Carpenter Technology (CRS) Raises Specialty Alloy Base Prices

Carpenter Technology Corporation CRS announced that it will raise the base price of the premium products in its Specialty Alloy portfolio by an average 7-12%. This increase will boost the company’s margin in the upcoming quarters.

The price change will take effect for all new orders placed after Oct 8, 2023. All relevant surcharges will be retained.

Carpenter Technology has been demonstrating its recovery growth trajectory through fiscal 2023, with increased productivity across the company’s facilities. It expects to make substantial progress in fiscal 2024. CRS seeks to incorporate strategic initiatives to maximize market demand, accelerate growth, optimize operations and generate cash.

The company expects operating income to double by fiscal 2027 (from the fiscal 2019 level). The upside will primarily be driven by higher prices, improved product mix and increased volumes. The increase in operating income will provide significant cash flow over the next several years, adding value to the company’s stockholders.

Carpenter Technology reported adjusted earnings of 78 cents per share in fourth-quarter fiscal 2023, which beat the Zacks Consensus Estimate of 67 cents. It had posted breakeven adjusted earnings in the year-ago quarter.

Net sales increased 34.5% year over year to $758.1 million in the reported period. The figure beat the Zacks Consensus Estimate of $724 million. The upside was driven by ongoing solid demand in most of the company’s end-use markets.

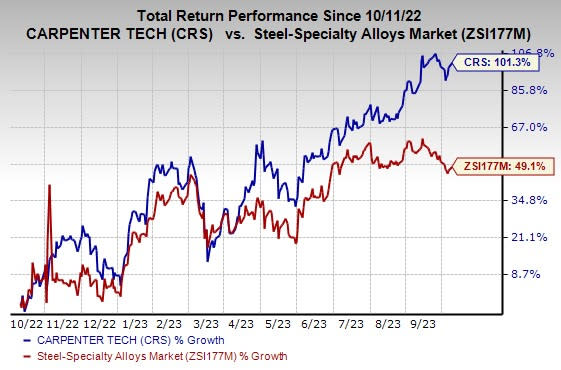

Price Performance

Shares of the company rallied 101.3% in the past year compared with the industry’s growth of 49.1%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Carpenter Technology currently carries a Zacks Rank 2 (Buy).

Some other top-ranked stocks from the basic materials space are Yara International ASA YARIY, Royal Gold, Inc. RGLD and L.B. Foster Company FSTR. While YARIY currently sports a Zacks Rank #1 (Strong Buy), both CRS and FSTR carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Yara International has a trailing four-quarter average earnings surprise of 56%. The Zacks Consensus Estimate for YARIY’s fiscal 2023 earnings is pegged at $1.27 per share, which has moved north 9% in the past 60 days. The company’s shares rallied 5.2% in the past year.

Royal Gold has a trailing four-quarter average earnings surprise of 2%. The Zacks Consensus Estimate for RGLD’s 2023 earnings is pegged at $3.51 per share, which has moved north 1% in the past 60 days. The company’s shares rose 13% in the past year.

L.B. Foster has a trailing four-quarter average earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share, which has remained unchanged in the past 60 days. FSTR’s shares rose 98.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Yara International ASA (YARIY) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report