Carnival (NYSE:CCL) Posts Q1 Sales In Line With Estimates

Cruise ship company Carnival (NYSE:CCL) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 22% year on year to $5.41 billion. It made a non-GAAP loss of $0.14 per share, improving from its loss of $0.55 per share in the same quarter last year.

Is now the time to buy Carnival? Find out by accessing our full research report, it's free.

Carnival (CCL) Q1 CY2024 Highlights:

Revenue: $5.41 billion vs analyst estimates of $5.40 billion (small beat)

EPS (non-GAAP): -$0.14 vs analyst estimates of -$0.18

Guidance for full year 2024 adjusted EBITDA of $5.63 billion is right in line with analyst estimates

Gross Margin (GAAP): 47.4%, up from 42.1% in the same quarter last year

Free Cash Flow was -$370 million, down from $64.17 million in the previous quarter

Passenger Cruise Days: 23.5 million (miss vs. expectations of 24.0 million)

Market Capitalization: $21.28 billion

"This has been a fantastic start to the year. We delivered another strong quarter that outperformed guidance on every measure, while concluding a monumental wave season that achieved all-time high booking volumes at considerably higher prices," commented Carnival Corporation & plc's Chief Executive Officer Josh Weinstein.

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

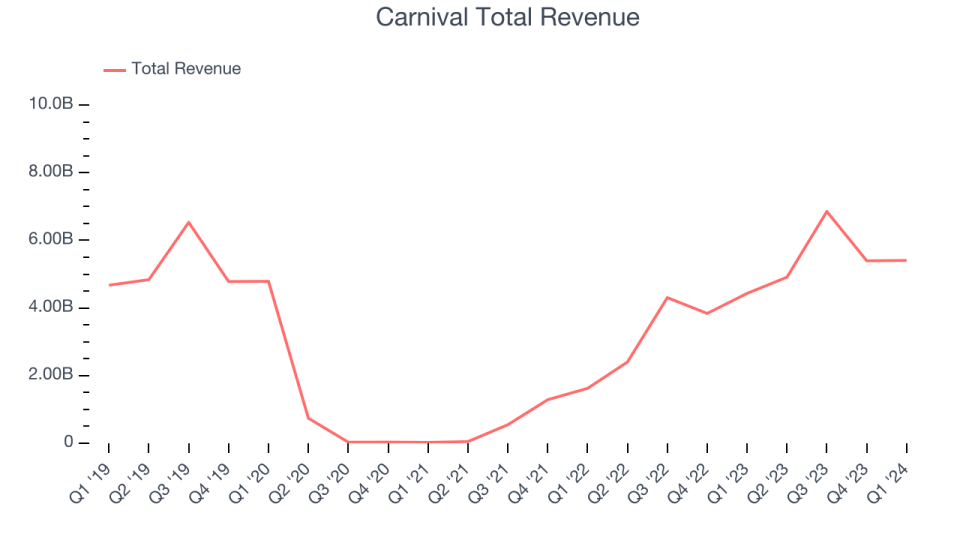

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Carnival's annualized revenue growth rate of 3.2% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Carnival's annualized revenue growth of 154% over the last two years is above its five-year trend, suggesting some bright spots as the world emerged from COVID lockdowns and restrictions. We can better understand the company's revenue dynamics by analyzing its number of passenger cruise days, which reached 23.5 million in the latest quarter. Over the last two years, Carnival's passenger cruise days averaged 1,189% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Carnival's year-on-year revenue growth of 22% was excellent, and its $5.41 billion of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 10.5% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Carnival's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 4.8%.

Carnival burned through $370 million of cash in Q1, equivalent to a negative 6.8% margin, increasing its cash burn by 34.2% year on year.

Key Takeaways from Carnival's Q1 Results

While the key volume metric of passenger cruise days unfortunately missed, we were impressed that Carnival still beat analysts' revenue expectations this quarter. With operating margin outperformance, EPS also beat. Looking ahead, full year adjusted EBITDA guidance was in like with Wall Street Consensus estimates. Overall, we think this was a solid quarter. The stock is flat after reporting and currently trades at $17.1 per share.

Carnival may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.