Cboe Global (CBOE) Q4 Earnings Surpass, Revenues Rise Y/Y

Cboe Global Markets, Inc. CBOE reported fourth-quarter 2023 adjusted earnings of $2.06 per share, which outpaced the Zacks Consensus Estimate by 2%. The bottom line increased 14% year over year.

The quarter witnessed improved adjusted revenues, an increase in net transaction and clearing fees, as well as access and capacity fees, offset by higher expenses.

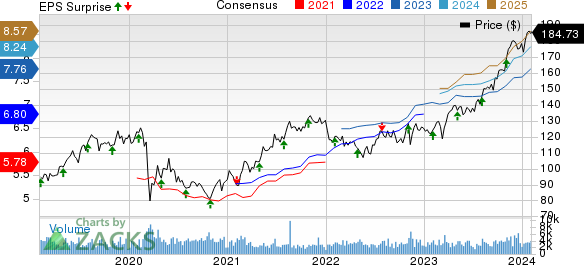

Cboe Global Markets, Inc. Price, Consensus and EPS Surprise

Cboe Global Markets, Inc. price-consensus-eps-surprise-chart | Cboe Global Markets, Inc. Quote

Operational Details

Total adjusted revenues of CBOE Global were $499 million, which increased 9% year over year, driven by a rise in derivatives markets and data and access solutions net revenues, partially offset by a decrease in cash and spot markets net revenues. The top line missed the consensus mark by 1.2%.

Options revenues climbed 15% year over year to $314.5 million. The growth was driven by an increase in net transaction and clearing fees, as well as growth in access and capacity fees.

Revenues of North American Equities totaled $86.3 million, down 10% year over year, mainly due to lower net transaction and clearing fees and industry market data.

Europe and Asia Pacific revenues increased 9% year over year to $48 million, driven by double-digit non-transaction revenue growth led by higher market data fees, access and capacity fees, and other revenues.

Futures net revenues increased 21% year over year to $32.4 million due to double-digit increases in net transaction and clearing fees and market data fees.

Global FX net revenues rose 12% year over year to $18.9 million, driven by higher net transaction and clearing fees.

Digital revenues were negative $1.1 million.

Adjusted operating expenses were $191.7 million, which increased 9% year over year, primarily due to higher compensation and benefits and technology support services. The increase was partially offset by a decline in other expenses, depreciation and amortization, and professional fees and outside services. Our estimate was $202.2 million.

Adjusted operating income grew 10% year over year to $307.3 million. Our estimate was $280.3 million.

Adjusted operating margin came in at 61.6%, which expanded 20 basis points (bps) year over year. Adjusted EBITDA margin of 64.3% expanded 40 bps year over year.

Financial Update

CBOE Global exited the fourth quarter with cash and cash equivalents of $543.2 million, which increased 25.5% from the 2022-end level. As of Dec 31, 2023, total assets of $7.5 billion rose 7% from the 2022-end figure.

CBOE’s long-term debt was $1.4 billion, up 0.1% from Dec 31, 2022. Total shareholders’ equity was $3.9 billion, up 15% from the Dec 31, 2022 figure.

Share Repurchase and Dividend Update

In the fourth quarter, CBOE Global paid out cash dividends worth $58.5 million or 55 cents per share.

CBOE Global utilized $5.8 million to repurchase shares under its share repurchase program. As of Dec 31, 2023, CBOE had about $384 million of availability remaining under its existing share repurchase authorizations.

2024 Guidance Reaffirmed

CBOE anticipates organic total net revenue growth in the range of 5-7% in 2024, in line with medium-term organic total net revenue expectations.

Organic net revenues from Data and Access Solutions are expected to increase by approximately 7% to 10% in 2024, which is in line with medium-term guidance expectations.

Adjusted operating expenses in 2024 are expected in the range of $798-$808 million. The guidance excludes the expected amortization of acquired intangible assets of $93 million. The company reflects the exclusion of this amount in its non-GAAP reconciliation.

Depreciation and amortization expense is expected in the range of $43-$47 million, excluding the expected amortization of acquired intangible assets.

Other income (expense) from minority investments is expected to contribute between $37 million and $43 million in 2024.

The effective tax rate on adjusted earnings is expected in the range of 28.5-30.5%.

Capital expenditures are expected in the band of $51-$57 million.

Zacks Rank

CBOE Global currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Securities and Exchanges

MarketAxess Holdings Inc. MKTX reported strong fourth-quarter 2023 results aided by higher commissions and trading volumes. Continued solid Eurobonds’ performance further aided its business. The positives were partially offset by an elevated expense level and a lower High-yield credit trading.

Its fourth-quarter 2023 earnings per share of $1.84 beat the Zacks Consensus Estimate by 7%. Moreover, the bottom line increased from $1.58 per share a year ago. Total revenues increased 10.9% year over year to $197.2 million in the quarter under review. Also, the top line beat the consensus mark by 0.7%.

Nasdaq NDAQ reported fourth-quarter 2023 adjusted earnings per share of 72 cents, beating the Zacks Consensus Estimate by 2.9%. The bottom line improved 12.5% year over year. Nasdaq’s revenues of $1.1 billion increased 23% year over year. The upside can primarily be attributed to a 7% impact from organic growth, net benefit from acquisitions and divestitures, including Adenza, and a $4 million increase from the impact of changes in FX rates. The top line beat the Zacks Consensus Estimate by 5%.

Annualized Recurring Revenue (ARR) increased 29% year over year. Annualized SaaS revenues increased 23% and represented 35% of ARR. Market Services net revenues were $247 million, up 1%. The increase reflects $1 million in organic growth and a $1 million positive impact from changes in FX rates. Revenues at the Solutions business increased 32% year over year to $860 million, reflecting growth from the Capital Access Platforms and Financial Technology divisions. Organic growth was 9%.

Upcoming Release

CME Group Inc. CME is slated to release fourth-quarter 2023 earnings on Feb 14. The Zacks Consensus Estimate for the fourth quarter is pegged at $2.27 per share, indicating an increase of 18.2% from the year-ago reported figure.

CME Group’s earnings beat estimates in each of the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report