Cars.com Inc (CARS) Reports Robust Revenue Growth and Record Traffic in 2023

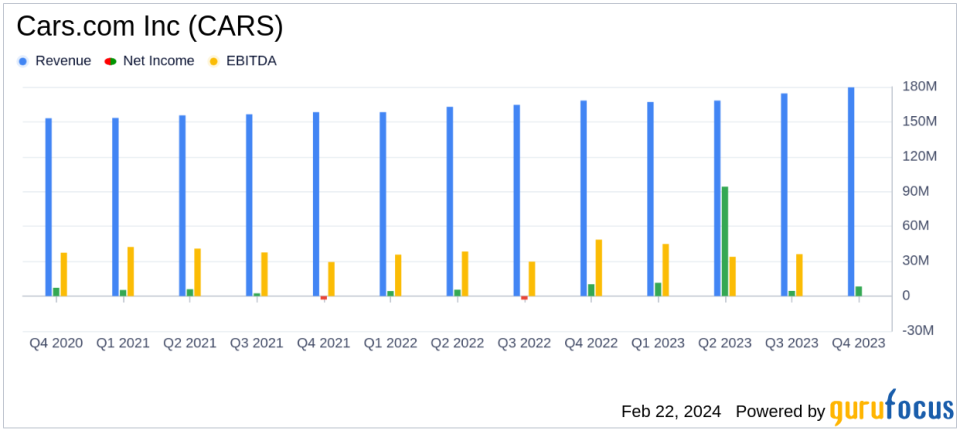

Revenue Growth: Full-year revenue increased by 5% to $689.2 million.

Net Income: Net income surged to $118.4 million, or $1.74 per diluted share.

Adjusted EBITDA: Reached $194.9 million, representing 28.3% of revenue.

Cash Flow: Operating activities generated $136.7 million in cash, with free cash flow of $115.8 million.

Customer Growth: Dealer Customers grew to 19,504, including 950 from the D2C Media acquisition.

Traffic Milestone: Record annual Traffic of 614.8 million, up 5% year-over-year.

On February 22, 2024, Cars.com Inc (NYSE:CARS) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, an online marketplace for buying and selling new and used vehicles, reported a 7% year-over-year increase in fourth-quarter revenue, reaching $179.6 million. This growth was driven by a 7% increase in Average Revenue Per Dealer (ARPD) and strong OEM performance.

Cars.com Inc (NYSE:CARS), with its portfolio of brands including Dealer Inspire, DealerRater, and others, faced challenges such as a slight decrease in Average Monthly Unique Visitors (UVs) but managed to set a company record for annual traffic. The company's financial achievements, particularly the significant growth in net income primarily due to the release of a valuation allowance, underscore its strong position in the Vehicles & Parts industry.

Financial Performance Highlights

The company's revenue for the full year was $689.2 million, a 5% increase from the previous year. Net income for 2023 was notably higher at $118.4 million, or $1.74 per diluted share, compared to $17.2 million, or $0.25 per diluted share, in the prior year. This increase was primarily related to the release of a significant portion of the company's valuation allowance. Adjusted EBITDA for the year was $194.9 million, or 28.3% of revenue, compared to $186.7 million, or 28.6% of revenue, in the previous year.

The company's balance sheet showed $39.2 million in cash and cash equivalents, and the total debt stood at $490.0 million as of December 31, 2023. The net leverage ratio improved to 2.3x, within the target range of 2.0x to 2.5x. Cars.com Inc (NYSE:CARS) also repurchased 1.7 million of its common shares for $31.3 million during the year.

"2023 marked a year of significant progress. We advanced our platform strategy through the introduction of Cars Commerce, the rollout of our Marketplace Repackaging initiative and our expansion into Canada with the acquisition of D2C Media," said Alex Vetter, Chief Executive Officer of Cars Commerce.

The company's operational highlights included the selection of AccuTrade by FordDirect as its preferred Vehicle Acquisition and Trade & Appraisal solution and the successful integration of D2C Media, enhancing its presence in Canada.

Looking Forward

For 2024, Cars.com Inc (NYSE:CARS) anticipates continued growth across its platform, with revenue growth guidance of 6% to 8%. The first quarter revenue is expected to be between $179 million and $181 million, representing year-over-year growth of 7% to 8%. Adjusted EBITDA margin for the first quarter is projected to be between 27% and 29%, with a full-year margin between 28% to 30%.

The company's focus on driving high-quality traffic and its strong free cash flow conversion position it well for sustained value creation for consumers, customers, and shareholders.

For more detailed financial information and the full earnings release, please refer to the Cars.com Inc (NYSE:CARS) 8-K filing.

Explore the complete 8-K earnings release (here) from Cars.com Inc for further details.

This article first appeared on GuruFocus.