Castor Maritime's (NASDAQ:CTRM) earnings have declined over three years, contributing to shareholders 53% loss

Castor Maritime Inc. (NASDAQ:CTRM) shareholders should be happy to see the share price up 26% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 69% in that time. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

On a more encouraging note the company has added US$8.9m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Castor Maritime

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

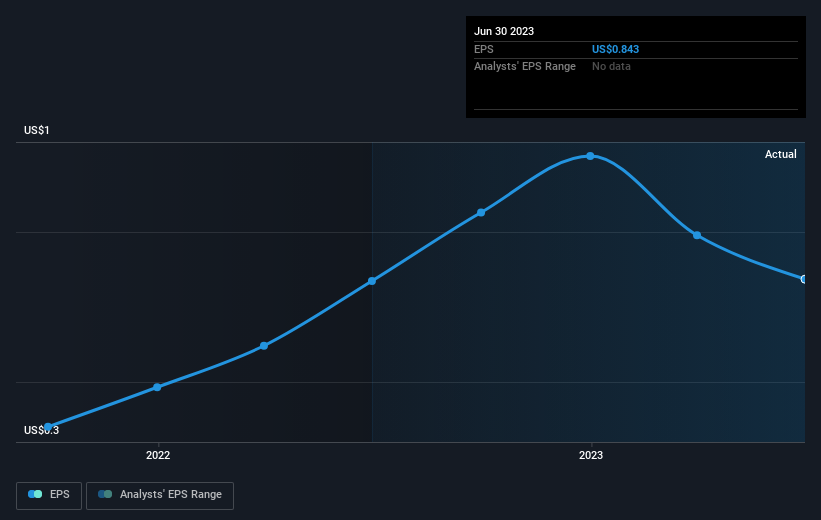

During the three years that the share price fell, Castor Maritime's earnings per share (EPS) dropped by 37% each year. This change in EPS is reasonably close to the 33% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Castor Maritime's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Castor Maritime's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Castor Maritime hasn't been paying dividends, but its TSR of -53% exceeds its share price return of -69%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Over the last year, Castor Maritime shareholders took a loss of 51%. In contrast the market gained about 6.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 15% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Castor Maritime better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Castor Maritime .

We will like Castor Maritime better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.