Casey's (CASY) Q2 Earnings Top, Inside Same-Store Sales Rise

Casey's General Stores, Inc. CASY came up with second-quarter fiscal 2024 results, wherein the top line missed the Zacks Consensus Estimate, while the bottom line beat the same. Notably, both metrics improved year over year. The company demonstrated strength in Inside same-store sales, underscoring its ability to engage customers effectively. Furthermore, it registered another strong quarter of fuel margin.

A Closer Look at Results

Casey's, one of the leading convenience store chains in the United States, posted quarterly earnings of $4.24 per share, which surpassed the Zacks Consensus Estimate of $3.74 and increased from earnings of $3.67 reported in the prior-year period.

Total revenues of $4,064.4 million fell short of the Zacks Consensus Estimate of $4,148 million but increased 2.2% year over year.

Total Inside sales jumped 6.2% to $1,346.9 million during the quarter. This was driven by a stellar performance in the prepared food and dispensed beverage category, including whole pizza pies, bakery and dispensed beverages as well as non-alcoholic and alcoholic beverages in the grocery and general merchandise category. Inside same-store sales increased 2.9% compared with a 7.9% rise registered in the year-ago period. We had expected Inside same-store sales to increase 3.7%.

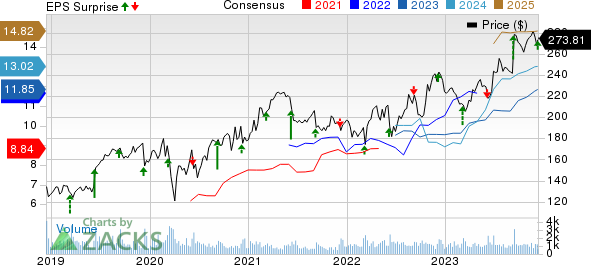

Casey's General Stores, Inc. Price, Consensus and EPS Surprise

Casey's General Stores, Inc. price-consensus-eps-surprise-chart | Casey's General Stores, Inc. Quote

Margins & Expenses

Gross profit increased 9.2% year over year to $885.6 million during the quarter. Gross margin expanded 140 basis points to 21.8%. The total Inside gross profit increased 9.7% to $553.3 million. Meanwhile, the Inside margin increased 130 basis points to 41.1% due to softening of prepared food and dispensed beverage ingredient costs as well as increased sales of private label products.

EBITDA increased 12.6% year over year to $305.9 million during the quarter under discussion. This can be attributed to higher profitability inside the store and higher fuel margin, partly offset by a rise in operating expenses owing to operating 129 more stores.

Casey's witnessed an increase of 7.5% in operating expenses of $579.7 million. The metric increased for operating 129 additional stores compared with the same period last year. We had estimated a 6.9% increase in operating expenses.

Performance of Categories

Prepared Food & Dispensed Beverage sales rose 8.9% to $382.5 million, faring better than our estimated growth of 6.6%. Same-store sales increased 6.1% compared with 10.5% in the year-ago quarter. The Prepared Food & Dispensed Beverage margin increased to 59% from 56.7% in the year-ago period.

Grocery & General Merchandise sales rose 5.2% to $964.4 million during the quarter, falling short of our projected growth of 6.9%. Same-store sales increased 1.7% compared with 6.9% growth in the year-ago quarter. The Grocery & General Merchandise margin increased to 34% from 33.3% in the year-ago period.

We note that Fuel sales increased a marginal 0.4% year over year to $2,646.5 million during the quarter. Fuel gallons sold jumped 4% to 730.4 million due to an increase in store count. We had anticipated an increase of 3.4% in fuel gallons sold.

Fuel gallons same-store sales remained flat compared with a 0.3% increase registered in the year-ago period. Fuel gross profit rose 8.6% to $308.8 million. We note that the fuel margin increased to 42.3 cents per gallon from 40.5 cents per gallon in the prior-year period.

Store Update

As of Oct 31, 2023, the company operated 2,592 stores. Casey's expects to add at least 150 stores in fiscal 2024.

Other Financial Aspects

Casey's ended the quarter with cash and cash equivalents of $409.9 million, long-term debt and finance lease obligations (net of current maturities) of $1,596.8 million and shareholders’ equity of $2,897.4 million.

During the quarter, Casey's repurchased shares worth approximately $30 million and expects to repurchase at least $100 million in shares throughout the fiscal year. The company has $340 million remaining under its existing share repurchase authorization.

FY24 Outlook

For fiscal 2024, Casey's estimates Inside same-store sales to increase between 3.5% and 5% and Inside margin in the band of 40-41%. Management foresees same-store fuel gallons sold between negative 1% and positive 1%. It expects fiscal 2024 EBITDA growth to be in line with the long-term strategic plan's target of 8-10%.

The company anticipates total operating expenses to increase approximately 6% to 8%. It expects to invest roughly $500 million to $550 million in fiscal 2024.

Shares of this Zacks Rank #2 (Buy) company have advanced 24.1% in the past six months compared with the industry’s 21.5% growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Picks You Can’t Miss Out On

Here, we have highlighted three other top-ranked stocks, namely Vital Farms VITL, The Kraft Heinz Company KHC and Celsius Holdings CELH.

Vital Farms offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

Kraft Heinz, which manufactures and markets food and beverage products, currently has a Zacks Rank #2. KHC has a trailing four-quarter earnings surprise of 9.9%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and earnings suggests growth of 1.1% and 6.5%, respectively, from the year-ago reported numbers.

Celsius Holdings, the maker of the leading global fitness drink, CELSIUS, currently carries a Zacks Rank #2. Celsius Holdings has a trailing four-quarter earnings surprise of 110.9%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 98.5% and 185.2%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report