Cavco Industries Inc Reports Decline in Q3 Revenue and Net Income

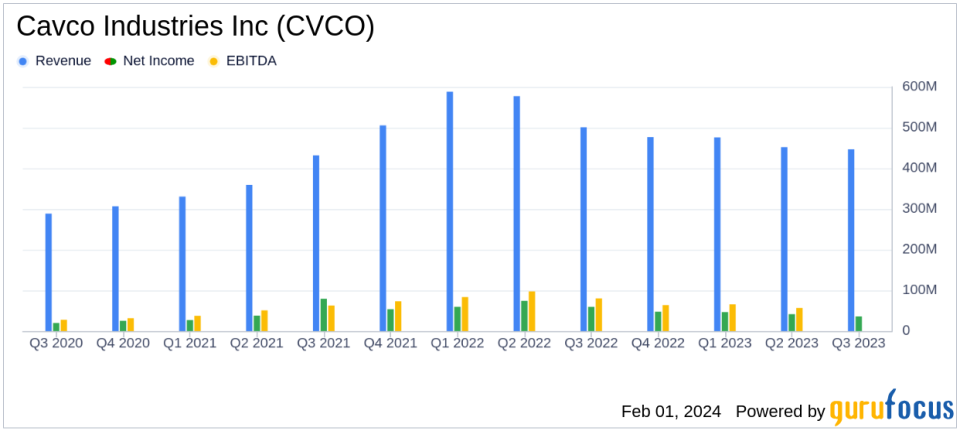

Net Revenue: Decreased by 10.8% to $447 million in Q3 compared to the previous year.

Gross Profit Margin: Factory-built housing gross profit margin decreased to 22.4% from 25.5% year-over-year.

Net Income: Dropped by 39.5% to $35.9 million, with diluted EPS falling from $6.66 to $4.27.

Backlogs: Ended the quarter at $160 million, a 5.9% sequential decrease.

Stock Repurchase: Cavco announced a new $100 million stock repurchase program.

On February 1, 2024, Cavco Industries Inc (NASDAQ:CVCO) released its 8-K filing, reporting financial results for the third fiscal quarter ended December 30, 2023. The company, a prominent player in the design and production of factory-built homes, experienced a downturn in its quarterly performance, with net revenue falling to $447 million, a 10.8% decrease compared to the same period last year. This decline was reflected across both the factory-built housing and financial services segments, with gross profit margins contracting in both divisions.

Company Overview

Cavco Industries Inc operates through two main segments: Factory-built housing and financial services. The former includes wholesale and retail systems-built housing operations, while the latter comprises manufactured housing consumer finance and insurance. The majority of the company's revenue is generated from the factory-built housing segment, which saw a notable decrease in net revenue and gross profit margin during the quarter.

Financial Performance and Challenges

The company's financial performance was impacted by a decrease in factory-built housing net revenue due to lower home sales volume and average selling prices, despite the addition of Solitaire Homes to its portfolio. The financial services segment saw an increase in net revenue, attributed to more insurance policies in force, but was offset by reduced revenue from loan sales. Gross profit as a percentage of net revenue for factory-built housing decreased primarily due to lower average selling prices, partially mitigated by lower input costs. The financial services segment's gross profit and income from operations were negatively impacted by reduced loan sales and higher insurance claims from weather-related events.

President and CEO Bill Boor commented on the quarter, stating, "Despite winter months typically being slower, our orders written this quarter, on a same plant basis, were the highest in the last six quarters." He highlighted the company's strong cash flow and focus on addressing the critical need for quality, affordable homes, exemplified by the launch of the Anthem series, a HUD-approved manufactured duplex.

Financial Achievements and Stock Repurchase Program

Despite the challenges faced in the quarter, Cavco Industries Inc managed to execute a significant stock repurchase, buying back approximately $50 million worth of shares. Additionally, the Board of Directors approved a new $100 million stock repurchase program, signaling confidence in the company's financial stability and commitment to delivering shareholder value.

Analysis of Financial Statements

The income statement revealed a 42.1% decrease in income before income taxes, which stood at $44 million, and a 39.5% drop in net income attributable to Cavco common stockholders to $35.9 million. Diluted net income per share also decreased by 35.9% to $4.27. The balance sheet showed a healthy cash and cash equivalents position of $352.8 million, an increase from $271.4 million at the beginning of the fiscal year. Total assets increased slightly to $1.326 billion from $1.308 billion.

These financial metrics are crucial for investors as they reflect the company's profitability, liquidity, and overall financial health, which are key considerations for value investing.

Looking Forward

While Cavco Industries Inc faces challenges such as decreased net revenue and gross profit margins, the company's strategic initiatives, including new product launches and stock repurchase programs, demonstrate a proactive approach to navigating the current market conditions. The company's management remains focused on leveraging its strong cash flow to innovate and improve housing affordability, positioning Cavco for potential growth as market conditions improve.

For additional details and to participate in the upcoming conference call, investors are encouraged to visit the investor relations section of Cavco's website.

Explore the complete 8-K earnings release (here) from Cavco Industries Inc for further details.

This article first appeared on GuruFocus.