Casey's General Stores Inc Reports Mixed Q3 Results Amidst Expansion and Margin Improvements

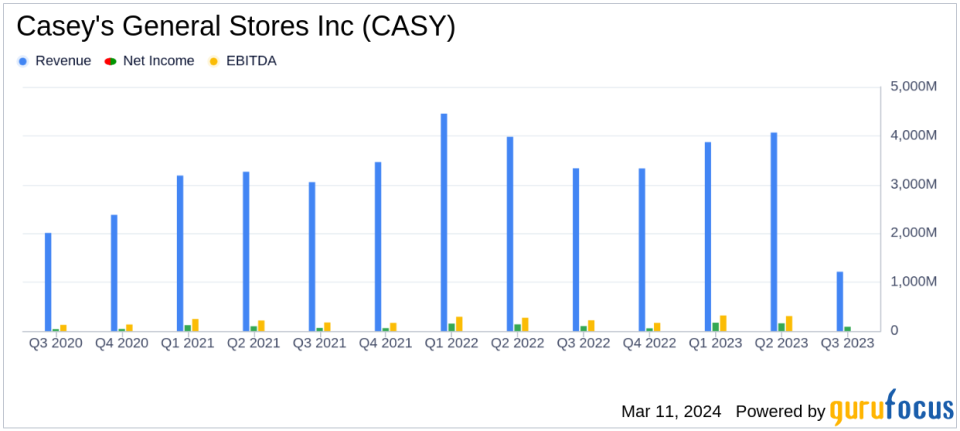

Net Income: $87 million, a 13% decrease year-over-year.

Diluted EPS: $2.33, down from $2.67 in the same period last year.

EBITDA: $218 million, a slight 2% decline from the previous year.

Inside Sales: Increased by 4.1% in same-store sales, with a notable 11.3% rise in inside gross profit.

Fuel Margin: Experienced a decrease to 37.3 cents per gallon, contributing to a 2.0% drop in total fuel gross profit.

Operating Expenses: Rose by approximately 10%, influenced by the addition of 167 new stores.

Store Expansion: Casey's ended the quarter with 2,639 stores, an increase from 2,521 stores at the beginning of the fiscal year.

On March 11, 2024, Casey's General Stores Inc (NASDAQ:CASY) released its 8-K filing, announcing financial results for the third quarter ended January 31, 2024. The company, known for its extensive network of over 2,500 convenience stores across Midwestern states, reported a decrease in net income and diluted earnings per share (EPS) compared to the same period last year. Despite these challenges, the company saw a robust increase in inside sales and gross profit, indicating a strong performance in its core convenience and food service operations.

Casey's operates its own distribution centers and owns most of its real estate, which includes nearly all of its stores and distribution centers. This vertically integrated model has allowed Casey's to maintain a strong presence in smaller communities, where over half of its stores are located.

The company's third-quarter performance was marked by a 13% decrease in net income and diluted EPS, primarily due to a strong fuel margin comparison in the prior year and a one-time operating expense benefit that was not repeated. However, inside same-store sales increased by 4.1%, with a notable 9.9% increase on a two-year stack basis. This growth was driven by prepared food and dispensed beverage sales, with whole pies and hot sandwiches performing exceptionally well. The inside margin improved to 41.3%, reflecting the company's ability to manage costs and make strategic price adjustments.

Despite the positive trends in inside sales, Casey's faced challenges in its fuel segment. Same-store fuel gallons sold decreased slightly by 0.4%, and the fuel margin contracted to 37.3 cents per gallon, leading to a 2.0% decrease in total fuel gross profit. Operating expenses increased by approximately 10%, partly due to the expansion of the store count by 167 locations.

Casey's financial achievements this quarter are significant, particularly in the context of the retail-cyclical industry. The company's ability to grow inside sales and maintain a strong inside margin is crucial for profitability, especially as fuel margins can be volatile and subject to external market factors. The expansion of store count and the management's focus on operational efficiency, as evidenced by the reduction in same-store labor hours, demonstrate Casey's commitment to sustainable growth.

Financial Performance Analysis

Casey's reported a total inside sales increase of 9.5% for the quarter, with the prepared food and dispensed beverage category leading the way. The company's strategic pricing and cost management led to a 70 basis point increase in inside margin compared to the same quarter a year ago. On the fuel front, while total gallons sold increased by 6.9% due to the store count increase, the decrease in fuel margin reflects the challenges of navigating a rising cost environment.

Operating expenses saw a significant increase, partly due to the expansion of the store network. The company's focus on efficiency is evident in the reduction of same-store labor hours, which helped mitigate the impact of rising labor rates on overall expenses.

Casey's ended the quarter with strong liquidity, with approximately $1.1 billion available, including cash on hand and borrowing capacity. The company also continued its shareholder return programs, repurchasing $30 million of shares and declaring a quarterly dividend of $0.43 per share.

Looking ahead, Casey's reaffirmed its annual outlook, expecting same-store inside sales to increase by 3.5% to 5% and aiming for an inside margin improvement to approximately 40% to 41%. The company anticipates same-store fuel gallons sold to be between negative 1% to positive 1% and projects total operating expenses to increase by approximately 6% to 8%. EBITDA growth is expected to align with the long-term strategic plan's goal of 8% to 10%, and the company plans to add at least 150 stores in fiscal 2024.

Casey's General Stores Inc (NASDAQ:CASY) remains focused on delivering value to its customers and shareholders alike, navigating the dynamic retail landscape with strategic initiatives aimed at driving long-term growth.

Explore the complete 8-K earnings release (here) from Casey's General Stores Inc for further details.

This article first appeared on GuruFocus.