Caxton Associates Adds to Amazon, Alibaba, AIG

- By Tiziano Frateschi

Investment firm Caxton Associates (Trades, Portfolio) bought shares of the following stocks during the fourth quarter.

Warning! GuruFocus has detected 1 Warning Sign with AMZN. Click here to check it out.

The intrinsic value of AMZN

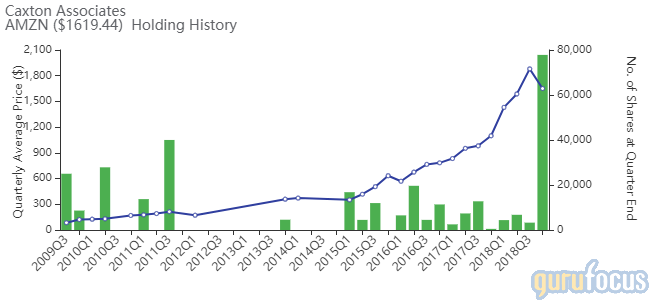

The firm boosted its Amazon.com Inc. (AMZN) holding by 2,282.7%, impacting the portfolio by 17.73%.

The online retailer has a market cap of $795.47 billion and an enterprise value of $794.01 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 28.48% and return on assets of 7.21% are outperforming 65% of companies in the Global Specialty Retail industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.04 is above the industry median of 0.99.

The company's largest guru shareholder is Ken Fisher (Trades, Portfolio) with 0.33% of outstanding shares, followed by Frank Sands (Trades, Portfolio) with 0.28%, Spiros Segalas (Trades, Portfolio) with 0.21% and Chase Coleman (Trades, Portfolio) with 0.15%.

The Alibaba Group Holding Ltd. (BABA) position was expanded 74.49%, impacting the portfolio by 5.61%.

The Chinese e-commerce company has a market cap of $441.5 billion and an enterprise value of $447.69 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 17.09% and return on assets of 8.62% are outperforming 83% of companies in the Global Specialty Retail industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.47 is above the industry median of 0.99.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 0.59% of outstanding shares, followed by the Sands with 0.58%, Fisher with 0.44% and Andreas Halvorsen with 0.39%.

The firm boosted its holding of American International Group Inc. (AIG) by 2,292.6%. The portfolio was impacted by 1.34%.

The insurance company has a market cap of $37.4 billion and an enterprise value of $60.34 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -0.01% is underperforming 96% of companies in the Global Insurance - Diversified industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.08.

Hotchkis & Wiley is the largest guru shareholder of the company with 2.81% of outstanding shares, followed by First Pacific Advisors (Trades, Portfolio) with 1.75%, Richard Pzena (Trades, Portfolio) with 1.36% and Steven Romick (Trades, Portfolio) with 1.28%.

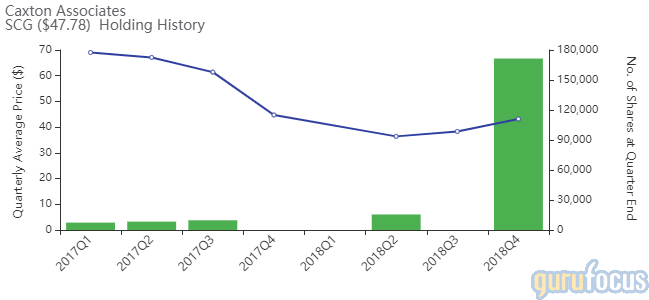

Caxton established a new position in Scana Corp. (SCG), buying 171,453 shares. The traded impacted the portfolio by 1.30%.

The company, which generates and sells electricity and natural gas, has a market cap of $6.81 billion and an enterprise value of $13.42 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -3.71% and return on assets of -1.06% are underperforming 91% of the companies in the Global Internet Content and Information industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.07 is below the industry median of 0.23.

Another notable guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.06% of outstanding shares, followed by Paul Tudor Jones (Trades, Portfolio) with 0.01% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.01%.

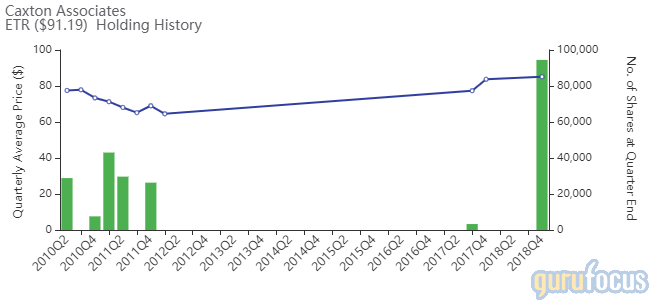

The firm invested in a 94,495-share holding of Entergy Corp. (ETR). The trade had an impact of 1.29% on the portfolio.

The electric company has a market cap of $17.14 billion and an enterprise value of $34.79 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 10.29% and return on assets of 1.81% are outperforming 81% of companies in the Global Utilities - Diversified industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.03 is below the industry median of 0.23.

Simons' firm is the company's largest guru shareholder with 2.06% of outstanding shares, followed by Pzena with 0.2%, Steven Cohen (Trades, Portfolio) with 0.02% and John Hussman (Trades, Portfolio) with 0.02%.

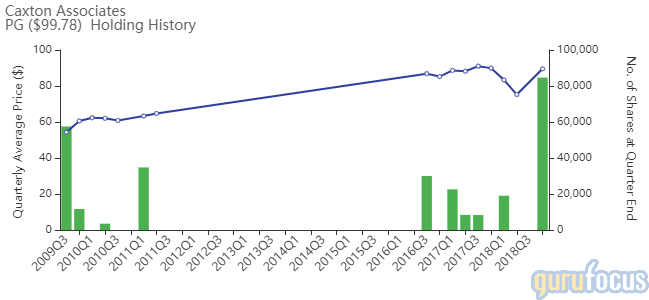

Caxton bought 84,648 shares of Procter & Gamble Co. (PG). The trade had an impact of 1.23% on the portfolio.

The consumer goods company has a market cap of $249.61 billion and an enterprise value of $272.52 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on assets of 19.71% and return of equity of 8.83% are outperforming 79% of companies in the Global Household and Personal Products industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.36 is below the industry median of 0.49.

With 0.49% of outstanding shares, Yacktman Asset Management (Trades, Portfolio) is the company's largest guru shareholder, followed by Fisher with 0.41%, the Yacktman Fund (Trades, Portfolio) with 0.23% and Diamond Hill Capital (Trades, Portfolio) with 0.1%.

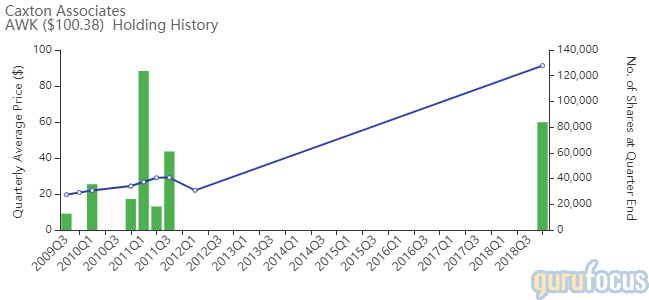

The firm picked up 83,849 shares of American Water Works Co. Inc. (AWK). The trade had an impact of 1.21% on the portfolio.

The provider of water and wastewater services has a market cap of $18.14 billion and an enterprise value of $26.62 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 10.02% and return on assets of 2.79% are underperforming 62% of companies in the Global Utilities - Regulated Water industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.23.

Simons' firm is the company's largest guru shareholder with 0.63% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio) with 0.02% and Ray Dalio (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Leon Cooperman Sells Alphabet, Microsoft

Largest Insider Trades of the Week

George Soros Exits Aetna, Microsoft

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with AMZN. Click here to check it out.

The intrinsic value of AMZN