Cedar Fair LP (FUN) Reports Mixed Results Amidst Merger Developments

Net Revenues: Q4 net revenues reached a record $371 million, a slight increase from the previous year.

Net Income: A net loss of $10 million in Q4, compared to a net income of $12 million in the same quarter last year.

Adjusted EBITDA: Slight increase to $89 million in Q4, indicative of stable operating performance.

Attendance: Record attendance of 5.8 million guests in Q4, a 9% increase year-over-year.

Per Capita Spending: In-park per capita spending decreased by 7% in Q4.

Out-of-Park Revenues: Achieved a record $43 million in Q4, up 7% year-over-year.

Proposed Merger: Transaction costs related to the proposed merger with Six Flags impacted earnings.

On February 15, 2024, Cedar Fair LP (NYSE:FUN) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, a leader in regional amusement parks, water parks, and immersive entertainment, reported a mix of achievements and challenges in its latest earnings release.

Cedar Fair LP operates a diverse portfolio of amusement park-resorts across the United States and Canada, including renowned destinations such as Cedar Point and Knott's Berry Farm. The company generates revenue from park admissions, parking fees, in-park purchases, accommodations, and other entertainment services.

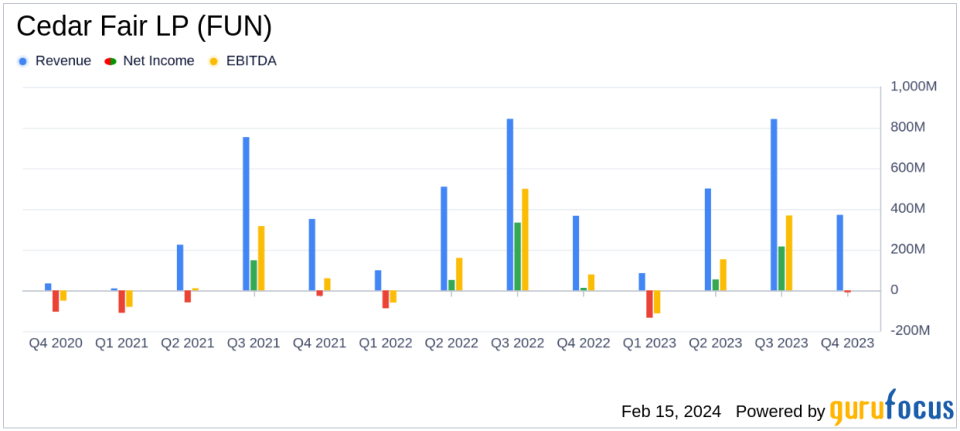

Despite a record fourth-quarter attendance, Cedar Fair LP faced a net loss of $10 million, primarily due to $17 million in transaction costs associated with the proposed merger with Six Flags. This compares unfavorably to the net income of $12 million reported in the fourth quarter of the previous year. However, the company's Adjusted EBITDA saw a modest increase to $89 million, reflecting a resilient operating performance amidst the merger proceedings.

Financial Performance Insights

The company's financial achievements, including a record $371 million in net revenues during the fourth quarter, underscore the strength of Cedar Fair LP's business model in the Travel & Leisure industry. The robust trends in long-lead indicators, such as 2024 season pass sales, signal a positive outlook for continued growth and value creation.

However, the full-year results painted a more nuanced picture. Net revenues for 2023 totaled $1.80 billion, a slight decrease from $1.82 billion in 2022. Net income for the year was $125 million, a significant drop from the $308 million reported in the previous year, largely due to the one-time gain from the sale of land at California's Great America in 2022 and the aforementioned merger-related costs.

Attendance for the year slightly declined to 26.7 million guests, and in-park per capita spending also saw a minor decrease. Conversely, out-of-park revenues reached a record $223 million, marking a 5% increase from 2022. This growth reflects the strong performance of the company's resort properties and the successful reopening of renovated resorts.

On the balance sheet, net debt as of December 31, 2023, stood at $2.2 billion, with the company maintaining $65 million in cash and cash equivalents. Cedar Fair's Board of Directors declared a quarterly cash distribution of $0.30 per LP unit, payable on March 20, 2024, demonstrating confidence in the company's financial stability and commitment to delivering shareholder value.

"With the return to more normal operating conditions in the back half of 2023, the strength and resiliency of Cedar Fairs business model was on full display," said Cedar Fair CEO Richard Zimmerman. "We remained nimble and successfully adapted to an evolving marketplace to offset the effects of anomalous macro-factors, including weather, on demand during the first half of the year."

As Cedar Fair LP navigates the proposed merger with Six Flags, the company's performance reflects both the potential for growth and the challenges of strategic corporate actions. Investors and stakeholders will be watching closely as Cedar Fair LP aims to complete the merger in the first half of 2024, anticipating the combined company's enhanced ability to deliver compelling value creation opportunities.

For a more detailed analysis of Cedar Fair LP's financial results and the potential implications of the proposed merger with Six Flags, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Cedar Fair LP for further details.

This article first appeared on GuruFocus.