Carter's (CRI) Continues to Focus on Pricing: Stock to Gain

Carter’s Inc. CRI has been implementing several measures, including improved pricing and optimized inventory management, to counteract the impacts of decreased consumer demand. The company has made significant efforts in pricing to address market conditions and enhance profitability. Additionally, the company’s focus on optimized inventory management bodes well.

In third-quarter 2023, CRI witnessed improved price realization and profit margins primarily due to the strength of its product offerings and lower ocean freight rates, along with better inventory management. This approach not only improved its cash flow but also supported its overall financial performance.

The company has strategically focused on essential core products, especially in the inflationary markets. This focus, coupled with a compelling value proposition, wherein average retail price points are around $11, makes Carter's an attractive option for budget-conscious consumers. The company’s pricing strategy involves keeping its brands competitively priced, usually within $1 or $2 of private label brands, which has proven effective in maintaining competitiveness in the market.

Looking ahead, Carter's anticipates lower product costs, which are expected to enable it to strengthen its product offerings and sharpen price points, thereby improving profitability in the next year. Even with lower traffic in the U.S. Retail segment than the previous year, the company managed to achieve improved pricing and grow average transaction values.

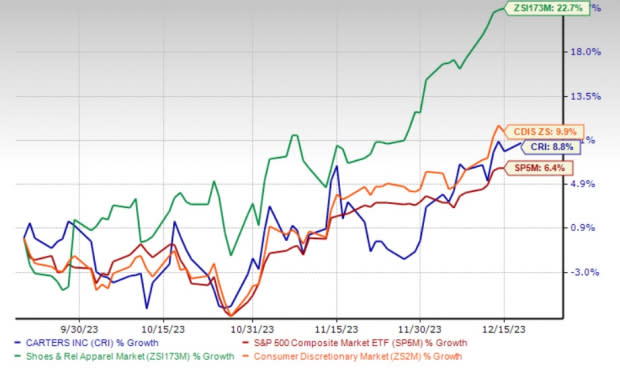

Gains from the company’s pricing efforts and inventory management have been well-reflected in its share price. Shares of this Zacks Rank #3 (Hold) company have gained 8.8% in the past three months, outpacing the S&P 500’s growth of 6.4%. However, the stock has lagged the industry’s rally of 22.7% and the Consumer Discretionary sector’s rise of 9.9% in the same period.

Image Source: Zacks Investment Research

Other Factors Driving Growth

Carter’s has been witnessing a notable expansion in the margin rates, driven in part by lower ocean freight rates, which were the most significant contributor to the gross margin expansion of 228 basis points (bps) in the third quarter. Additionally, lower inventory levels in the same quarter aided the gross margin. This narrates the company’s focus on efficient cost management and operational improvements. The adjusted operating margin increased 100 bps to 12.2% in the quarter mainly on favorable ocean freight rates, lower inventory provisions, and decreased distribution and freight costs.

Carter’s guidance indicates better consumer demand trends in fourth-quarter 2023 than in the third quarter. The company expects improved gross margins and a lower SG&A rate in fourth-quarter 2023, driven by reduced inventory-related costs, improved price realization and lower ocean freight rates.

Hurdles in the Path

Soft consumer spending trends, owing to inflation, rising interest rates, higher consumer debt levels and recession risks, have been hurting CRI’s performance. Management envisions the overall demand trends to improve in the second half of 2023, as it expects inflation to moderate. However, it provided a bleak sales view for the fourth quarter and 2023.

For 2023, Carter’s expects net sales of $2.95-$2.97 billion compared with the earlier mentioned $2.95-$3 billion. Adjusted earnings per share (EPS) are likely to be $5.95-$6.15, whereas it reported $6.90 in 2022. Adjusted operating income is forecast to be $325-$335 million, down from the previously communicated $340 million. For the fourth quarter of 2023, net sales are expected to be $862-$877 million, indicating a decline from the $912 million recorded in the year-ago quarter. Adjusted earnings are likely to be $2.50-$2.72, suggesting a decline from the $2.29 reported in the prior-year quarter.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, such as Rocky Brands RCKY, GIII Apparel Group GIII and lululemon athletica LULU.

Rocky Brands, a leading designer, manufacturer and marketer of premium quality footwear and apparel, currently sports a Zacks Rank #1 (Strong Buy). Shares of RCKY have rallied 70% in the past three months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Rocky Brands’ current financial year’s sales and earnings per share suggests declines of 24.5% and 46.8%, respectively, from the year-ago reported figures. RCKY has a trailing four-quarter earnings surprise of 17.2%, on average.

GIII Apparel, a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands, has a trailing four-quarter earnings surprise of 541.8%, on average. It currently flaunts a Zacks Rank #1.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year earnings suggests growth of 33% from the prior-year actual. GIII shares have gained 37% in the past three months.

lululemon is a yoga-inspired athletic apparel company that creates lifestyle components. It currently carries a Zacks Rank #2 (Buy). Shares of LULU have risen 28% in the past three months.

The Zacks Consensus Estimate for LULU’s current financial-year sales and earnings suggests growth of 18.2% and 22.9%, respectively, from the year-earlier reported figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report

Rocky Brands, Inc. (RCKY) : Free Stock Analysis Report