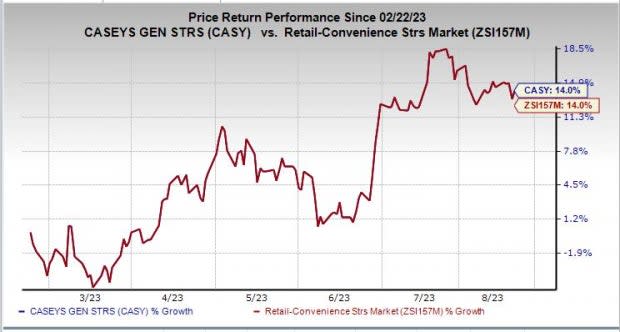

Casey's (CASY) Stock Displays Decent Run in the Past 6 Months

Casey's General Stores, Inc. CASY has demonstrated a decent performance in the stock market over the past six months. Based in Ankeny, Iowa, the company's shares have rallied 14% in this period, mirroring the industry’s growth. Its diverse offerings, expansion into new markets and the integration of digital technologies have contributed to its growth.

Leveraging its expansive store network, Casey's has effectively met its customer demands. By embracing technology, the company has successfully cultivated stronger connections with its customers. Through user-friendly mobile apps for convenient ordering and innovative loyalty programs, Casey's has effectively engaged customers and bolstered its position.

Furthermore, the stock's prominent Value Score of A enhances its appeal, indicating a positive outlook for potential appreciation. The collective blend of strategic initiatives, coupled with the promising valuation, positions Casey's as a compelling contender.

Unlocking the Factors

Casey's price and product optimization strategies, increased penetration of private brands and digital engagements comprising the mobile app and online ordering capabilities are commendable. As the third-largest convenience retailer and the fifth-largest pizza chain, its distinctive self-distribution model, robust Inside category performance and strategic acquisitions are noteworthy strengths.

Image Source: Zacks Investment Research

During the final quarter of fiscal 2023, Inside sales, comprising Grocery & General Merchandise and Prepared Food & Dispensed Beverage, increased 8.4% to reach $1,124.1 million. Inside same-store sales rose 6.5%, surpassing the 5.2% growth recorded in the prior year. This was driven by exceptional performances in non-alcoholic and alcoholic beverages within the Grocery & General Merchandise category, along with bakery and hot food in the Prepared Food & Dispensed Beverage category.

Grocery & General Merchandise sales experienced an 8.8% increase, reaching $809.8 million, while Prepared Food & Dispensed Beverage sales grew 7.1% to $314.2 million during the quarter.

Casey’s focus on technology advancements, merchandise ordering efficiency, inventory management and data analytics positions it well for future growth. The company has been strengthening pizza promotions for guests seeking meal solutions, along with enhancing breakfast lineups. Casey’s Rewards, the company's flagship loyalty program boasting a membership of more than 6.5 million, has proven to be a vital tool for guest engagement.

With more than 2,500 stores in 16 states, Casey’s aims to strategically increase its footprint. By ensuring the right stores at the right locations with the right products, the company targets the addition of 350 stores by the end of fiscal 2026. This growth strategy involves both organic expansion and strategic acquisitions. In the latest move, the company has unveiled plans to acquire 63 convenience stores from EG America.

Wrapping Up

Casey's business operating model, omnichannel capabilities, enhanced customer reach and private-label offerings reinforce its position in the industry. Through its unwavering commitment to guest-centered convenience and restaurant-quality food, Casey’s aims to carve out a unique position in the market. The company estimates Inside same-store sales to increase between 3% and 5% in fiscal 2024. Additionally, it foresees an Inside margin in the band of 40%-41%.

Casey's currently carries a Zacks Rank #3 (Hold).

3 Stocks Looking Red Hot

Here we have highlighted some better-ranked stocks, namely Grocery Outlet GO, The TJX Companies TJX and Celsius Holdings CELH.

Grocery Outlet, the extreme value retailer of quality, name-brand consumables and fresh products, currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 12.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales and earnings suggests growth of 10.6% and 2.9%, respectively, from the year-ago reported numbers. GO has a trailing four-quarter earnings surprise of 14.3%, on average.

The TJX Companies, the leading off-price apparel and home fashion retailer, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 11.1%.

The Zacks Consensus Estimate for The TJX Companies’ current financial-year sales and earnings suggests growth of 7.3% and 18.7%, respectively, from the year-ago reported numbers. TJX has a trailing four-quarter earnings surprise of 6.6%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 87.6% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report