Carrier (CARR) Boosts Refrigeration Segment With relayr Deal

Carrier Global’s CARR Commercial Refrigeration unit has partnered with relayr to launch a Refrigeration-as-a-Service (RaaS) solution.

Notably, the comprehensive RaaS solution integrates industry knowledge, energy-efficient refrigeration systems and optimized operations, backed by innovative IoT technology.

The solution is designed to allow food retailers to make monthly payments for refrigeration performance instead of making upfront investments, thereby enhancing efficiency, reliability, cost performance and business resiliency.

We note that the underlined solution will likely help Carrier in gaining traction among food retailers.

Further, the partnership with relayr will help Carrier strengthen its presence in the commercial refrigeration space.

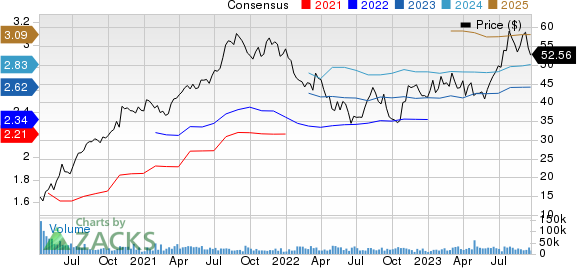

Carrier Global Corporation Price and Consensus

Carrier Global Corporation price-consensus-chart | Carrier Global Corporation Quote

Growth Prospects

Per an IMARC Group report, the global commercial refrigeration market size is expected to hit $37.2 billion by 2028, indicating a CAGR of 4.5% between 2023 and 2028.

A Spherical Insights report suggests that the market is expected to reach $59.9 billion by 2032, witnessing a CAGR of 5.5% during the period of 2022-2032.

We believe that Carrier’s growing prospects in the booming commercial refrigeration market will likely instill investor optimism in the stock.

Notably, CARR has gained 27.4% in the year-to-date period, outperforming the industry’s rally of 10.9%.

Expanding Refrigeration Portfolio

The latest move is in sync with Carrier’s growing efforts toward strengthening its Refrigeration segment’s portfolio.

Recently, Carrier Commercial Refrigeration introduced HeatCO2 OL heat pumps, utilizing renewable energy sources for compact, efficient design, reducing carbon emissions and accelerating sustainability efforts at low ownership costs.

Further, Carrier’s refrigerated transport and cold chain visibility brand, Transicold, introduced its new Vector 8400R refrigeration unit for domestic intermodal containers, offering improved fuel efficiency and lifetime compliance with California's latest emissions standards.

Further, Transicold unveiled the Vector S15 temperature-controlled trailer unit, which offers fuel efficiency, low maintenance costs and improved performance, reducing operating costs and carbon impact.

Also, Transicold launched the Aspen diesel auxiliary power unit, which offers reliable climate control and power during rest breaks for long-haul truck drivers, reducing fuel consumption and carbon emissions.

We believe that the abovementioned endeavors will likely drive the refrigeration segment’s performance in the days ahead.

Our model estimate for 2023 refrigeration revenues stands at $3.7 billion, indicating year-over-year growth of 16.7%.

Further, strong momentum in the Refrigeration segment will likely benefit Carrier’s overall financial performance in the upcoming period.

For 2023, Carrier expects sales of $22 billion.

Zacks Rank and Other Stocks to Consider

Currently, Carrier carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Dell Technologies DELL, Badger Meter BMI and Arista Networks ANET. While Dell Technologies sports a Zacks Rank #1 (Strong Buy), Badger Meter and Arista Networks carry a Zacks Rank #2 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dell Technologies shares have gained 70.2% in the year-to-date period. DELL’s long-term earnings growth rate is currently projected at 12%.

Badger Meter shares have gained 40% in the year-to-date period. BMI’s long-term earnings growth rate is currently projected at 15.05%.

Arista Networks shares have gained 46.6% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 18.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report