Casella Waste Systems (NASDAQ:CWST) delivers shareholders fantastic 33% CAGR over 5 years, surging 4.4% in the last week alone

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. For example, the Casella Waste Systems, Inc. (NASDAQ:CWST) share price is up a whopping 315% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. We note the stock price is up 4.4% in the last seven days.

Since the stock has added US$176m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Casella Waste Systems

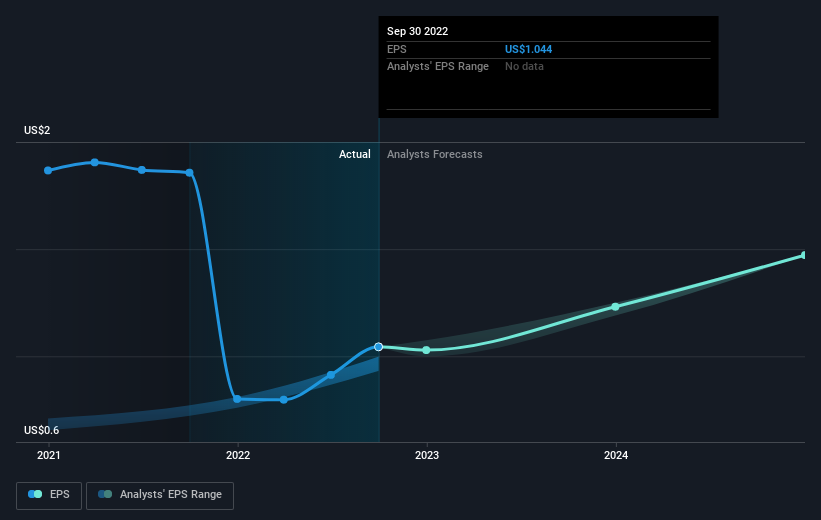

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Casella Waste Systems became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Casella Waste Systems share price is up 90% in the last three years. Meanwhile, EPS is up 75% per year. This EPS growth is higher than the 24% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. Having said that, the market is still optimistic, given the P/E ratio of 77.05.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Casella Waste Systems has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Casella Waste Systems stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, Casella Waste Systems shareholders can take comfort that their trailing twelve month loss of 7.5% wasn't as bad as the market loss of around 21%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 33% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Casella Waste Systems better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Casella Waste Systems .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here