Casey's (CASY) Growth Initiatives Position It Well for 2024

Casey's General Stores, Inc. CASY is advancing its technologies, refining inventory management and leveraging data analytics. These improvements are pivotal in understanding customer trends and optimizing inventory, setting the stage for sustainable growth.

The company’s strategic initiatives in price and product optimization, along with cost management and distribution efficiency, are key drivers in enhancing its sales performance and expanding profit margins. For instance, in the fiscal second quarter, CASY's gross profit increased 9.2% year over year to $885.6 million, whereas its gross margin expanded 140 basis points to 21.8%.

Apart from this, CASY is focusing on enhancing pizza promotions and breakfast offerings. By catering to customers seeking convenient meal solutions, the company is meeting a critical market need, which can drive customer loyalty and increase sales.

The expansion of private-label products, with a range of more than 300 affordable yet premium snacks and beverages, is a strategic move that meets the dual objectives of offering quality and affordability. This approach is tailored to meet customer needs and helps in distinguishing the brand in a crowded retail market.

We believe that the above-mentioned upsides will keep CASY well-positioned for growth in 2024.

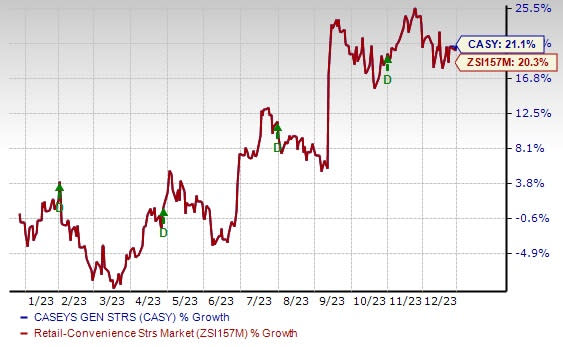

Image Source: Zacks Investment Research

Strong Inside Sales

Casey's reported robust inside sales, contributing significantly to its overall financial success. These sales drove a 10% year-over-year increase in inside gross profit dollars to $553 million in the second quarter of fiscal 2024. The total inside sales grew 6.2% year over year to $1,346.9 million and inside same-store sales rose 2.9% year over year in the second quarter.

Increased inside sales reflect the company's strong operational capabilities, effective product offerings and successful marketing strategies, which have resonated well with customers. Also, the rise in inside sales is indicative of CASY's ability to attract and retain customers through various in-store offerings. The company estimates inside same-store sales growth between 3.5% and 5%, and the inside margin to rise 40-41% in fiscal 2024.

Casey's has established itself as a prominent convenience store retailer in the United States with a significant physical store network. In the first half of fiscal 2024, the company added 23 stores, acquired 64 and closed 3. Its target is to increase its store count by at least 150 in fiscal 2024.

Clearly, Casey’s is set to keep adding new leaves to its growth story. In the past year, shares of this Zacks Rank #1 (Strong Buy) company have gained 21.1% compared with the industry’s growth of 20.3%.

3 Other Promising Stocks

A few other top-ranked stocks in the same space are The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and American Eagle Outfitters Inc. AEO.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company currently sports a Zacks Rank #1. GPS delivered a significant earnings surprise in the last reported quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings implies growth of 387.5% from the previous year’s reported number. GPS has a trailing four-quarter average earnings surprise of 137.9%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently flaunts a Zacks Rank #1. ANF delivered a 60.5% earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 13.3% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 713%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear for men and women. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 39.2% and 4%, respectively, from the previous year’s reported figures. AEO has a trailing four-quarter average earnings surprise of 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report