Carrier (CARR) Expands Portfolio by Selling Its Security Unit

Carrier Global CARR recently announced that it is divesting the security business, Global Access Solutions, to Honeywell International HON for $4.95 billion. This reflects approximately 17 times the 2023 expected EBITDA.

The deal will help Carrier put more focus on intelligent climate and energy solutions, as previously announced in April this year. As part of the transformation strategy, the company bought Viessmann Climate Solutions at that time. The company expects to close the acquisition in the first week of 2024.

The net proceeds of nearly $4 billion will help Carrier settle some of its debts. As of Sep 30, 2023, Carrier had a total debt of $8.79 billion compared with $8.8 billion as of Jun 30, 2023. Cash and cash equivalents were $3.9 billion as of Sep 30 compared with $3.21 billion as of Jun 30, 2023.

Carrier shares dropped slightly following the divestiture news. Shares have returned 20.6% in the past month compared with the Zacks Computer and Technology sector’s rise of 8.3%.

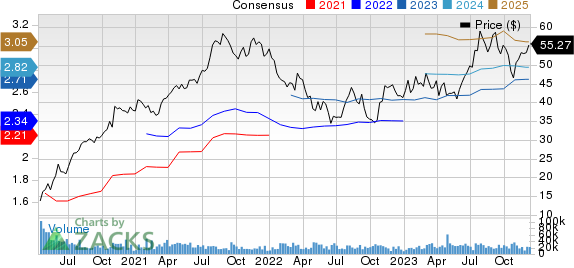

Carrier Global Corporation Price and Consensus

Carrier Global Corporation price-consensus-chart | Carrier Global Corporation Quote

CARR’s Growth Prospects

The latest move is in sync with the company’s effort toward strengthening its intelligence climate and energy solutions.

CARR, through its subsidiary Carrier Transicold, enhances customer support and environmental sustainability with the relocation of Arras Froid Services to a new 1,300 square-meter facility featuring solar panels, rainwater collection and upcoming electric vehicle charging stations.

In November, Carrier bolstered its dedication to sustainability by launching the One DV, One Tree initiative, planting a tree for each AquaEdge 19DV chiller sold in Singapore, aligning with its 2030 ESG Goals and collaborating with the National Parks Board for environmental restoration.

Simultaneously, Carrier introduced the i-Vu weather forecasting add-on, empowering its building automation system with real-time outside air quality data to drive intelligent control strategies for enhanced energy efficiency, water utilization and indoor air quality adjustments in line with varying climate conditions.

Fourth-Quarter View Positive

For 2023, Carrier expects sales in the band of $22.1-$22.2 billion. It expects mid-single-digits organic sales growth. The Zacks Consensus Estimate for the same is pegged at $22.25 billion, suggesting growth of 8.94%.

Carrier expects organic sales growth in the container business, commercial refrigeration and the entire Refrigeration segment.

CARR anticipates earnings of nearly $2.70 per share. The Zacks Consensus Estimate for the same is pegged at $2.72.

The company expects to generate slightly more than $1.9 billion of free cash flow in 2023.

Zacks Rank & Stocks to Consider

Currently, CARR carries a Zacks Rank #3 (Hold).

Flex FLEX and Intel INTC are a few better-ranked stocks that investors can consider from the broader sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Flex and INTC have returned 19.6% and 61.6%, respectively, on a year-to-date basis.

Long-term earnings growth rates for Flex and Intel are pegged at 12.39% and 14.18%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report