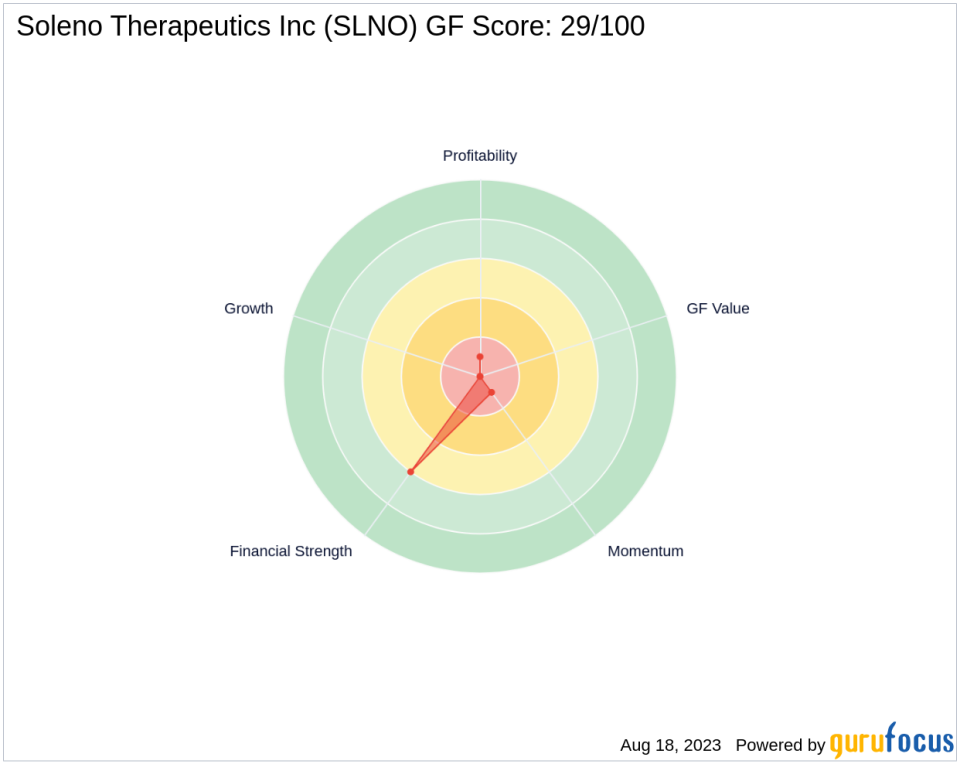

Evaluation of Soleno Therapeutics Inc.'s Performance

Soleno Therapeutics Inc.'s performance is evaluated using various metrics. The company's GF Score is 29/100, indicating poor future performance potential. Its financial strength is ranked 6/10, while its profitability rank and growth rank are 1/10 and 0/10, respectively. The company's Piotroski F-Score is 1, indicating poor financial health.

Financial Health of Soleno Therapeutics Inc.

Soleno Therapeutics Inc.'s financial health is evaluated using various metrics. The company's cash to debt ratio is 39.93, ranking it 492nd in the industry. Its return on equity (ROE) and return on assets (ROA) are -233.49 and -97.55, respectively, ranking it 1291st and 1335th in the industry.

Growth and Momentum of Soleno Therapeutics Inc.

Soleno Therapeutics Inc.'s growth and momentum are evaluated using various metrics. The company's 3-year EBITDA growth is 33.40%, while its 3-year earnings growth is 40.30%. However, the company's gross margin growth, operating margin growth, and 3-year revenue growth are all 0.00%, indicating no growth in these areas.

Technical Analysis of Soleno Therapeutics Inc.'s Stock

Soleno Therapeutics Inc.'s stock is evaluated using various technical analysis metrics. The stock's 5-day, 9-day, and 14-day RSI are 19.71, 31.88, and 38.57, respectively. Its 6-month and 1-month momentum indices are 184.49 and 96.82, respectively.

In conclusion, Carlyle Group Inc. (Trades, Portfolio)'s acquisition of Soleno Therapeutics Inc.'s shares represents a significant addition to its portfolio. However, given Soleno Therapeutics Inc.'s current financial performance and growth prospects, the impact of this transaction on the stock and the firm's portfolio remains to be seen.

This article first appeared on GuruFocus.