Causeway International Value Sheds iShares MSCI EAFE ETF in Q4

Insight into Causeway International Value (Trades, Portfolio)'s Latest Portfolio Adjustments

Causeway International Value (Trades, Portfolio), known for its value-driven investment approach, has revealed its N-PORT filing for the fourth quarter of 2023. The fund, which launched on October 26, 2001, targets long-term capital and income growth through investments in developed non-U.S. markets, with a focus on dividend-paying or share-repurchasing companies. With a strategy that includes a three-stage investment processscreening and initial analysis, fundamental research, and portfolio constructionthe fund emphasizes a bottom-up approach to stock selection, favoring mid- to large-cap stocks that complement a U.S. portfolio.

Summary of New Buys

Causeway International Value (Trades, Portfolio) expanded its portfolio with 10 new stocks. Noteworthy additions include:

Seven & i Holdings Co Ltd (TSE:3382), purchasing 1,926,300 shares, which translates to 1.06% of the portfolio and a total value of 76,437.22 million.

Compagnie Financiere Richemont SA (XSWX:CFR), acquiring 524,338 shares, making up about 1% of the portfolio, valued at CHF 72,162.33 million.

Assa Abloy AB (OSTO:ASSA B), with 1,447,931 shares, accounting for 0.58% of the portfolio and a total value of kr 41,674.83 million.

Key Position Increases

The fund also raised its stakes in 35 stocks, with significant increases in:

Fanuc Corp (TSE:6954), adding 4,717,100 shares for a total of 5,378,600 shares, marking a 713.09% increase in share count and a 1.93% portfolio impact, valued at 158,191.87 million.

Alstom SA (XPAR:ALO), with an additional 8,039,844 shares, bringing the total to 10,747,559 shares, a 296.92% increase in share count, valued at 144,512.57 million.

Summary of Sold Out Positions

Exiting four holdings in Q4 2023, Causeway International Value (Trades, Portfolio) made the following divestments:

iShares MSCI EAFE ETF (EFA): Sold all 4,745,100 shares, impacting the portfolio by -5.12%.

Zurich Insurance Group AG (XSWX:ZURN): Liquidated 142,916 shares, with a -1.03% portfolio impact.

Key Position Reductions

Portfolio reductions were made in 22 stocks, with the most substantial being:

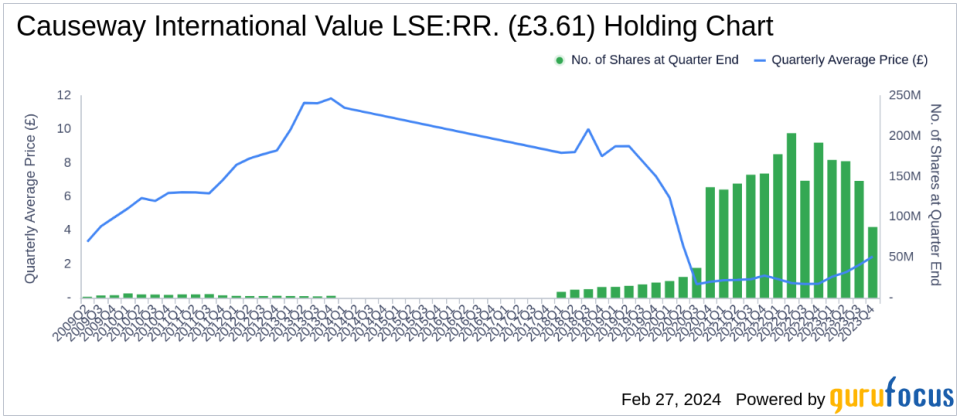

Rolls-Royce Holdings PLC (LSE:RR.), cutting 57,190,326 shares, a -39.53% decrease, affecting the portfolio by -2.42%. The stock's average trading price was 2.45 during the quarter, with a 49.88% return over the past three months and 20.52% year-to-date.

Rio Tinto PLC (LSE:RIO), reducing by 1,188,301 shares, a -69.97% decrease, impacting the portfolio by -1.18%. The stock's average trading price was 53.6 during the quarter, with a -7.64% return over the past three months and -13.27% year-to-date.

Portfolio Overview

As of the fourth quarter of 2023, Causeway International Value (Trades, Portfolio)'s portfolio comprised 70 stocks, with top holdings including 4.65% in Rolls-Royce Holdings PLC (LSE:RR.), 4.59% in Samsung Electronics Co Ltd (XKRX:005930), 2.87% in Roche Holding AG (XSWX:ROG), 2.84% in Reckitt Benckiser Group PLC (LSE:RKT), and 2.68% in BP PLC (LSE:BP.). The investments span across all 11 industries, with a focus on Financial Services, Industrials, Healthcare, Consumer Defensive, Technology, Consumer Cyclical, Basic Materials, Utilities, Energy, Communication Services, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.