Do CB Financial Services' (NASDAQ:CBFV) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like CB Financial Services (NASDAQ:CBFV). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for CB Financial Services

CB Financial Services' Improving Profits

In the last three years CB Financial Services' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, CB Financial Services' EPS grew from US$2.19 to US$4.40, over the previous 12 months. It's a rarity to see 101% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

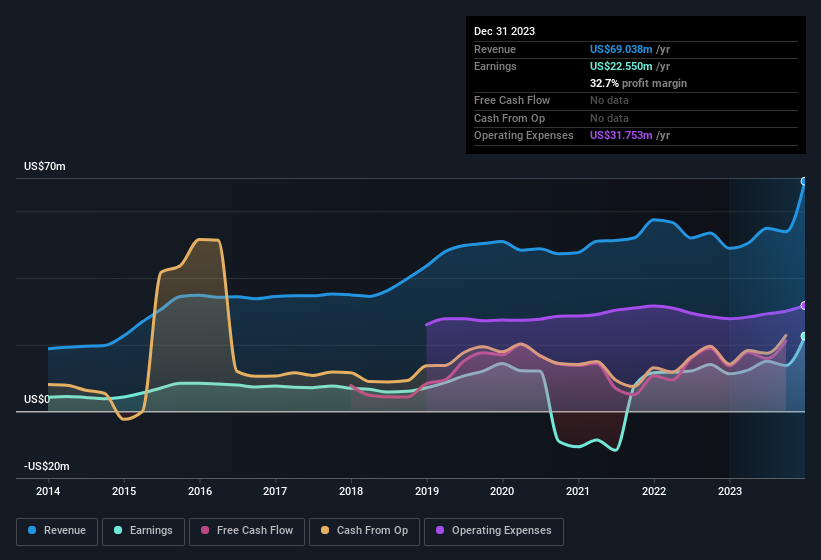

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that CB Financial Services' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for CB Financial Services remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 41% to US$69m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for CB Financial Services?

Are CB Financial Services Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it CB Financial Services shareholders can gain quiet confidence from the fact that insiders shelled out US$232k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Independent Director John LaCarte for US$145k worth of shares, at about US$18.80 per share.

The good news, alongside the insider buying, for CB Financial Services bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$12m worth of shares. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 9.9% of the shares on issue for the business, an appreciable amount considering the market cap.

Is CB Financial Services Worth Keeping An Eye On?

CB Financial Services' earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest CB Financial Services belongs near the top of your watchlist. Still, you should learn about the 1 warning sign we've spotted with CB Financial Services.

The good news is that CB Financial Services is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.