Cboe Global Markets Inc Reports Notable Revenue and Earnings Growth in Q4 and Full Year 2023

Total Revenues Less Cost of Revenues: Increased by 9% to $499.0 million in Q4 2023.

Operating Income: Rose by 17% to $294.0 million in Q4 2023.

Net Income Allocated to Common Stockholders: Grew by 33% to $210.8 million in Q4 2023.

Diluted Earnings Per Share (EPS): Increased by 33% to $1.98 in Q4 2023.

Adjusted Operating Expenses: Expected to grow in the 6-8% range for 2024.

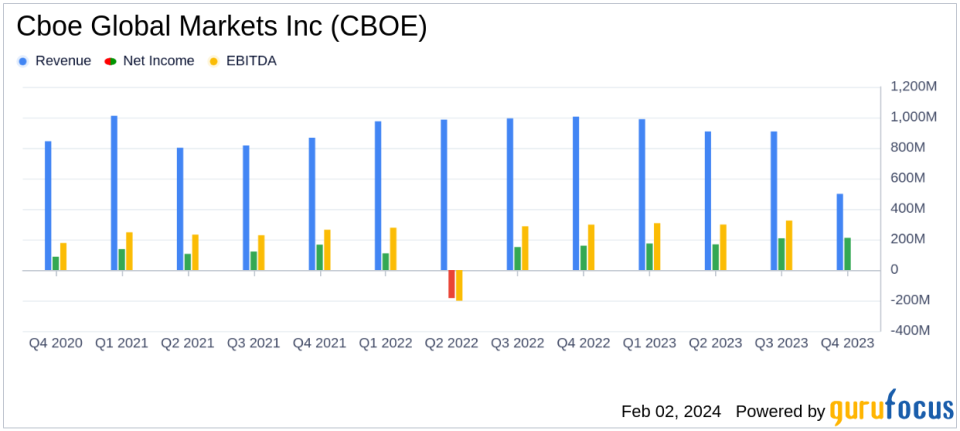

On February 2, 2024, Cboe Global Markets Inc (CBOE) released its 8-K filing, announcing financial results for the fourth quarter of 2023 and the full year. The company, a leading provider of market infrastructure and tradable products, reported a year of robust revenue growth and financial results, with a particular strength in its Derivatives and Data and Access Solutions segments.

Financial Highlights and Business Segment Performance

CBOE's net revenue saw a 10% increase, while adjusted diluted EPS grew by 13% for the year. The company's Derivatives segment experienced a 21% growth in net revenues, and the Data and Access Solutions segment grew by 9%. However, the Cash and Spot Markets faced headwinds due to a challenging volume environment for global cash equity markets. Despite this, CBOE anticipates an average organic total net revenue growth of 5-7% for 2024, aligning with medium-term guidance.

The fourth quarter results were particularly strong, with record net revenues and a significant increase in earnings. Operating income for Q4 2023 was $294.0 million, up 17% from the same period in the previous year, and net income allocated to common stockholders rose by 33% to $210.8 million. Diluted EPS also saw a substantial increase of 33%, reaching $1.98.

Capital Management and Shareholder Returns

As of December 31, 2023, CBOE had adjusted cash of $533.5 million and reduced its total debt by $74.4 million from the previous quarter. The company paid dividends of $58.5 million, or $0.55 per share, during the fourth quarter and repurchased approximately 34 thousand shares of its common stock at an average price of $173.59 per share. With $384.0 million available under its share repurchase authorizations, CBOE continues to demonstrate its commitment to returning value to shareholders.

Strategic Initiatives and Outlook for 2024

CEO Fredric Tomczyk expressed satisfaction with the progress on strategic initiatives and the company's positioning for 2024. CBOE plans to leverage its global derivatives and securities network, technology, and product innovation to drive further revenue growth and financial results. CFO Jill Griebenow highlighted the company's disciplined expense management, targeting expense growth in the 6-8% range for the year.

Overall, CBOE's performance in 2023 and its strategic outlook for 2024 reflect a company that is not only navigating market challenges but also capitalizing on opportunities to enhance its offerings and deliver value to its stakeholders.

About Cboe Global Markets

Cboe Global Markets is the worlds leading derivatives and securities exchange network, providing innovative trading, clearing, and investment solutions globally. The company operates a trusted, inclusive marketplace and offers trading solutions in equities, derivatives, FX, and digital assets across North America, Europe, and Asia Pacific.

For more detailed information, including the full financial tables and reconciliation of GAAP to non-GAAP results, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Cboe Global Markets Inc for further details.

This article first appeared on GuruFocus.