Cava Group Is Scaling Profitably

Cava Group Inc. (NYSE:CAVA) is an American company that operates two Mediterranean fast-casual restaurant brands: Cava and Zoe's Kitchen. The restaurant chain was founded in 2006 with the launch of a full-service restaurant called Cava Mezze, and later launched a line of dips and spreads that are sold in grocery stores. In 2011, the company opened its first Cava restaurant, which offers customizable meals with fresh ingredients and bold flavors.

The company has grown rapidly since then and acquired Zoe's Kitchen in 2018. In June, it went public on the New York Stock Exchange, becoming the largest restaurant operator in the Mediterranean category in the U.S. restaurant industry.

Earlier this week, Cava reported second-quarter earnings, marking the first earnings announcement since going public. A closer look at the companys second-quarter performance and the industry outlook suggest it is carving out competitive advantages, which makes it an attractive bet for growth investors.

Strong guest visitation despite inflationary pressures

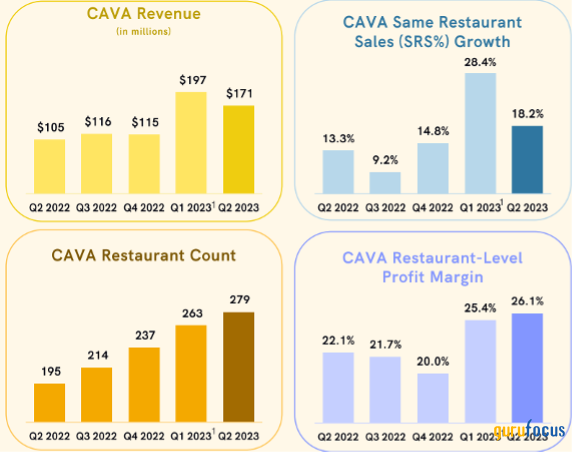

Cava announced second-quarter revenue of $171.1 million, a 62% increase year over year, aided by new restaurant openings. Net income was $6.5 million, a notable improvement from the previous year's net loss of $8.2 million. During the quarter, the company added 16 net new Cava restaurants 102 restaurants opened since the second quarter of last year - bringing the total to 279. The company reported an impressive 18.2% year-over-year increase in same-restaurant sales as well.

Source: Earnings presentation

Impact of inflation on restaurant industry

According to the Bureau of Labor Statistics, costs for meals consumed away from home increased 7.1% year over year in July. Further, Black Box Intelligence data shows that in April, this years worst month for restaurant sales growth, traffic at restaurants decreased by 3.5% from the previous year as the price of eating out increased.

Although costs for meals consumed away from home increased faster than prices at grocery stores, home food costs also saw an increase of 7.1% over the same period. As a result, fewer people were eating out, resulting in a decline in restaurant traffic. In a December survey conducted by AlixPartners, 74% of respondents said they intended to cut back on eating out and 39% of respondents claimed to prefer less costly eateries.

Cava's response to industry challenges

Despite guests switching over to fewer services, guest visitation contributed 10.3% of Cavas total sales growth in the second quarter. According to management, this surge in traffic despite the slowdown in the restaurant industry can be attributed to enhanced brand recognition following the company's initial public offering.

All of the company's restaurant segments had declining same-store visits in the second quarter. The fastest-growing segment was quick service, followed by family dining and fast casual. Additionally, management noted during the earnings call that customers are cutting back on their restaurant spending by picking up their own warm bowls and salads instead of ordering delivery.

Impact of digital channels on revenue

Consumers in particular are reducing their takeout and food delivery orders because these orders are frequently more expensive due to additional fees such as taxes, convenience fees, delivery fees and, occasionally, higher food prices. Cava's menu prices also increased by about 8% when compared to the same time last year. However, the restaurant chain has no plans to increase prices further. More than a third of its quarterly revenue came from digital orders. According to PYMNTS 2022 survey data, digital channels such as mobile apps, aggregators and websites now account for 41% of typical restaurant sales. This share of revenue is significantly higher than the 32% generated by the average restaurant's brick-and-mortar store and the 26% generated by phone calls.

Future plans and investments

Although Cava is outperforming its competitors in the restaurant industry, CEO Brett Schulman said that customer spending is being impacted by the restart of student loan payments, increasing electricity prices and elevated interest rates. However, the company continues to invest to improve both the customer experience and its operations, including investments in expanding locations and boosting its vertically integrated production capabilities. The ongoing construction of a food production plant in Verona, Virginia is set to begin operations in the first quarter of 2024 and is expected to supply at least 750 restaurants as well as Cava's CPG business alongside its current 30,000-square-foot manufacturing facility in Laurel, Maryland.

Relaunching of loyalty program

In terms of branding, the company is working on relaunching its loyalty program with a focus on tailoring the customer experience to promote traffic, mix and check as it scales. The company plans to debut the program in late 2024 and, by the end of this year, test pilots will be operating to help shape the new initiative.

According to the National Restaurant Association, the average American eats out five times per week, but only one in 10 consumers sign up for a chain's loyalty program. However, customers are now a part of more loyalty programs than ever before thanks to the increasing usage of smartphones and the development of app-based loyalty systems. According to a Statista 2022 survey, 70% of Americans believed loyalty programs were a major component in ensuring their commitment to their preferred businesses. Additionally, over 50% of American consumers were likely to increase their membership in loyalty programs and 80% of American customers stated they made more regular purchases from brands where they are loyalty program members.

Expansion into plant-based market

The company expanded its presence in the plant-based market with the introduction of new items in the second quarter, including spicy falafel and fiery broccoli, both of which were well-received by consumers. According to the Plant Based Food Association, 48.4% of U.S. restaurants now offer plant-based options, a 62% increase since 2012. Additionally, one-third of Americans associate the phrase "plant-based" with sustainable food choices with millennial and gen Z women in Asian and Black populations showing more interest in plant-based food. Statista predicts that the global plant-based food market will reach $77.8 billion by 2025. These figures demonstrate Cava's tremendous opportunity to grow its offering in the plant-based market.

Catering market potential

Cava sees additional growth potential in the catering market with enlarged facilities to accommodate centralized catering production. The company currently has 10 digital kitchens that allow centralized catering hub production and digital order pickup, as well as five hybrid kitchens that provide in-restaurant dining and digital pickup.

Takeaway

Cava Group made a significant turn toward profitability in the second quarter by reporting a positive net income. This highlights the companys ability to scale profitably, which is not a characteristic often associated with fast-growing companies with a long runway. What stands out is Cava's strong performance amid challenging macroeconomic conditions, which suggests it is well-positioned to grow in the recovery phase of the current business cycle.

Although challenges remain in the food service market with cautious consumer spending being a major growth barrier, Cavas expansion into new regions and business verticals present a significant opportunity for growth. The companys improving profitability profile and expectations for easing inflationary pressures in the coming quarters make the stock an interesting bet in the restaurant space.

This article first appeared on GuruFocus.