Carter's (CRI) Q3 Earnings Surpass Estimates, Sales Decline Y/Y

Carter's, Inc. CRI has reported third-quarter 2023 results, wherein the top and bottom lines beat the Zacks Consensus Estimate. The bottom line rose year over year. However, the top line fell year over year, hurt by the impacts of inflation, which led to reduced spending.

On the flip side, the company continued to witness higher-than-planned demand in its wholesale business for the fourth consecutive quarter, driven by the strength of product offerings and lower inventory.

Carter's, Inc. Price, Consensus and EPS Surprise

Carter's, Inc. price-consensus-eps-surprise-chart | Carter's, Inc. Quote

Q3 in Detail

Carter’s reported third-quarter 2023 adjusted earnings of $1.84 per share, beating the Zacks Consensus Estimate of $1.49 per share. This figure rose 10.2% from the $1.67 posted in the prior-year quarter.

The company reported net sales of $791.7 million, which beat the Zacks Consensus Estimate of $787 million. However, the metric declined 3.3% from the $818.6 million posted in the year-ago period. The downside can be attributed to inflation, rising interest rates, higher consumer debt levels and recession risks, which affected the demand from consumers and wholesale customers. Unexpectedly warm weather in September started to affect the demand for CRI’s fall and holiday product offerings.

Segmental Sales

Sales in the U.S. Retail segment decreased 8.2% to $374.8 million year over year and surpassed our estimate of $323.5 million and U.S. Retail Comparable net sales fell 9.9% in the third quarter of 2023.

The U.S. Wholesale segment’s sales increased 4.1% year over year to $300.3 million and beat our estimate of $186.9 million.

The International segment witnessed a 4.5% year-over-year drop in revenues from $122 million to $116.5 million in the third quarter. The metric lagged our estimate of $89.9 million.

Image Source: Zacks Investment Research

Margins

Gross profit increased 1.6% year over year to $376.4 million and beat our estimate of $291.9 million. Meanwhile, the gross margin expanded 228 basis points to 47.5%.

Further, adjusted operating income increased 5.2% year over year to $96.3 million in the reported quarter and beat our estimate of $37.9 million. The adjusted operating margin increased 100 basis points to 12.2% in the quarter under review.

Balance Sheet & Shareholder-Friendly Moves

This Zacks Rank #3 (Hold) player ended the quarter with cash and cash equivalents of $169.1 million, long-term debt of $567.2 million, and shareholders’ equity of $785.3 million.

The company’s total liquidity at the end of the third quarter of 2023 was $945 million, with $776 million in unused borrowing capacity out of an $850-million secured revolving credit facility.

In the third quarter of 2023, the company returned $55.4 million to shareholders through share repurchases and cash dividends. In the quarter under review, it repurchased and retired approximately 0.4 million shares of its common stock for $27.6 million at an average price of $70.69 per share. As of Oct 26, 2023, CRI had a $670-million remaining capacity under its previously announced repurchase authorization.

Also, it paid out a dividend of 75 cents per common share in the said quarter.

Outlook

For the fourth quarter of 2023, net sales are expected to be $862-$877 million, indicating a decline from the $912 million recorded in the year-ago quarter. Adjusted earnings are likely to be $2.50-$2.72, suggesting a decline from the $2.29 reported in the prior-year quarter. Adjusted operating income is expected to be $133-$143 million, implying a rise from the $119 million recorded in the year-ago quarter.

The fourth-quarter guidance indicates a better consumer demand trend than the third quarter. The company also expects a higher effective tax rate. Nevertheless, it expects improved gross margins and a lower SG&A rate, suggesting reduced inventory-related costs, improved price realization and lower ocean freight rates. The company expects a lower average number of shares outstanding for the fourth quarter of 2023.

For 2023, Carter’s expects net sales of $2.95-$2.97 billion compared with the earlier mentioned $2.95-$3 billion. Notably, it reported net sales of $3.21 billion in the previous year. Adjusted earnings per share (EPS) are likely to be $5.95-$6.15. Notably, it reported an EPS of $6.90 in 2022.

Adjusted operating income is forecast to be $325-$335 million, down from the previously communicated $340 million. The estimate indicates a decline from the $388 million reported in the year-ago period. The company expects an operating cash flow of more than $350 million and a capital expenditure of $65 million.

Management envisions an improved demand trend for the second half of 2023, as it expects inflation to moderate. Carter’s also forecasts a significant improvement in the operating cash flow this year, enabling it to continue investing in its growth strategies, and returning excess capital to shareholders through dividends and share repurchases.

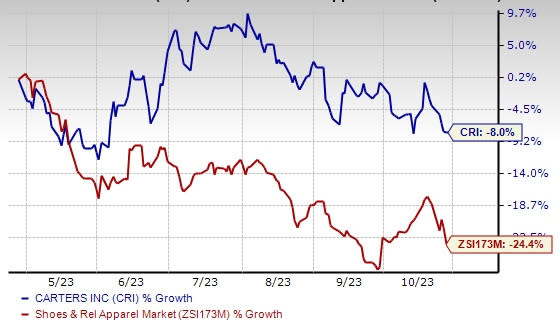

Shares of Carter’s have lost 8% in the past six months compared with the industry’s 24.4% decline.

Stocks to Consider

A few better-ranked stocks in the same space are American Eagle Outfitters Inc. AEO, Abercrombie & Fitch Co. ANF and The Gap, Inc. GPS.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 34% and 2.2% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 43.2%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently flaunts a Zacks Rank #1. ANF delivered a significant earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 10% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 724.8%.

Gap is a premier international specialty retailer offering a diverse range of clothing, accessories, and personal care products. The company sports a Zacks Rank #1 at present.

The Zacks Consensus Estimate for Gap’s current fiscal-year earnings indicates growth of 277.5% from the year-ago period’s reported figure. GPS has a trailing four-quarter average earnings surprise of 1001.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report