Casey's (CASY) to Report Q3 Earnings: What's in the Cards?

Casey's General Stores, Inc. CASY is likely to register an increase in the top line when it reports third-quarter fiscal 2024 numbers on Mar 11 after the closing bell. The Zacks Consensus Estimate for revenues is pegged at $3,554 million, which indicates an increase of 6.7% from the prior-year reported figure.

The bottom line of this operator of convenience stores is expected to decline year over year. The Zacks Consensus Estimate for third-quarter earnings per share has been unchanged at $2.06 over the past 30 days, which suggests a decrease of 12.7% from the year-ago period.

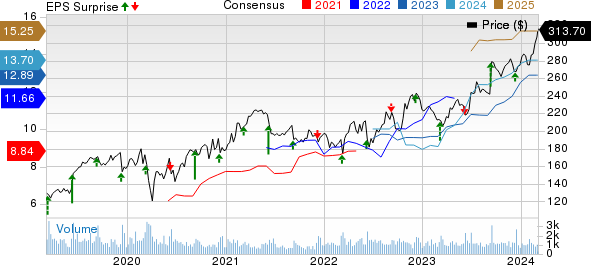

This Ankeny, Iowa-based company has a trailing four-quarter earnings surprise of 17.8%, on average. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by a margin of 13.4%.

Casey's General Stores, Inc. Price, Consensus and EPS Surprise

Casey's General Stores, Inc. price-consensus-eps-surprise-chart | Casey's General Stores, Inc. Quote

Key Factors to Consider

Casey's strategic initiatives, efficient operational management and a focus on high-margin product categories are likely to have favorably impacted third-quarter revenues. The company’s expansion into new markets signifies a strategic move to broaden its geographic footprint and capitalize on new customer bases. This expansion is part of Casey's ongoing efforts to grow its store count, thereby increasing its market presence and customer reach.

Casey's emphasis on continuous improvement and innovation, particularly in its prepared food offerings, is likely to have contributed to fourth-quarter results. Products like Thin Crust Pizza and the introduction of the Ultimate Waffle breakfast sandwich cater to changing consumer preferences and have been well-received, driving sales growth in the prepared food segment.

A significant driver of the revenue increase comes from growth in inside sales, primarily driven by the Grocery and General Merchandise segment and the Prepared Food and Dispensed Beverage segment. We expect inside sales to increase 9.4% year over year in the third quarter.

Casey's is poised for noteworthy growth across its key business categories. Our projection indicates a robust 8.5% increase in sales for the Grocery & General Merchandise category. The Prepared Food & Dispensed Beverage segment is expected to follow suit with projected growth of 11.6%. In the fuel category, our forecast points to a decent 2.8% rise in sales. These estimates underscore Casey’s potential for well-rounded performance across its diverse product offerings.

While the aforementioned factors raise optimism, we cannot ignore operating margins. We expect the operating margin to shrink 110 basis points during the quarter under review. This is due to higher operating expenses. We expect operating expenses to increase 12.8% year over year. This is likely to be reflected in the bottom line.

What Does the Zacks Model Unveil?

Our proven model does not conclusively predict an earnings beat for Casey's this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Casey's has an Earnings ESP of 0.00% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this season:

Costco COST currently has an Earnings ESP of +1.58% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports second-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.60 implies a rise of 9.1% from the year-ago reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $59.2 billion, which calls for an increase of 7.1% from the prior-year quarter. COST has a trailing four-quarter earnings surprise of 2.6%, on average.

Burlington Stores BURL currently has an Earnings ESP of +2.32% and a Zacks Rank #3. The company is likely to register top and bottom-line growth when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly EPS of $3.27 suggests an increase of 10.5% from the year-ago quarter. The consensus estimate for earnings has moved up by 2 cents in the past seven days.

The consensus mark for BURL’s revenues is pegged at $3.02 billion, indicating an increase of 10.3% from the figure reported in the year-ago quarter. BURL has a trailing four-quarter earnings surprise of 9.4%, on average.

Guess GES has an Earnings ESP of +4.25% and a Zacks Rank of 3 at present. The company is likely to register top-line growth when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly revenues is pegged at $855.5 million, which indicates a decline of 4.6% from the year-ago quarter.

The consensus mark for GES’ fourth-quarter fiscal 2023 earnings per share is pegged at $1.55, suggesting a 10.9% year-over-year decline. The consensus estimate for earnings has been unchanged in the past 30 days. GES has a trailing four-quarter earnings surprise of 43.1%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report