Catalent (CTLT) Preliminary Q1 Revenues Dampened by Lower Sales

Catalent, Inc. CTLT reported preliminary first-quarter fiscal 2024 adjusted loss per share of 10 cents against the year-over-year period’s earnings per share (EPS) of 34 cents. The metric was narrower than the Zacks Consensus Estimate of a loss of 13 cents per share.

The adjustments include charges related to amortization, and acquisition, integration and other special items’ costs, among others.

The company’s GAAP loss per share (including non-cash goodwill impairment charges of $700 million and incorporating the effect of a $29 million deferred tax adjustment) was $3.94 during the quarter, against the year-over-year period’s breakeven EPS.

Revenues in Detail

Per the preliminary report, revenues grossed $982 million in the reported quarter, down 3.9% year over year. However, the metric surpassed the Zacks Consensus Estimate by 5.2%.

At constant exchange rate or CER, revenues were also down 6%.

The top line was hampered by soft performances in its Biologics segment in the reported quarter.

Organic net revenues (excluding the impact of acquisitions, divestitures and currency translation) decreased 8% year over year.

Segments in Detail

Per Catalent’s new organizational structure, it reports via two segments — Biologics and Pharma and Consumer Health (PCH).

Per the preliminary report, revenues in the Biologics segment fell 14.5% year over year on a reported basis (down 16% at CER) to $447 million in the quarter under review. The decline was primarily due to significantly lower year-on-year COVID-19 demand. This compares to our projection of fiscal first-quarter segmental revenues of $432.2 million.

Per the preliminary report, revenues in the PCH segment increased 7.2% from the year-ago period (up 5% at CER) to $535 million. The segment's revenue growth was primarily driven by the prior year's acquisition of Metrics. This compares to our projection of fiscal first-quarter segmental revenues of $505.3 million.

Operational Update

In the quarter under review, Catalent’s gross profit fell 29.8% to $181 million. The gross margin contracted 681 basis points to 18.4%.

We had projected 24.6% of gross margin for the fiscal first quarter.

Selling, general and administrative expenses rose 9.7% to $215 million year over year.

Adjusted operating loss totaled $34 million against the prior-year quarter’s adjusted operating profit of $62 million.

Financial Update

Catalent exited first-quarter fiscal 2024 with cash and cash equivalents of $209 million compared with $280 million at the end of fiscal 2023. Total debt at the first-quarter fiscal 2024-end was $4.95 billion compared with $4.85 billion at the end of fiscal 2023.

Net cash used in operating activities at the end of first-quarter fiscal 2023 was $70 million compared with $92 million a year ago.

Guidance

Catalent has revised its financial outlook for fiscal 2024.

The company continues to project revenues between $4,300 million and $4,500 million for the full year, reflecting growth of 1-5% from the comparable fiscal 2023 period. The Zacks Consensus Estimate for fiscal 2024 revenues is currently pegged at $4.35 billion.

COVID revenues for the full fiscal year are now projected to be $180 million, up from the previous outlook of $130 million.

PCH revenues for the full fiscal year are continued to be projected to be mid- to high-single-digit revenue growth.

Our Take

Catalent exited the first quarter of fiscal 2024 with dismal overall top-line and bottom-line performances. The decline in Biologics segment’s revenues during the period was also disappointing. Rising product costs leading to the contraction of gross margin in the quarter do not bode well. Catalent also faced escalating operating costs during the quarter, thereby incurring an adjusted operating loss. This was also discouraging.

On a positive note, Catalent’s narrower-than-expected loss per share and better-than-expected revenues in the reported quarter were encouraging. The year-over-year improvement in the PCH segment and the Biologics segment’s non-COVID year-over-year revenue growth was impressive. Management’s confirmation regarding Catalent’s strength in its non-COVID Biologics portfolio and continued progress in improving its operational performance raise our optimism.

Price Performance

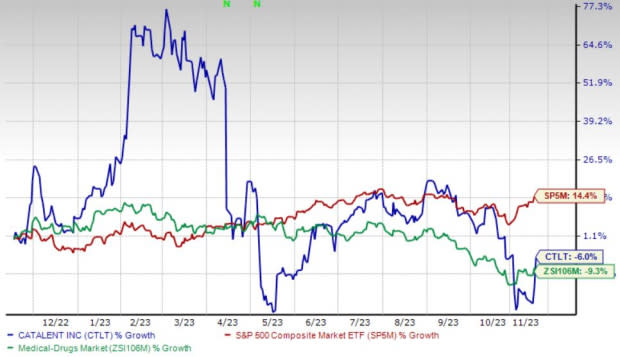

Shares of Catalent have lost 5.9% in the past year compared with the industry’s 9.3% decline. The S&P 500 has witnessed 14.4% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Catalent currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 35.7% compared with the industry’s 4.8% rise over the past year.

HealthEquity, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 26.7%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 11.7% against the industry’s 11.2% decline over the past year.

Integer Holdings, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings has gained 24.5% against the industry’s 7.2% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report