Will Carter's (CRI) Inclusive Strategy Aid It Amid Challenges?

Carter's, Inc. CRI, a prominent player in the retail apparel industry, has been leaving no stone unturned in crafting a comprehensive response to industry challenges. With a multifaceted strategy encompassing pricing innovation, inventory management, and customer-centric initiatives, Carter's is trying to navigate market fluctuations.

Unveiling Strategic Foundations

In the face of a shift in consumer behavior and pattern, Carter’s has undertaken strategic measures to bolster its performance. These measures encompass improved pricing strategies and optimized inventory management, two pillars that play pivotal roles in maintaining operational agility.

Recognizing the evolving landscape of consumer preferences, Carter’s is proactively expanding its e-commerce prowess. The integration of diverse elements, such as curbside pickup, same-day pickup, buy online and pick up at the store, and ship-from-store capabilities, leads to a seamless and versatile shopping experience for consumers.

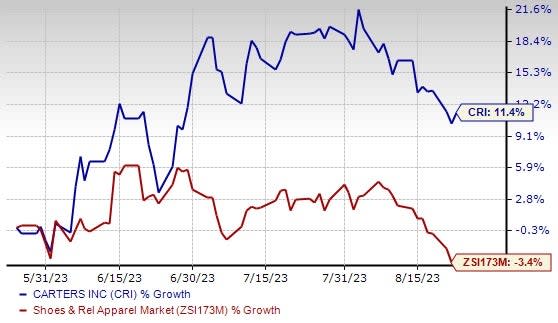

Image Source: Zacks Investment Research

The Carter's and OshKosh brands have garnered a strong following across generations, offering compelling value propositions that encompass not only attractive price points but also quality, durability and stylish designs. The company actively shares its brand story through various marketing channels, including a highly engaged presence on social media.

Carter's exclusive brands — Just One You, Child of Mine and Simple Joys — gained significant visibility through Target's website, social media and in-store marketing, and maintained strong performance at this crucial shopping destination. A partnership with Amazon opened doors to expand Simple Joys globally, leveraging Amazon's extensive reach beyond the United States. These concerted endeavors chart a promising trajectory for elevating the company's top line.

Wrapping Up

Buoyed by these strategic measures, Carter's envisions a gross margin expansion driven by improved price realization, and lower transportation and inventory-related costs for the latter half of 2023. Stronger product offerings, improved on-time shipping performance, lower ocean freight rates and product costs are likely to play a pivotal role. Despite these tailwinds, we cannot ignore the challenge of increased competition in the retail apparel sector, putting pressure on market share.

This Zacks Rank #3 (Hold) stock has outperformed the Zacks Shoes and Retail Apparel industry in the past three months. In the said period, shares of the company have gained 11.4% against the industry's decline of 3.4%.

Red-Hot Stocks to Consider

Here we have highlighted three better-ranked stocks, namely Urban Outfitters, Inc. URBN, Crocs, Inc. CROX and lululemon athletica LULU.

Urban Outfitters, which specializes in the retail and wholesale of general consumer products, flaunts a Zacks Rank #1 (Strong Buy) at present. The company’s expected EPS growth rate for three to five years is 20.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and earnings suggests growth of 5.3% and 61.1% from the year-ago period’s reported figure. URBN has a trailing four-quarter earnings surprise of 19.2%, on average.

Crocs is one of the leading footwear brands with a focus on comfort and style. It currently has a Zacks Rank #2 (Buy). CROX delivered an earnings surprise of 20.5% in the last reported quarter.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 12.9% and 11.2%, respectively, from the year-ago reported numbers. CROX has a trailing four-quarter earnings surprise of 19.9%, on average.

lululemon, which is a yoga-inspired athletic apparel company, currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 18.5% for three to five years.

The Zacks Consensus Estimate for lululemon’s current financial-year sales and earnings suggests growth of 17.2% and 18.5%, respectively, from the year-ago period’s reported figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report