Casey's General Stores Inc's Meteoric Rise: Unpacking the 21% Surge in Just 3 Months

Casey's General Stores Inc (NASDAQ:CASY), a prominent player in the Retail - Cyclical industry, has been making waves in the stock market with its impressive performance. The company's stock price currently stands at $265.2, with a market cap of $9.92 billion. Over the past week, the stock has seen a gain of 10.22%, and over the past three months, it has surged by an impressive 20.84%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of the stock is $265.21, indicating that it is fairly valued. Comparatively, the GF Value three months ago was $265.71, suggesting that the stock was modestly undervalued at that time.

Company Overview

Casey's General Stores Inc owns and operates over 2,500 convenience stores in multiple Midwestern states of the U.S. The stores provide self-service gasoline, grocery items, and processed foods such as pizza, donuts, and sandwiches. Casey's operates its own distribution centres, delivering its in-store products and fuel supplies. The company owns of its real estate, including nearly all of the stores, distribution centres, and some of its subsidiaries' facilities. More than half of the company's stores are located in areas with populations of fewer than 5,000 people.

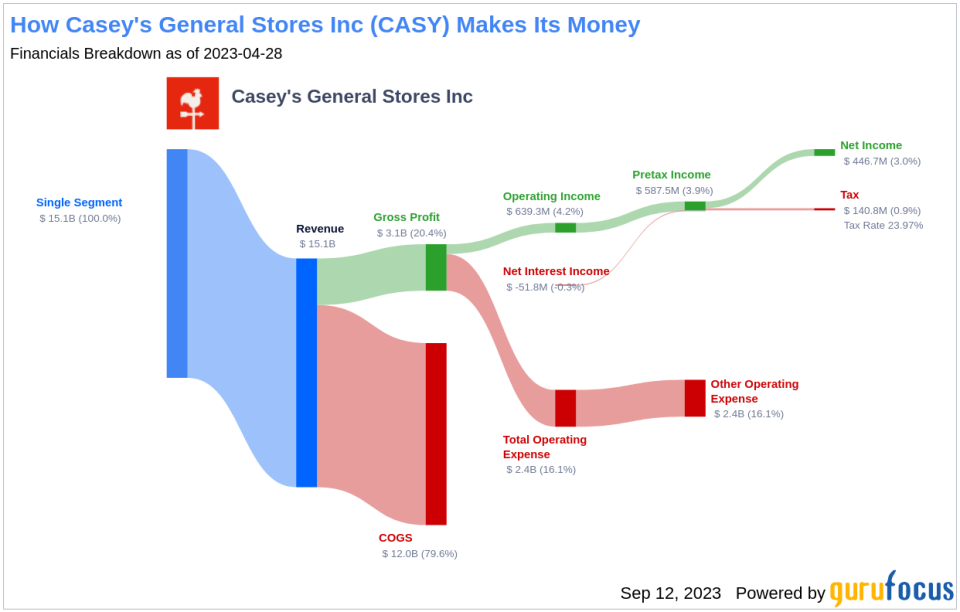

Profitability Analysis

Casey's General Stores Inc boasts a high Profitability Rank of 8/10, indicating a high level of profitability. The company's Operating Margin stands at 4.24%, which is better than 54.41% of companies in the industry. The ROE is 18.01%, the ROA is 7.77%, and the ROIC is 9.94%, all of which are better than the majority of companies in the industry. The company has consistently demonstrated profitability over the past 10 years, which is better than 99.9% of companies.

Growth Prospects

The company's Growth Rank is 9/10, indicating strong growth. The 3-Year Revenue Growth Rate per Share is 17.70%, and the 5-Year Revenue Growth Rate per Share is 11.80%, both of which are better than the majority of companies in the industry. The company's future 3-year to 5-year total revenue growth rate estimate is 1.32%, and the EPS without NRI growth rate estimate is 11.85%.

Top Holders

The top three holders of the stock are Steven Cohen (Trades, Portfolio) with 271038 shares (0.72%), Ray Dalio (Trades, Portfolio) with 69252 shares (0.19%), and Mairs and Power (Trades, Portfolio) with 56108 shares (0.15%).

Competitive Landscape

The company's main competitors are Williams-Sonoma Inc (WSM, $9.08 billion market cap), Dick's Sporting Goods Inc (DKS, $9.44 billion market cap), and Five Below Inc (FIVE, $8.78 billion market cap).

Conclusion

In conclusion, Casey's General Stores Inc has demonstrated impressive performance in the stock market, with a significant gain over the past three months. The company's high profitability and strong growth prospects, coupled with its competitive position in the market, make it a compelling consideration for investors. Based on the analyzed data, the stock's future performance looks promising.

This article first appeared on GuruFocus.