Carrier's (CARR) Viessmann Buyout Receives Approval in Europe

Carrier Global CARR recently announced that it has received the European Commission’s approval to acquire Viessmann Climate Solutions.

The transaction, announced in April of 2023, is now expected to be completed on Jan 2, 2024.

The acquisition will boost Carrier Global’s portfolio of sustainable energy and climate solutions.

Viessman broadens Carrier's European footprint by offering solutions for all energy classes, including heat pumps, gas boilers and hydrogen boilers.

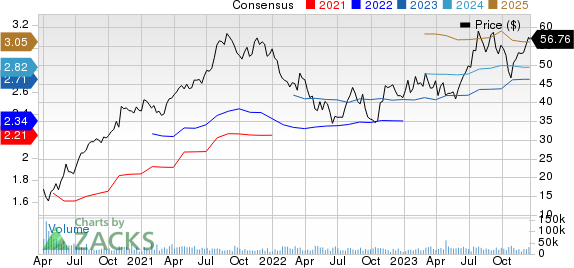

Carrier Global Corporation Price and Consensus

Carrier Global Corporation price-consensus-chart | Carrier Global Corporation Quote

Carrier's Strong Portfolio Aids Prospects

Carrier is benefiting from an expanding clientele and strong partner base, driven by strong demand for its sustainable energy and climate solutions.

In the past six months, Carrier’s shares have risen 19.2%, outperforming the Zacks Computer and Technology Sector’s rise of 8.8%. The growth is attributed to its strong product portfolio, which is helping it to win market share in the sustainable environmental solution domain.

Carrier recently launched a full new line of high and extremely high-temperature heat pumps for use in industrial, commercial and healthcare facilities, as well as district heating.

Carrier has also launched Lynx Logix, a new software-as-a-service application within its Lynx digital platform, to assist in detecting and solving supply chain disruption by automatically analyzing trends, patterns and errors in distribution networks and transportation lines.

Recently, Carrier Transicold created a new optimal line refrigerated container unit that is 15% more fuel efficient than the previously launched units. Carrier Transicold intends to improve customer service and environmental sustainability by relocating Arras Froid Services to a new 1,300-square-meter building equipped with solar panels, rainwater collection and future electric vehicle charging stations.

Divestitures Aid Core Business Focus

Carrier is expected to benefit from portfolio strength and the divestiture of non-core assets.

Carrier recently announced the sale of both its commercial refrigeration business to Haier for an enterprise value of $775 million.

The company also announced the divestiture of its security business, Global Access Solutions, to Honeywell International.

These divestitures will help Carrier focus on growing its intelligent climate and energy solutions business. The company continues to introduce market-leading products that help its customers meet their sustainability goals while decarbonizing the planet for future generations.

Guidance Strong

The Zacks Consensus Estimate for Carrier’s revenues for the fourth quarter of 2023 is pegged at $5.25 billion, indicating 2.8% growth year over year. The consensus mark for Carrier’s earnings for the fourth quarter of 2023 is pegged at 51 cents per share, indicating growth of 27.5% year over year.

For full year 2023, Carrier expects revenues between $22.1 billion and $22.2 billion. The consensus mark for fiscal 2023 revenues is pegged at $22.25 billion, indicating 8.9% growth year over year.

For 2023, Carrier expects earnings of $2.80 per share. The consensus estimate for fiscal 2023 earnings is pegged at $2.72, indicating 16.2% growth year over year.

Zacks Rank & Stocks to Consider

Currently, Carrier carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Flex FLEX, Badger Meter BMI, and NetEase NTES, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Flex shares have gained 33.7% in the year-to-date period. Flex’s long-term earnings growth rate is currently projected at 12.9%.

Badger Meter’s shares have gained 39.9% in the year-to-date period. Badger Meter’s long-term earnings growth rate is currently projected at 20.4%.

NetEase shares have gained 41.7% in the year-to-date period. NetEase's long-term earnings growth rate is currently projected at 15.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report