Celanese (CE) Up 15% in 3 Months: What's Driving the Stock?

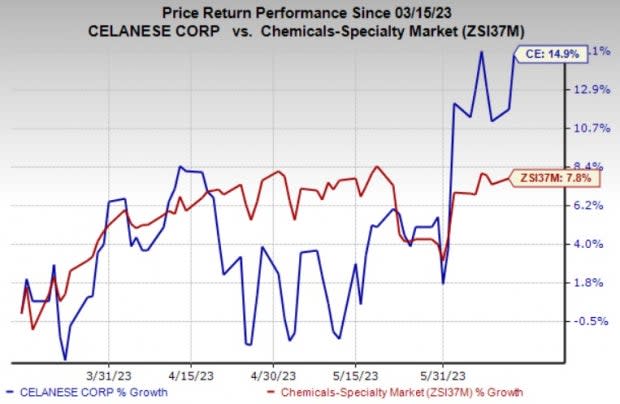

Celanese Corporation’s CE shares have popped 14.9% over the past three months. The company has also outperformed its industry’s rise of 7.8% over the same time frame. It has also topped the S&P 500’s 11.7% rise over the same period.

Let’s dive into the factors behind this leading chemical and specialty materials maker’s stock price appreciation.

Image Source: Zacks Investment Research

Acquisitions & Productivity Aid CE

Celanese, a Zacks Rank #3 (Hold) stock, is benefiting from its cost and productivity actions, investments in high-return organic projects and synergies of acquisitions.

The company continues to actively pursue acquisitions, which are providing it opportunities for additional growth, investment and synergies. The buyout of the majority of DuPont’s Mobility & Materials (“M&M”) business also enables Celanese to enhance its growth in high-value applications. The company expects M&M to contribute $130-$140 million to its operating EBITDA in second-quarter 2023.

Moreover, the purchase of Exxon Mobil's Santoprene business broadens the company’s portfolio of engineered solutions and enables it to offer a wider range of functionalized solutions to targeted growth areas, including future mobility, medical and sustainability.

The acquisitions of SO.F.TER., Nilit and Omni Plastics are also expected to contribute to earnings expansion in the company's Engineered Materials segment. The Elotex acquisition also strengthened the company’s position in the vinyl acetate ethylene emulsions space. The buyout is expected to contribute to volumes in the Acetyl Chain segment.

Celanese also remains focused on executing its productivity programs that include the implementation of a number of cost reduction capital projects. Productivity actions are expected to support to its margins in 2023.

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include L.B. Foster Company FSTR, Gold Fields Limited GFI, and Linde plc LIN.

L.B. Foster currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for FSTR's current-year earnings has been stable over the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

L.B. Foster’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 140.5%, on average. FSTR has gained around 10% in a year.

Gold Fields currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for GFI’s current-year earnings has been revised 4% upward in the past 60 days.

The consensus estimate for current-year earnings for GFI is currently pegged at $1.05, reflecting an expected year-over-year growth of 8.3%. Gold Fields’ shares have popped roughly 58% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 4.4% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN’s shares have gained roughly 24% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report