Carter's: The Nike of Children's Apparel

Carter's Inc. (NYSE:CRI) is a beautiful retail business with strong brand names, proven success in mutli-channel distribution and stable management. It is also trading at reasonable price.

I regard the stock as a long-term buy, but it has broken out after trading between $80 and $110 for quite some time. As the market has just hit a new record, I recommend not chasing performance right now, but wait for about the $90 level and the true breakout of retail industry business fundamentals.

What does Carter's do?

Carter's sells children's clothes. The 150-year-old company started when Abraham Lincoln was the president. The company also own Oshkosh, which was founded in 1895. These two brands are the best-known children's apparel companies for newborns to 10-year olds.

It is the dominant baby apparel brand with a market share five times that of its nearest competitor. Oshkosh focuses on toddlers with a market share two times larger than the next competitor. The company also uses other brands when it wholesales to other channels, such as Just One For You for Target (NYSE:TGT), Child of Mine for Walmart (NYSE:WMT) and Simple Joys for Amazon (NASDAQ:AMZN). Carter's brand is dominant in both sales and earnings, and baby apparel accounts about 50% of the total. The average ticket per item is under $10. In summary, Carter's sells high-quality, affordable and cute clothes for kids.

The $27 billion U.S. children's clothing market is highly fragmented with many players. Carter's is the largest player with about 15% market share, doubling its closest competitors. The nice thing about children's clothes versus many other retail categories is that children grow nonstop and moms come back for new clothes frequently. Not a lot of retailers have natural traffic like this.

Carter's is more like a smaller version of Nike (NYSE:NKE) than its closest peer, The Chidren's Place (NASDAQ:PLCE). It does both retail and wholesale. Wholesale has higher margin than retail. Besides its own brands, it has been supplying private-label brands to Target since 2001, Walmart since 2003 and Amazon since 2017.

It generates almost one-third of its U.S. retail sales from e-commerce. The margin of Carter's wholesale and retail segments are similar. The e-commerce margin is surprisingly high at low 20%. Management commented that this is an "industry enviable online margin" and expect an increase in online sales as well as efficiency improvement to be margin positive.

What is the problem?

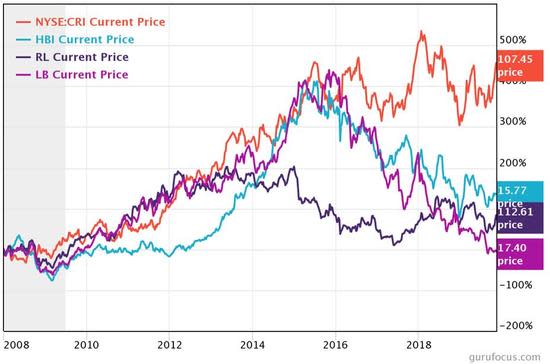

Since its initial public offering in 2003, Carter's has been a long-term outperformer, especially since CEO Michael Casey took over in 2008. The market apparently recognizes the strength of its brands, business and management.

But in the last three years, Carter's has underperformed.

The company's operations have deteriorated from prior years in a very weak retail environment for brick-and-mortar stores. Neither Carter's retail segment nor customers of its wholesale segment are immune to the secular trends that caused many retailers to file for bankruptcy.

The bankruptcy of Toys "R" Us in 2017 was especially disruptive as Carter's lost one of its largest and most profitable customers, hurting its sales in other channels. Then Gymboree declared bankruptcy at the beginning of 2019. The inventory liquidation also hurt Carter's sales temporarily. But with all the turmoil, Carter's comparable overall sales growth was still positive and profit margins were strong.

Why is the stock a buy?

One of the reasons the stock is a buy is because Carter's is a consistently profitable, recession-proof business with two 100-year-old brands and multi-channel distribution.

Good consistency is golden. It is hard to come by, especially in bad times.

Traditional retail used to be a good business with consistently strong demand and a deep moat. But in recent years, as a result of Amazon disrupting the space, it has become a place full of carnage as retailer after retailer has closed their doors. Many others are experiencing never-ending deterioration in fundamentals. It is simply depressing to see the stock charts for some of the iconic brands who have not gone bankrupt. Carter's is one of the good houses standing, but is not immune to the secular trends in the sector. Growth slowed down and the stock stopped outperforming the market in 2016.

In this bad neighborhood of increasingly deteriorating businesses, Carter's has largely maintained its high margins and high return on invested capital. We can only home for better things to come when the industry eventually stabilizes.

Carter's business is also defensive in nature. Revenue even grew during the Great Recession. The operating margin was also very respectable during that period.

(Note: Revenue growth abnormally spiked in 2006 because of the Oshkosh acquisition and in 2011 because of an increase in cotton prices. Weak revenue in 2018 was due to disruptions from Toys "R" Us's bankruptcy.)

Another reason to invest is the company has strong management that manifested in high ROIC and industry-leading profit margins. E-commerce helps enhance margins.

Casey joined Carter's in 1993 as vice president of finance from PriceWaterhouseCoopers. He worked his way up the ladder, becoming chief financial officer in 1998 and CEO in 2008.

Since then, Carter's has maintained strong margins and high ROIC, even when cotton prices skyrocketed in 2011. The company developed a good e-commerce channel that doubles the operating margins of the entire business, which is uncommon among brick-and-mortar retailers. It also developed a relationship with Amazon, making the e-commerce giant its channel rather than its competitor.

(Note in the following chart, 2019 data includes a $30 million non-cash writedown on Skip Hop brand).

Finally, the valuation is at all-time low.

Carter's has been a long-term outperformer and I believe it will continue to be. The stock didn't move for four years, underperforming the market. In the meantime, however, the business grew.

Valuation

The stock has become cheaper against the market.

Carter's previous valuation premium over the S&P 500 has become a discount. This does not make sense because it is certainly an above-average quality company with below-average cyclicality. We are more likely at the peak of the business cycle. Carter's should trade at least on par with the market.

Regardless, the company is attractively valued against its peers given its strong brand and market position.

Compared to these peers, Carter's has the combination of a strong multi-channel distribution instead of concentrating on malls, an exceptionally strong brand name and dominant position in its category, a high profit margin and high ROIC, very small international exposure, which indicates future growth opportunities, and an attractive valuation.

In terms of its business model, Carter's is a small version of Nike in the children's apparel category. When the growth returns, I believe it will regain its premium to the market. The stock is also defensive in a weak economy. It makes sense to make a pair trade against the market.

What keeps me up at night

There are several factors I am concerned about. The first of which is value-destroying acquisitions.

Carter's bought the Oshkosh brand in 2005 under another CEO and subsequently wrote down half of it in 2007. Apparently, the acquisition didn't go as planned. Carter's bought Skip Hop in 2017 under Casey for $140 million and just wrote down $30 million last quarter. I think this is a failed acquisition, too. I mostly worry that the company will make another value-destroying acquisition. But I took some comfort from the fact that, unlike Oshkosh, Skip Hop was not a big purchase and Carter' actually grew sales of the brand by 50%.

What is lagging was the profitability, which I think it will return when the retail environment is better. The company is using all its cash flow on dividends and stock repurchases. It currently pays a dividend of $1.32 per share, which increased from the first dividend of 48 cents per share in 2013. The share count dropped 23% over the same period.

The decline birth rate in the U.S. has also been a headwind. In 2018, it sank to the new low, but this seems to be mainly due to the significant birth rate decline among teenagers and women who are waiting to have children. I don't consider this is a significant secular problem. More importantly, Carter's organic sales grew from 2008 to 2018, demonstrating it can and will take market share in a mature but increasingly competitive business.

The weakening position of peers and customers causing inventory liquation. Carter's cannot be immune to the weak retail environment. In 2018, its wholesale revenue was down 2.4% with units sold down 3% as a result of the bankruptcies of Toys "R" Us and Bon-Ton. In the first three quarters of 2019, retail comp sales decreased 0.1% due to the liquidation of Gymboree.

As every retailer around you is putting up sale signs, it is hard to raise prices even with a strong brand name. Occasional entire inventory liquidation at failed retailors makes the situation worse. I don't know how long this problem will persist, but retailers have significantly underperformed the market over the past several years. I believe we are closer to the bottom than to the top. When I look at the past financials of retailers who have been languishing recently, they were among the best in class. Those with strong brand names have great profitability and returns even through they are shrinking. In due time, many of them will come back. When they do, Carter's will be among those that fly.

The final concern I have is cotton prices. Carter's business is subject to fluctuations in cotton prices. Its profitability was weak in 2011 as a result of a spike in the crop's price.

Disclosure: I don't own Carter's.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.