Caterpillar (CAT) Q3 Earnings & Revenues Beat, Rise Y/Y

Caterpillar Inc. CAT reported adjusted earnings per share of $5.52 in the third quarter of 2023, which beat the Zacks Consensus Estimate of adjusted earnings per share of $4.75 by a margin of 16%. The bottom-line figure marked a 39.7% year-over-year improvement. Despite unfavorable costs, higher sales volumes in the Energy & Transportation and Construction Industries segments, and favorable price realization led to the improvement in CAT’s earnings for the quarter.

Including one-time items, Caterpillar’s earnings per share were $5.45, up 41% from the prior-year quarter’s $3.87.

Revenues Up on Favorable Price Realization

The company reported third-quarter revenues of around $16.8 billion, which surpassed the Zacks Consensus Estimate of $16.6 billion. The top line improved 12% from the year-ago quarter, aided by higher sales volumes in the Energy & Transportation and Construction Industries segments and favorable price realization in all the segments. The improvement in overall sales volume was driven by higher sales of equipment to end users, partially offset by the impact of changes in dealer inventories and lower services sales volume.

Sales growth was noted across all segments. Region-wise, North America witnessed a 25% year-over-year improvement in sales. EAME reported 8% growth in sales while Latin America and the Asia Pacific saw declines of 11% and 1%, respectively.

Caterpillar Inc. Price, Consensus and EPS Surprise

Caterpillar Inc. price-consensus-eps-surprise-chart | Caterpillar Inc. Quote

Higher Sales Offset Cost Impact on Margins

In the quarter under review, the cost of sales increased 4% year over year to around $10.6 billion. Manufacturing costs were higher in the quarter, reflecting inflated material costs, unfavorable cost absorption, an increase in period manufacturing costs and the impact of manufacturing inefficiencies. These were somewhat offset by lower freight costs.

Gross profit improved 30% year over year to $6.23 billion, mainly driven by higher sales. The gross margin was 37% in the quarter under review, up from 32% in the prior-year quarter.

Selling, general and administrative expenses increased 16% year over year to around $1.6 billion. Research and development expenses were up 16% to $554 million. This was mainly due to CAT’s investments aligned with strategic initiatives.

CAT reported an operating profit of $3.45 billion in the third quarter of 2023 compared with $2.43 billion in last year’s quarter. Gains from increased volumes and favorable price realization helped offset higher costs, leading to a 42% year-over-year jump in profits. The operating margin was 20.5% in the reported quarter, up from 16.2% in the prior-year quarter.

Adjusted operating profit was around $3.49 billion in the quarter, up 41% from $2.47 million in last year’s quarter. The adjusted operating margin was 20.8% in the third quarter of 2023 compared with 16.5% in the year-ago quarter.

Segment Performances

Machinery and Energy & Transportation (ME&T) sales rose 12% year over year to around $16 billion in the quarter under review.

Construction Industries' sales were up 12% year over year to $7 billion on favorable price realization. Sales were up 31% in North America and 8% in EAME. Sales meanwhile plunged 31% in Latin America and 8% in Asia Pacific.

The segment’s external sales were higher than our estimate of $6.26 billion, which had factored in a volume and pricing growth of 3.1% and 1.1%, respectively, for the quarter. The segment reported volume growth of 1% and a favorable price impact of 11%, which led to the variance.

Sales in the Resource Industries segment gained 9% year over year to around $3.35 billion as improved price realization offset lower volumes. Sales volume was impacted as higher sales of equipment to end users were more than offset by lower aftermarket parts sales volume and the impact of changes in dealer inventories. North America reported year-over-year growth of 22%, followed by Latin America registering 6% growth. Sales at EAME and Asia Pacific declined 3% and 1%, respectively.

The segment’s third-quarter sales were higher than our projection of $3.31 billion. We had expected volume and pricing to contribute 10.7% and 2.2%, respectively, to the revenue growth in the quarter. The segment reported a 3% decline in volume which was offset by an 11% favorable impact from pricing.

Sales of the Energy & Transportation segment in the quarter were around $6.86 billion, reflecting growth of 11% on higher sales volume and favorable price realization. The segment reported sales growth across all applications, which are Oil and Gas (26%), Power Generation (21%) Industrial (5%) and Transportation (6%).

For the Energy & Transportation segment, our sales estimate was $6 billion, with volume growth at 16% and pricing at 5%. The segment’s volume growth was 8% in the third quarter and pricing improved 6%.

The ME&T segment reported an operating profit of $3.39 billion, which reflected an improvement of 48% year over year. The Construction Industries segment witnessed a 53% surge in operating profit to $1.85 billion. The Resource Industries segment’s operating profit soared 44% year over year to $730 million in the third quarter. The Energy & Transportation segment’s operating profit increased 26% year over year to $1.18 billion. Favorable price realization helped offset the impact of higher costs, resulting in the improvement in respective segments’ profits.

Financial Products’ total revenues climbed 20% to $979 million from the prior-year quarter due to higher average financing rates in all regions. The segment's profits were $203 million in the reported quarter, which was 8% lower than the year-ago quarter. This was due to the absence of prior-year reserve releases for credit losses at Cat Financial, partially offset by a favorable impact from mark-to-market adjustments on derivative contracts.

Cash Position

During the first nine-month period of 2023, Caterpillar’s operating cash flow was $8.9 billion compared with $5.03 billion in the prior-year comparable period. Through the quarter, the company returned $1 billion to shareholders as dividends and share repurchases. CAT ended the reported quarter with cash and equivalents of around $6.5 billion.

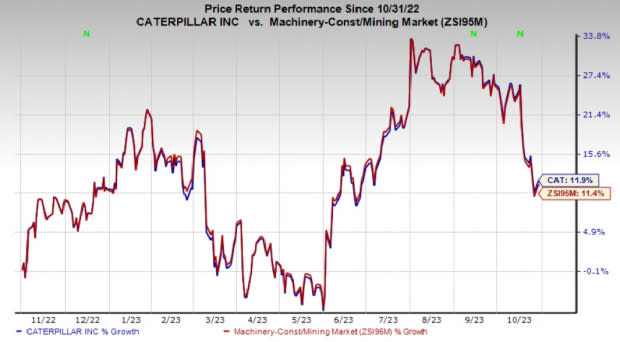

Price Performance

Over the past year, the Caterpillar stock has gained 11.9% compared with the industry’s 11.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Caterpillar currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and Emerson Electric Co. EMR. BRC currently sports a Zacks Rank #1, and AIT and EMR have a Zacks Rank of 2.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $3.62. The consensus estimate for 2023 earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC have rallied 13% in the last year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pegged at $9.13 per share, which indicates year-over-year growth of 2%. Estimates have moved up 2% in the past 60 days. The company’s shares have gained 22% in the last year.

Emerson has an average trailing four-quarter earnings surprise of 7.4%. The Zacks Consensus Estimate for EMR’s 2023 earnings is pegged at $4.45 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. EMR’s shares have gained 2% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report