CBAK Energy Technology Inc (CBAT) Reports Mixed 2023 Financial Results

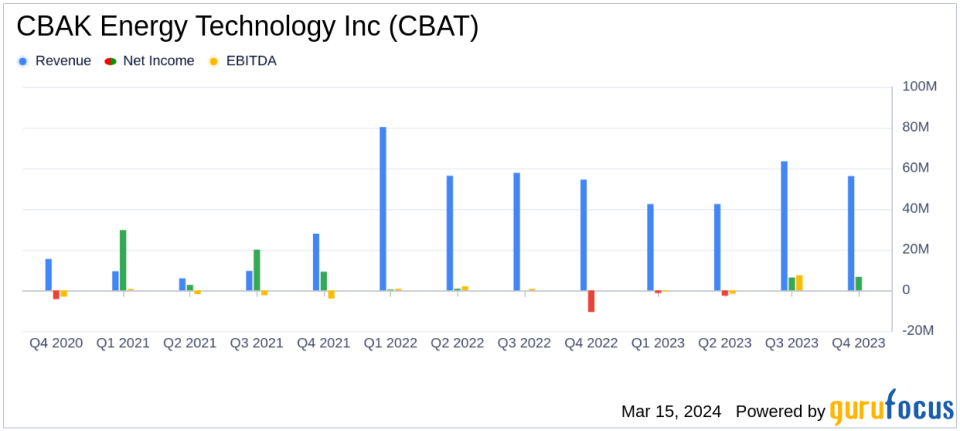

Net Revenues: Decreased by 17.8% year-over-year to $204.4 million in 2023.

Gross Profit: Increased by 75.3% to $31.7 million in 2023, with a gross margin improvement to 15.5%.

Net Income: Net loss attributable to shareholders narrowed to $1.0 million in 2023 from $9.4 million in 2022.

Battery Business: Achieved a 40.4% increase in net revenues and a significant gross margin increase to 23.8% in 2023.

Operating Expenses: Increased by 31.2% to $39.0 million in 2023.

Debt Position: No outstanding secured bank loans as of December 31, 2023.

Outlook: Management confident in growth trajectory and projects net income for the battery business in 2024.

On March 15, 2024, CBAK Energy Technology Inc (NASDAQ:CBAT) released its 8-K filing, unveiling its unaudited financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading lithium-ion battery manufacturer and electric energy solution provider in China, faced a challenging year with a mix of achievements and setbacks.

Company Overview

CBAK Energy Technology Inc is known for its manufacture and distribution of lithium-ion high-power rechargeable batteries, which are primarily utilized in electric vehicles, light electric vehicles, electric tools, energy storage, uninterruptible power supply, and other high-power applications. The company operates mainly in Mainland China and has a presence in Europe, the United States, Korea, and other countries.

Financial Performance and Challenges

The company reported a decrease in net revenues by 17.8% to $204.4 million in 2023 compared to $248.7 million in 2022. This decline was primarily attributed to a slowdown in the raw materials market, which affected sales from Hitrans, a subsidiary of CBAK Energy. Despite this, the company's battery business saw a significant increase in net revenues by 40.4% and a gross margin increase to 23.8% in 2023. The robust performance of the battery business, particularly in residential energy supply and uninterruptible supplies, which saw an 84.3% increase in the fourth quarter, was a highlight in an otherwise challenging year.

Chairman and CEO Yunfei Li expressed satisfaction with the company's strong performance in the fourth quarter, emphasizing the growth of the primary battery business and the strategic move to secure a new facility in Shangqiu city to meet high product demand. CFO Jiewei Li also highlighted the positive net income for the second consecutive quarter and the absence of outstanding secured bank loans, signaling a strong foundation for future growth.

Financial Highlights

The company's financial achievements in 2023, particularly the battery business's record-high gross margin and the reduction in net loss attributable to shareholders, are critical for CBAK Energy as it competes in the industrial products sector. These achievements demonstrate the company's ability to optimize its product mix and manage costs effectively, even in a challenging economic environment.

Cost of revenues decreased by 25.1% from the previous year, contributing to the gross profit increase. Operating expenses, however, increased by 31.2% to $39.0 million, driven by higher research and development, sales and marketing, and general and administrative expenses. The operating loss for the year was $7.3 million, an improvement from an operating loss of $11.5 million in 2022.

"We are delighted to announce a strong performance in the fourth quarter of 2023, concluding the year on a positive note," said Yunfei Li, Chairman and CEO of CBAK Energy.

"Looking ahead to 2024, we are confident in our growth trajectory and project another year of net income for our battery business," added Jiewei Li, CFO of CBAK Energy.

Analysis of Performance

The company's performance in 2023 reflects resilience in its core battery business amidst broader market challenges. The strategic expansion into a new facility and the absence of debt underscore management's proactive approach to growth and financial stability. The positive outlook for 2024, with anticipated net income, suggests that CBAK Energy is positioning itself for a rebound in the coming year.

Value investors may find CBAK Energy's improved gross margins and reduced net loss as positive indicators of the company's potential for long-term value creation. The company's focus on expanding its core businesses and attracting more clients could lead to sustained growth and profitability, making it a company to watch in the industrial products sector.

For more detailed information and to stay updated on CBAK Energy Technology Inc's financial developments, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CBAK Energy Technology Inc for further details.

This article first appeared on GuruFocus.