Cautious Optimism on GDP Might Support the Pound

UK GDP Data and Currency Trends: A Look Ahead

The pound mostly made gains against other major currencies early on Friday 29 September in the aftermath of final GDP data for the second quarter. This article summarises recent important economic indicators from the UK and looks ahead to possible movements on the charts of GBPUSD and GBPJPY.

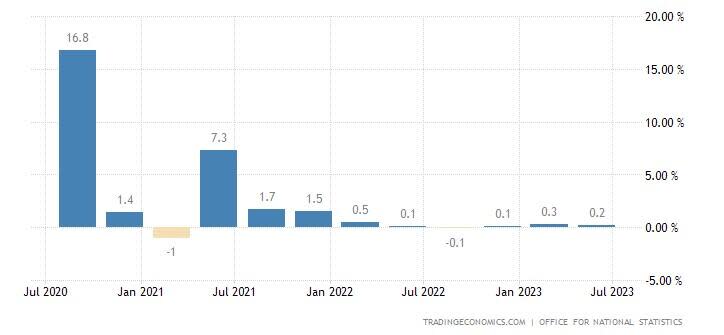

British GDP data on 29 September came in mostly positive, with final quarterly GDP growth in Q2 steady from the second estimate at 0.2% and annual growth up to 0.6%. Furthermore the annual figure for the first quarter was revised up to 0.5% from 0.2%.

These releases show that the UK’s economic recovery from the pandemic in terms of GDP has been faster than previously estimated. Overall, the British economy has grown around 1.8% compared to the end of 2019, better than France or Germany but below the USA, Japan and others. Recent quarterly GDP data suggest stagnation rather than an imminent recession:

The recovery in 2020 and 2021 wasn’t very consistent, but a technical recession was avoided last year and 2023’s GDP data so far are consistently barely positive. This contrasts with expectations around this time last year, when analysts and the Bank of England itself were warning of a possibly severe recession to come this year.

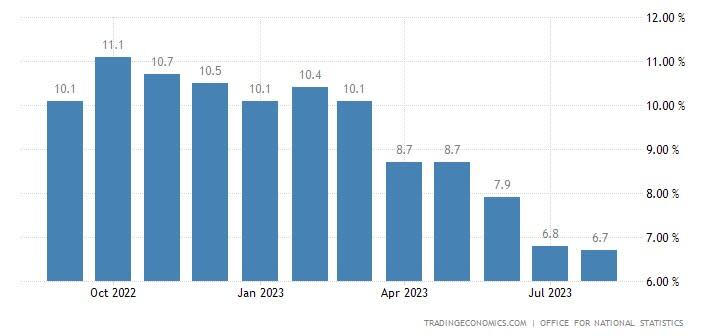

That’s now much less likely based on the usual definition of a technical recession as being two consecutive quarters of declining GDP. However, the UK still faces the most significant challenge with inflation of all the G7:

While the rate of inflation has declined quite strongly and somewhat consistently since the third quarter of last year, it now seems to have reached a trough just below 7%. This is still far too high for the Bank of England compared to the traditional target of 2%.

The BoE surprised many participants in markets at its last meeting by not hiking. The Monetary Policy Committee had a majority of only one vote to hold at 5.25%. It cited clear evidence of improvement of the situation with inflation combined with a generally cooler labour market as reasons for maintaining the bank rate and assessing developments.

Nevertheless, it seems likely that the BoE will follow the Fed in keeping rates high for longer and especially not pivoting too quickly. Most traders expect the bank rate to remain stable in the next statement on 2 November but it’s possible that there could be another hike in December if inflation won’t come down.

There’s no major British data due next week, so current sentiment and technical movements might dominate until the American job report on 6 October. However, if the American government shuts down next week, the NFP might be delayed, so it’s important to monitor the news and be prepared for a change.

Cable, Daily

Cable is on track for its worst monthly performance for a year after the Fed’s ‘hawkish hold’ and negative recent releases from the UK apart from GDP. The 38.2% monthly Fibonacci retracement remains in view as s possible support given the strength of the bounce from around there so far, with a possible short-term target around the 50% Fibo at $1.235.

It would usually make sense to expect a pause or consolidation in a downtrend this long, especially considering recent oversold signals from the slow stochastic and Bollinger Bands. Failure to break above $1.24 might suggest another leg down, but the NFP scheduled for 6 October could make matters clearer further ahead.

Pound-yen, Daily

Sterling has held its strength a lot better against the yen than most other currencies given that the Bank of Japan remains notably dovish, the only major central bank not to hike its base rate at all since Covid as the rest now seem to be nearing the end of this cycle of tightening. The BoJ stuck to the script of ultra-easy policy at September’s meeting despite Japanese annual headline inflation having remained above 3% for a year.

The price hasn’t clearly broken through the 100 SMA and now seems ready to retest the 50 SMA from Bands after a crossover of the slow stochastic in oversold. However, pound-yen might not attract very much interest from medium-term buyers in the immediate future because a fundamental catalyst would probably be needed to reach a new high above ¥186.50.

That’s not necessarily a problem for carry traders given that the difference in rates is likely to remain 5.35% in favour of the pound for at least the next few months. However, Japan’s ministry of finance has warned of a possible intervention several times in the last few weeks. With no very important data from Japan or the UK next week, traders are likely to watch yields from the countries’ bonds and political developments, if any.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire