Cars.com (NYSE:CARS) Reports Q4 In Line With Expectations

Online new and used car marketplace Cars.com (NYSE:CARS) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 6.8% year on year to $179.6 million. The company expects next quarter's revenue to be around $180 million, in line with analysts' estimates. It made a GAAP profit of $0.12 per share, down from its profit of $0.54 per share in the same quarter last year.

Is now the time to buy Cars.com? Find out by accessing our full research report, it's free.

Cars.com (CARS) Q4 FY2023 Highlights:

Revenue: $179.6 million vs analyst estimates of $178.4 million (small beat)

EPS: $0.12 vs analyst expectations of $0.16 (24.4% miss)

Revenue Guidance for Q1 2024 is $180 million at the midpoint, roughly in line with what analysts were expecting

Free Cash Flow of $39.83 million, up 31.1% from the previous quarter

Gross Margin (GAAP): 82.8%, up from 69.1% in the same quarter last year

Dealer Customers: 19,504, down 2 year on year

Market Capitalization: $1.20 billion

"2023 marked a year of significant progress. We advanced our platform strategy through the introduction of Cars Commerce, the rollout of our Marketplace Repackaging initiative and our expansion into Canada with the acquisition of D2C Media. Our focus on simplifying everything about buying and selling cars enabled us to continue to deliver value for consumers, dealers, and OEMs, supporting our twelve consecutive quarters of year-over-year profitable revenue growth," said Alex Vetter, Chief Executive Officer of Cars Commerce.

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE:CARS) is a digital marketplace that connects new and used car buyers and sellers.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

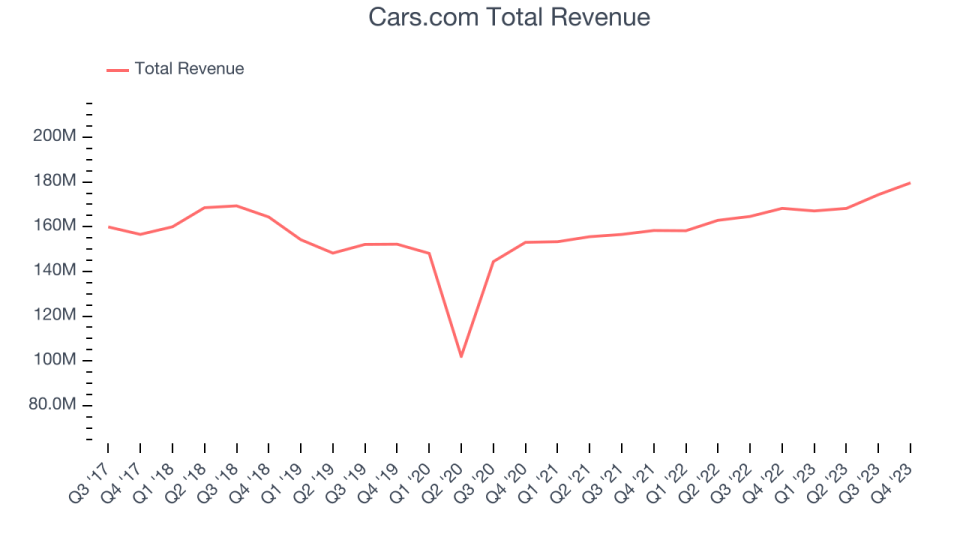

Sales Growth

Cars.com's revenue growth over the last three years has been unremarkable, averaging 9.1% annually. This quarter, Cars.com reported mediocre 6.8% year-on-year revenue growth, in line with what analysts were expecting.

Guidance for the next quarter indicates Cars.com is expecting revenue to grow 7.7% year on year to $180 million, improving on the 5.6% year-on-year increase it recorded in the same quarter last year.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

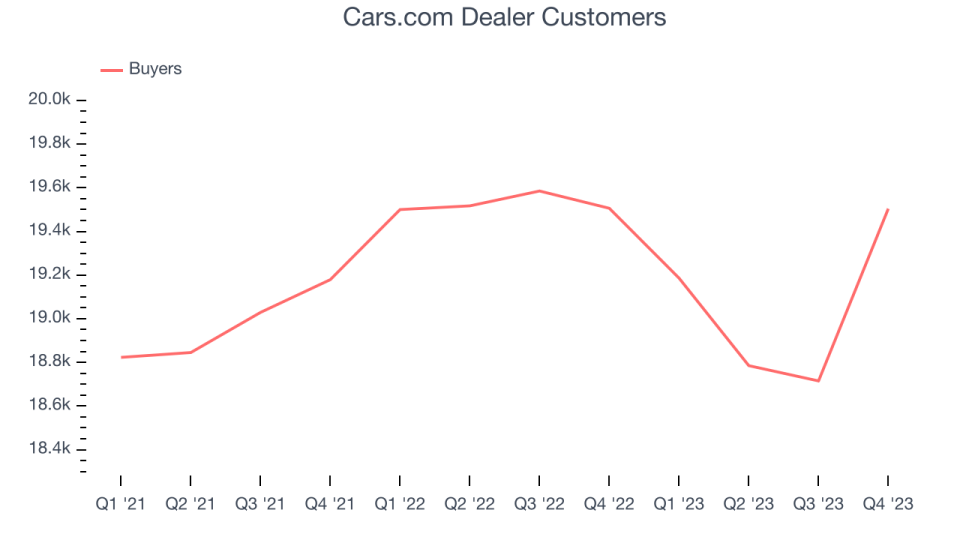

Usage Growth

As an online marketplace, Cars.com generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Over the last two years, Cars.com's active buyers, a key performance metric for the company, grew 0.2% annually to 19,504. This is one of the lowest rates of growth in the consumer internet sector.

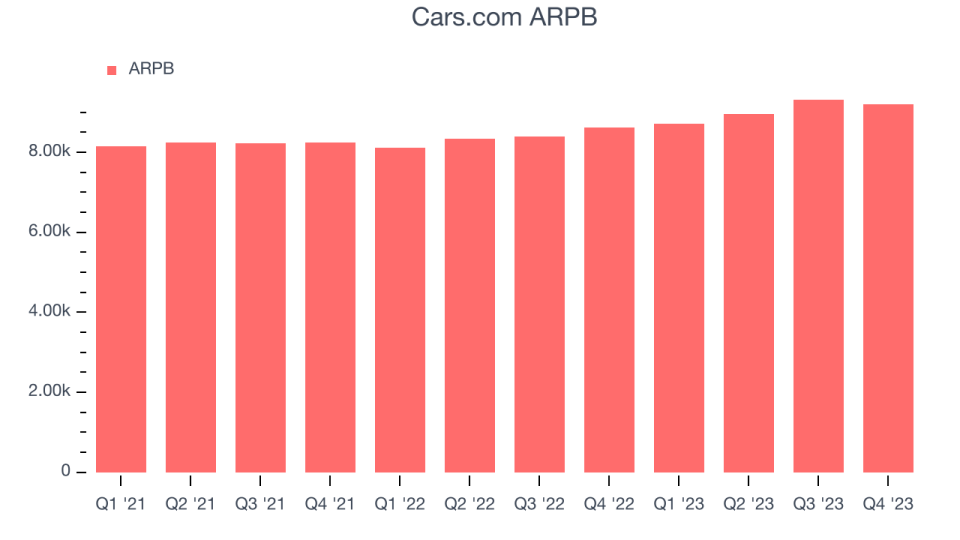

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Cars.com because it measures how much the company earns in transaction fees from each buyer. Furthermore, ARPB gives us unique insights as it's a function of a user's average order size and Cars.com's take rate, or "cut", on each order.

Cars.com's ARPB growth has been mediocre over the last two years, averaging 4.9%. However, the company's ability to continue increasing prices while growing its active buyers shows that buyers still find value in its platform. This quarter, ARPB grew 6.8% year on year to $9,209 per buyer.

Key Takeaways from Cars.com's Q4 Results

It was unfortunate to see Cars.com's revenue growth slow and miss analysts' estimates. Its revenue guidance for next quarter also fell short, but it expects to generate higher adjusted EBITDA margins than expected (28% vs estimates of 27%). During the quarter, the company acquired D2C Media for $76 million to expand its platform into Canada.

Looking at the broader automotive market, the company is optimistic for 2024. It stated it "believes market conditions are improving, with increased OEM production, new model launches, and rising dealer inventory... OEM and National Advertising spend is also expected to be up year-over-year". Despite this optimism, the results could have been better. The stock is flat after reporting and currently trades at $18.05 per share.

So should you invest in Cars.com right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.