Cass Information Systems Inc (CASS) Reports Mixed Q4 Results Amid Freight Recession

Net Income: $8.4 million, a decrease of 9.4% from Q4 2022.

Earnings Per Share: $0.61 per diluted share, down from $0.67 in Q4 2022.

Net Interest Margin: Increased to 3.30% from 3.15% in Q4 2022.

Facility Expense Transaction Volumes: Grew by 9.7%.

Transportation Dollar Volumes: Declined by 17.3% from Q4 2022.

Deposits: Average deposits decreased by 10.7% compared to Q4 2022.

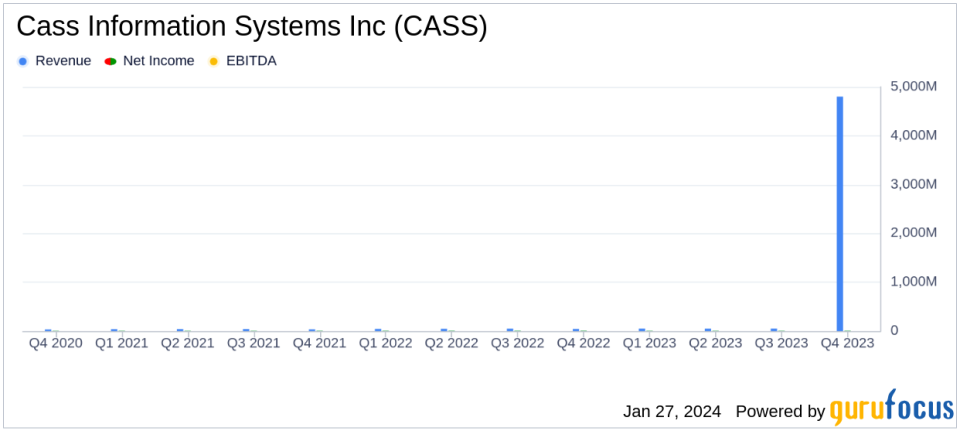

On January 25, 2024, Cass Information Systems Inc (NASDAQ:CASS) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a provider of payment and information processing services, reported a net income of $8.4 million, or $0.61 per diluted share, marking a decrease from the $9.3 million, or $0.67 per diluted share, reported in the same period last year. Despite the year-over-year decline, net income showed an improvement from the third quarter of 2023, rising by 13.8%.

Performance Amid Economic Headwinds

Cass Information Systems Inc (NASDAQ:CASS) faced a challenging economic environment, particularly due to the ongoing freight recession which impacted payment float and financial fees. However, the company's strategic investments in technology are expected to support growth in client and transaction volumes. President and CEO Martin Resch highlighted the successful onboarding of new facility clients and the growth in facility transaction volumes, which are anticipated to further accelerate in the upcoming quarters.

Financial Highlights and Challenges

The company's financial achievements include an increase in net interest margin to 3.30% and a 9.7% growth in facility expense transaction volumes. These are significant for Cass Information Systems Inc (NASDAQ:CASS) as they reflect the company's ability to manage its interest-earning assets and expand its facility services segment despite the broader economic challenges.

However, transportation dollar volumes, a key revenue driver for the company, decreased by 17.3% due to lower fuel costs and overall freight rates. This decline poses a challenge as it directly affects the company's payment float and financial fee income. Additionally, average deposits saw a decrease of 10.7%, indicating a shift by commercial depository clients to higher interest rate alternatives.

"While we continue to experience challenges related to the ongoing freight recession and its impact on payment float and financial fees, our recent technology investments should place us in a good position to grow clients and transactions in a highly efficient manner," said Martin Resch, President and CEO of Cass Information Systems Inc (NASDAQ:CASS).

Key Financial Metrics

Important metrics from the income statement include a 7.5% increase in processing fees, driven by an increase in ancillary fees and facility transaction volumes. Financial fees saw a modest increase of 1.0%, while net interest income decreased by 1.7% due to a decline in average interest-earning assets. The balance sheet reflects a decrease in ending loans by 6.3%, with the company being selective in booking new loans due to a decline in deposits.

The cash flow statement indicates changes in payments in advance of funding, which decreased by 20.3%, primarily due to the decrease in transportation dollar volumes. This metric is crucial as it impacts the company's liquidity and ability to advance payments to freight carriers.

Analysis of Company Performance

Cass Information Systems Inc (NASDAQ:CASS) has demonstrated resilience in a challenging economic climate, particularly in its facility services segment. The company's focus on technology investments and client onboarding is a strategic move to counterbalance the negative impacts of the freight recession. However, the decline in transportation dollar volumes and deposits are areas that require close monitoring as they can significantly influence the company's financial stability and growth prospects.

Value investors may find Cass Information Systems Inc (NASDAQ:CASS) an interesting case study in balancing growth in certain business segments while navigating industry-wide challenges. The company's ability to maintain exceptional credit quality, with no non-performing loans or charge-offs, is a testament to its prudent risk management practices.

For a more detailed analysis and to stay updated on Cass Information Systems Inc (NASDAQ:CASS)'s financial performance, visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Cass Information Systems Inc for further details.

This article first appeared on GuruFocus.