CBRE Group Inc (CBRE) Posts Mixed Results for Q4 and Full Year 2023

Q4 GAAP EPS: Increased to $1.55, a significant rise from $0.25 in Q4 2022.

Full Year GAAP EPS: Declined to $3.15, down from $4.29 in the previous year.

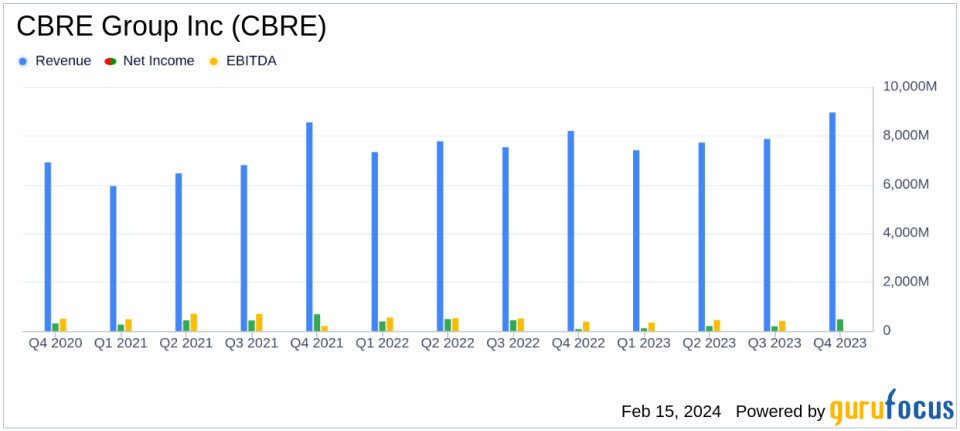

Revenue: Q4 saw a 9.2% increase to $8,950 million, while full-year revenue grew by 3.6% to $31,949 million.

Net Income: GAAP net income for Q4 skyrocketed by 487.9% to $477 million, but annual GAAP net income fell by 30.0% to $986 million.

Free Cash Flow: Q4 free cash flow improved by 6.2% to $759 million, but there was a significant annual decline of 87.2% to $175 million.

Core EPS: Q4 core EPS increased modestly to $1.38, while the full-year core EPS decreased by 32.5% to $3.84.

2024 Outlook: CBRE forecasts core EPS of $4.25 to $4.65, indicating mid-teens percentage growth at the midpoint.

On February 15, 2024, CBRE Group Inc (NYSE:CBRE) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a global leader in real estate services and investment, operates across more than 100 countries, providing services such as property management, investment management, and strategic consulting.

Performance Highlights and Challenges

CBRE's Q4 performance showcased a robust increase in GAAP EPS, attributed to operating profit growth across all business segments. However, the full-year figures painted a different picture, with declines in both GAAP EPS and core EPS. This dichotomy underscores the challenges faced by the real estate sector, particularly those businesses sensitive to interest rates and debt availability.

Despite these challenges, CBRE managed to deliver the third-highest full-year earnings in its history, demonstrating the resilience of its diversified business model. The company's ability to navigate a difficult year for commercial real estate is a testament to its operational strength and strategic positioning.

Financial Achievements and Industry Significance

CBRE's financial achievements, particularly the growth in Q4 revenue and operating profit, are significant in an industry that has been grappling with economic headwinds. The company's performance is indicative of its strong market position and ability to capitalize on growth opportunities even in a challenging environment.

The increase in net revenue and segment operating profit margins in the Advisory Services and Global Workplace Solutions (GWS) segments highlight CBRE's ability to generate value from its core services. The Real Estate Investments (REI) segment also saw impressive growth, with a surge in operating profit and an increase in Assets Under Management (AUM), which now total $147.5 billion.

Key Financial Metrics and Commentary

CBRE's financial results reveal several key metrics that are vital to understanding the company's performance:

"We ended 2023 on a high note with fourth quarter year-over-year operating profit growth across all three of our business segments," said Bob Sulentic, CBREs chair and chief executive officer.

This statement reflects the company's strong finish to the year, despite the full-year earnings being overshadowed by market-driven revenue declines in certain segments.

CBRE's balance sheet remains healthy, with a net leverage ratio of 0.71x, significantly below the company's primary debt covenant. The company also reported substantial liquidity, with approximately $4.9 billion available at year-end 2023.

Analysis of CBRE's Performance

CBRE's mixed financial results for 2023 highlight the company's resilience in a challenging market. The strong Q4 performance, particularly in GAAP EPS and operating profit, suggests that CBRE is well-positioned to capitalize on market recovery. However, the full-year declines in core EPS and net income indicate that the company is not immune to broader market trends.

The company's outlook for 2024, with expected core EPS growth, suggests confidence in its business strategy and market conditions. CBRE's continued investment in acquisitions and its robust free cash flow generation provide a solid foundation for future growth.

Overall, CBRE's ability to deliver solid results in a difficult year underscores the strength of its diversified service offerings and global presence. Investors and stakeholders will be watching closely to see if the company can maintain its momentum and achieve its projected growth in 2024.

For more detailed information and analysis on CBRE Group Inc's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CBRE Group Inc for further details.

This article first appeared on GuruFocus.