Carter's (CRI) Improved Price Realization Eases Demand Risks

Carter's, Inc. CRI has been implementing several measures to counteract the impacts of decreased consumer demand for discretionary items due to lower incomes.

The largest marketer of branded apparel and related products for babies, and young children in North America tackles lower consumer demand with cost reduction, data-driven pricing and optimized inventory management. By scrutinizing expenses and finding areas to trim without compromising operations, it optimizes resource allocation. Analyzing market trends and customer behavior helps set prices for maximum profitability. Enhanced inventory practices, using advanced analytics, ensure better control, reducing excess stock and obsolescence risks.

These efforts have yielded positive results, surpassing expectations in terms of earnings and cash flow from operations in the first quarter of 2023. The company increased the mix of longer-life-cycle products, which are less likely to be marked down, and bought fewer units to improve sell-throughs and reduce the mix of low-margin clearance sales.

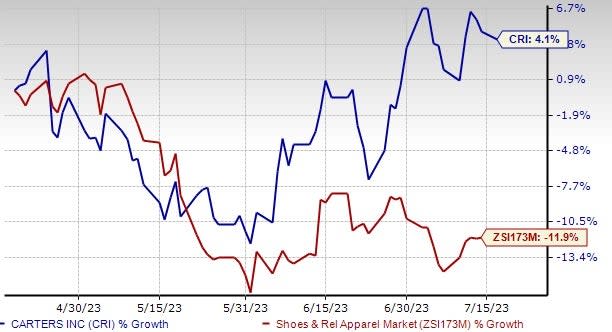

This Zacks Rank #3 (Hold) stock has outperformed the Zacks Shoes and Retail Apparel industry in the past three months. In the said period, shares of the company have gained 4.1% against the industry’s decline of 11.9%.

Image Source: Zacks Investment Research

Carter's Enhancing Brand Influence

Carter's website provides customers with the widest range of brand offerings, allowing customers to choose from a wide range of options, catering to their preferences, needs and tastes. The company is constantly seeking ways to improve the online shopping experience. Remarkably, within a short time span, sales through the Carter's app have grown to account for approximately one-fourth of all U.S. e-commerce sales.

CRI is conducting a collaboration with Shipt, testing same-day delivery services. This collaboration, unique in the young children's apparel sector, demonstrates Carter's dedication to staying at the forefront of industry trends.

The Carter's and OshKosh brands have garnered a strong following across generations, offering compelling value propositions that encompass not only attractive price points but also quality, durability and stylish designs. The company actively shares its brand story through various marketing channels, including a highly engaged presence on social media.

Carter's exclusive brands — Just One You, Child of Mine and Simple Joys — gained significant visibility through Target's website, social media and in-store marketing, and maintained strong performance at this crucial shopping destination. A partnership with Amazon opened doors to expand Simple Joys globally, leveraging Amazon's extensive reach beyond the United States. These efforts are expected to go a long way in boosting the company’s top lines.

Wrapping Up

Despite challenging macro conditions, Carter's focus on productivity, earnings and cash flow has kept it in good stride. Better inventory mix, resolved port congestion and leaner inventories, leading to improved sell-through, are likely to be key to Carter’s performance in the second-half of 2023. Planned gross margin expansion, spending control and EPS benefits are other positives.

On the last reported quarter’s earnings call, management expected sales of $3 billion for 2023, whereas it reported $3.20 billion in 2022. It also targets an adjusted operating income of $350 million and an adjusted EPS of $6.15 for 2023.

Red-Hot Stocks to Consider

Here we have highlighted three better-ranked stocks, namely Urban Outfitters, Inc. URBN, GIII Apparel Group GIII and lululemon athletica LULU.

Urban Outfitters, which specializes in the retail and wholesale of general consumer products, flaunts a Zacks Rank #1 (Strong Buy) at present. The company’s expected EPS growth rate for three to five years is 18%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and earnings suggests growth of 5.1% and 57.1% from the year-ago period’s reported figure. URBN has a trailing four-quarter earnings surprise of 12.2%, on average.

GIII Apparel, which is a manufacturer, designer and distributor of apparel and accessories, sports a Zacks Rank #1 at present. The company has an expected EPS growth rate of 15% for three to five years.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales and earnings suggests growth of 1.9% and 0.4% from the year-ago period’s actuals. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

lululemon, which is a yoga-inspired athletic apparel company, currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 20% for three to five years.

The Zacks Consensus Estimate for lululemon’s current financial-year sales and earnings suggests growth of 17.1% and 18.4%, respectively, from the year-ago period’s reported figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report