Is CarMax Inc (KMX) Modestly Undervalued?

CarMax Inc (NYSE:KMX) experienced a daily loss of -2.34%, with a 3-month gain of 12.79%. The Earnings Per Share (EPS) stands at 2.91. The question to address is: Is CarMax (NYSE:KMX) modestly undervalued? This article provides a comprehensive valuation analysis, shedding light on the company's intrinsic value and future prospects.

Introduction to CarMax

CarMax Inc (NYSE:KMX), formed in 1993 as a unit of Circuit City, is an independent company since late 2002. It sells, finances, and services used and new cars through around 240 retail stores. Used-vehicle sales typically account for about 83% of revenue, with the remaining portion composed of extended service plans and repair. Despite being the largest used-vehicle retailer in the U.S., CarMax only estimates about 4% U.S. market share of vehicles 0-10 years old in 2022, aiming for over 5% share by the end of 2025. The company is based in Richmond, Virginia.

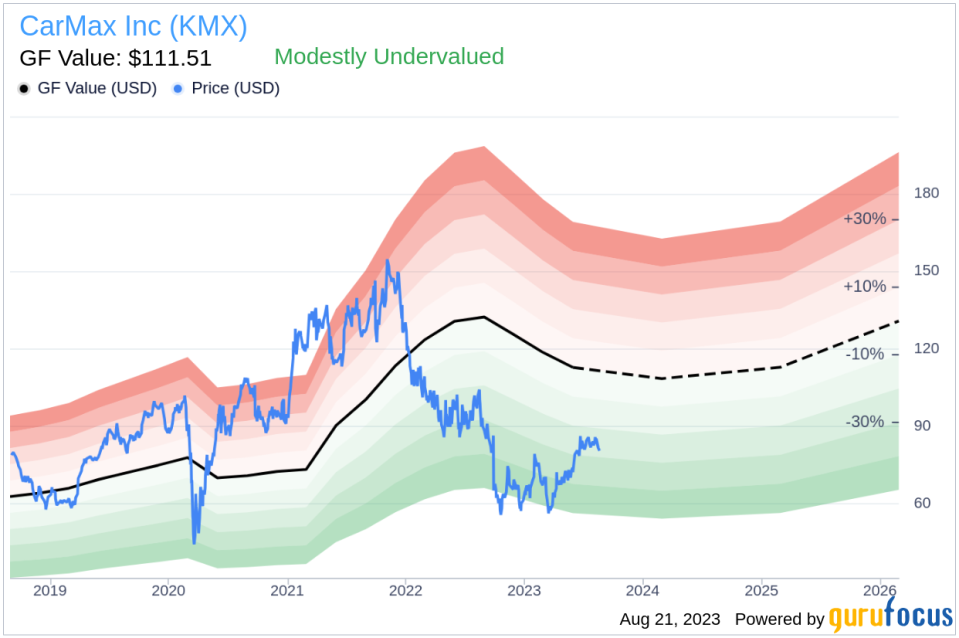

Understanding the GF Value of CarMax

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

CarMax (NYSE:KMX) appears to be modestly undervalued according to the GF Value calculation. At its current price of $80.56 per share, CarMax has a market cap of $12.70 billion, suggesting that the stock is modestly undervalued. As CarMax is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Financial Strength of CarMax

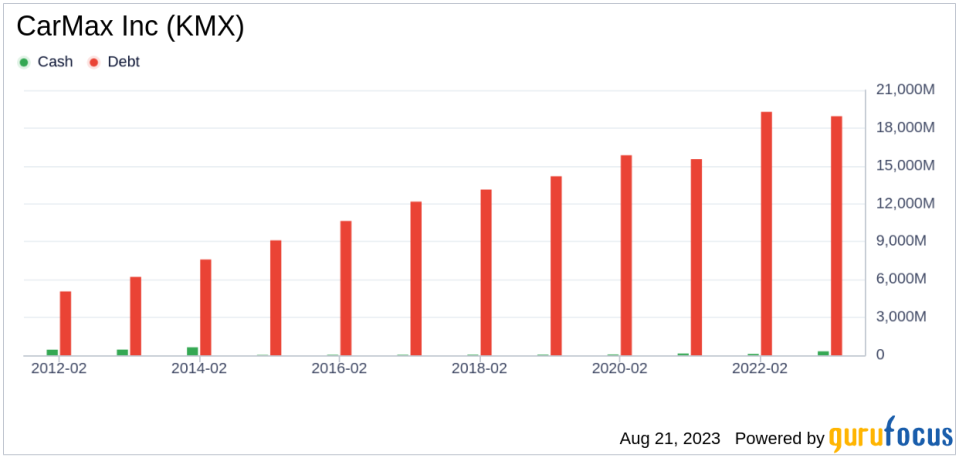

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Therefore, it is crucial to review the financial strength of a company before deciding to buy its stock. CarMax has a cash-to-debt ratio of 0.01, which is worse than 98.17% of 1203 companies in the Vehicles & Parts industry. GuruFocus ranks the overall financial strength of CarMax at 4 out of 10, indicating that the financial strength of CarMax is poor.

Profitability and Growth of CarMax

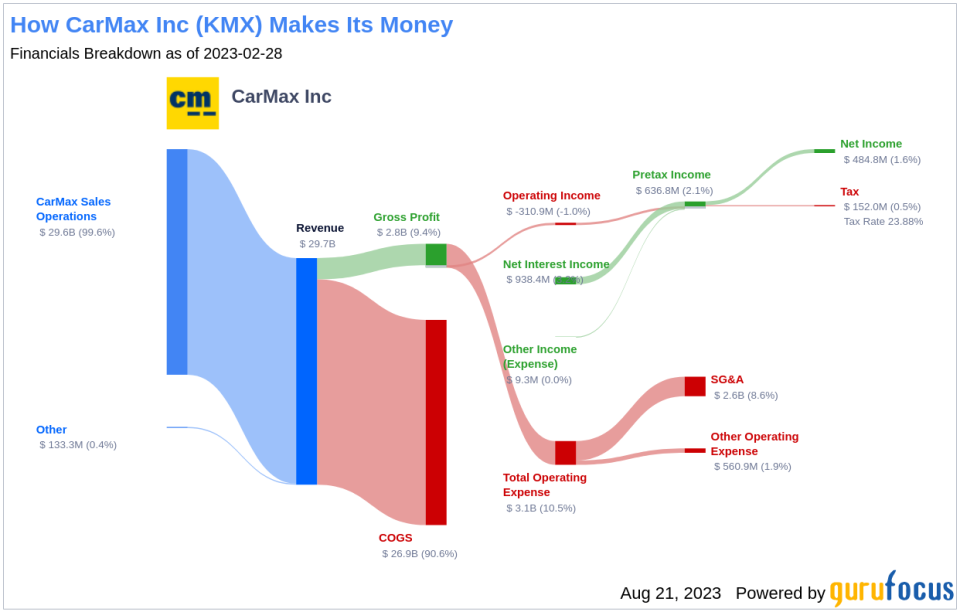

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. CarMax has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $28.10 billion and Earnings Per Share (EPS) of $2.91. Its operating margin is -1.07%, which ranks worse than 80.8% of 1229 companies in the Vehicles & Parts industry. Overall, the profitability of CarMax is ranked 8 out of 10, indicating strong profitability.

Growth is one of the most important factors in the valuation of a company. If a company's business is growing, the company usually creates value for its shareholders, especially if the growth is profitable. CarMax's 3-year average revenue growth rate is better than 75.47% of 1182 companies in the Vehicles & Parts industry. However, CarMax's 3-year average EBITDA growth rate is -8.5%, which ranks worse than 77.9% of 1059 companies in the Vehicles & Parts industry.

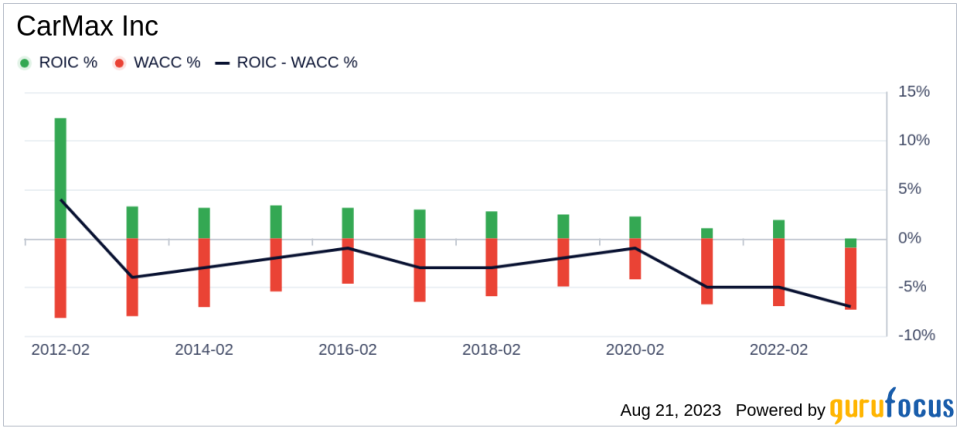

ROIC vs WACC

Another method of determining the profitability of a company is to compare its return on invested capital (ROIC) to the weighted average cost of capital (WACC). For the past 12 months, CarMax's return on invested capital is -0.92, and its cost of capital is 5.67.

Conclusion

In summary, the stock of CarMax (NYSE:KMX) appears to be modestly undervalued. The company's financial condition is poor but its profitability is strong. Its growth ranks worse than 77.9% of 1059 companies in the Vehicles & Parts industry. To learn more about CarMax stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.