Carvana Co (CVNA) Achieves Record Profitability and Efficiency in Latest Earnings

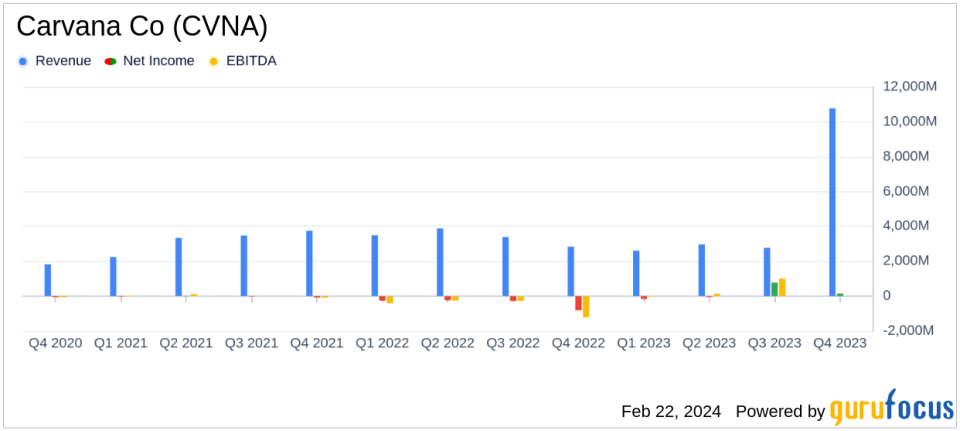

Net Income: Achieved a record full year net income of $150 million.

Adjusted EBITDA: Recorded a full year Adjusted EBITDA of $339 million.

Gross Profit Per Unit (GPU): Set new company records for full year GAAP GPU of $5,511 and Non-GAAP GPU of $5,984.

Cost Efficiency: Reduced GAAP SG&A by $940 million and Non-GAAP SG&A by $884 million year-over-year.

Retail Units Sold: Sold a total of 312,847 retail units, a decrease of 24% from the previous year.

Revenue: Total revenue reached $10.771 billion, a decrease of 21% year-over-year.

Customer Experience: Improved Customer Net Promoter Score (NPS) throughout 2023.

On February 22, 2024, Carvana Co (NYSE:CVNA), a leading e-commerce platform for buying and selling used cars, released its 8-K filing, revealing a year of significant financial achievements despite a challenging macroeconomic environment. The company's focus on efficiency and profitability has yielded record net income and Adjusted EBITDA, underscoring the effectiveness of its business model and operational improvements.

Financial Performance and Challenges

Carvana Co (NYSE:CVNA) reported a decrease in retail units sold by 24% and a 21% drop in revenue compared to the previous year. Despite these challenges, the company's strategic focus on profitability led to a record net income of $150 million, which was significantly assisted by a gain on debt extinguishment from a Q3 exchange offer. Adjusted EBITDA also reached a new high at $339 million, or 3.1% of revenue. These achievements are particularly noteworthy as they were not driven by growth but by fundamental gains in efficiency.

Operational Efficiency and Scalability

Carvana has made substantial strides in operational efficiency, reducing average days to sale and implementing proprietary technology across all inspection and reconditioning centers. The optimization of its logistics network and the leveraging of technology to improve customer experience have contributed to a more streamlined operation. These improvements are crucial for a company in the Vehicles & Parts industry, where margins can be tight and efficiency gains directly contribute to the bottom line.

Key Financial Metrics

Important financial metrics from Carvana's earnings report include a record full year net income and Adjusted EBITDA per unit of $479 and $1,084, respectively. The company's focus on cost efficiency is evident in the substantial reduction of both GAAP and Non-GAAP SG&A expenses, which decreased by 13% and 16% per unit, respectively. Additionally, Carvana achieved a record low full year Advertising Expense per unit of $729.

Management Commentary

"2023 was an exceptional year for Carvana. From a financial standpoint, it was the best year in our history by a meaningful margin. We set new company records for full-year GAAP and Non-GAAP Total GPU at ~$5,500 and ~$6,000, beating our previous best in 2021 by nearly $1,000 and $1,400, respectively. By year end, we had also removed over $1.1 billion of annualized SG&A expenses from the business since our peak in early 2022, driven primarily by our focus on efficiency. These achievements came together to generate record Net Income and Adjusted EBITDA in FY 2023."

Outlook and Future Performance

Looking forward, Carvana expects to grow retail units sold and Adjusted EBITDA compared to FY 2023. The company's financial performance is beginning to clearly demonstrate the significant power of its business model. With a focus on efficiency and profitability, Carvana is well-positioned to navigate the uncertain macroeconomic and industry environment.

For a detailed analysis of Carvana Co (NYSE:CVNA)'s financial performance and future prospects, visit GuruFocus.com, where value investors can find comprehensive insights into the company's earnings and strategic direction.

Explore the complete 8-K earnings release (here) from Carvana Co for further details.

This article first appeared on GuruFocus.