Catching the Wave: CVR Energy Inc's Stock's Dramatic 47% Leap in 90 Days

Over the past week, CVR Energy Inc's stock has seen a gain of 4.40%, and over the past three months, the stock has surged by an impressive 47.09%. The company's current market cap stands at $3.47 billion, with a stock price of $34.51. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of CVR Energy Inc is $31.34, compared to the past GF Value of $33.57. This indicates that the stock is 'Fairly Valued', a shift from its past GF Valuation of 'Modestly Undervalued'.

Unpacking CVR Energy Inc

CVR Energy Inc operates in the Oil & Gas industry, with its business operations primarily focused on petroleum refining and nitrogen fertilizer manufacturing. The company's refining capabilities are extensive, with several complex full coking crude oil refineries under its belt. CVR Energy Inc can process a variety of crude oil, ranging from heavy sour to light sweet crude oil. The company's wholly-owned gathering system and pipeline supply crude oil for its refineries. CVR Energy Inc's products are supplied directly to customers located in close geographic proximity and customers at throughput terminals, including retailers, railroads, and farm cooperatives.

Profitability Analysis

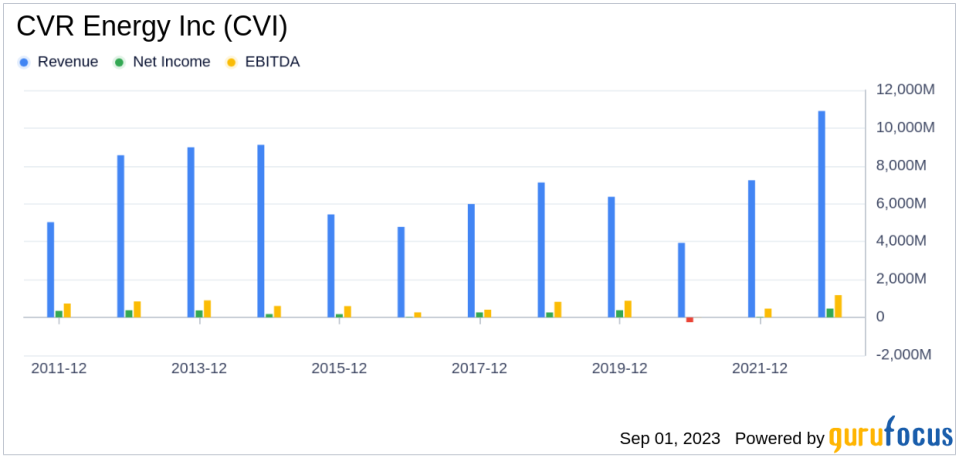

With a Profitability Rank of 7/10, CVR Energy Inc's profitability is better than 84.49% of 948 companies in the Oil & Gas industry. The company's Operating Margin of 9.14% is better than 50.67% of 967 companies in the same industry. The company's ROE of 80.55% and ROA of 12.37% are better than 94.17% and 80.09% of companies in the industry, respectively. The ROIC of 27.68% is better than 91.35% of 1075 companies. Over the past 10 years, CVR Energy Inc has had 9 years of profitability.

Growth Prospects

CVR Energy Inc's Growth Rank is 3/10, indicating moderate growth prospects. The company's 3-Year Revenue Growth Rate per Share of 19.60% is better than 69.72% of 852 companies in the industry. The 5-Year Revenue Growth Rate per Share of 4.60% is better than 49.94% of 777 companies. However, the future 3 to 5-year total revenue growth rate estimate is -11.88%, which is better than only 7.98% of 263 companies. The 3-Year EPS without NRI Growth Rate is 6.80%, better than 35.51% of 690 companies.

Major Stock Holders

The top three holders of CVR Energy Inc's stock are Carl Icahn (Trades, Portfolio), holding 70.42% of the shares, Jim Simons (Trades, Portfolio), holding 0.79% of the shares, and Joel Greenblatt (Trades, Portfolio), holding 0.04% of the shares.

Competitive Landscape

CVR Energy Inc's main competitors in the Oil & Gas industry are Sunoco LP with a market cap of $3.9 billion, Par Pacific Holdings Inc with a market cap of $2.19 billion, and Valvoline Inc with a market cap of $4.84 billion.

Conclusion

In conclusion, CVR Energy Inc's stock performance has been impressive, with a 47.09% surge over the past three months. The company's profitability and growth prospects are promising, with a Profitability Rank of 7/10 and a Growth Rank of 3/10. The company's major holders include Carl Icahn (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). Despite stiff competition from Sunoco LP, Par Pacific Holdings Inc, and Valvoline Inc, CVR Energy Inc's future outlook remains positive based on the analyzed data.

This article first appeared on GuruFocus.