Celanese (CE) & Glaukos Join Forces for Glaucoma Treatment

Celanese Corporation CE has signed a deal with Glaukos Corporation to supply its VitalDose Drug Delivery Platform. This platform will be included in Glaukos’ iDose TR, a micro-invasive intraocular implant designed to decrease intraocular pressure in patients with primary open-angle glaucoma or ocular hypertension.

The iDose TR aims to address the problem of non-adherence to topical medications and associated chronic side effects by providing continuous, long-lasting therapy for 24 hours a day. Currently, Glaukos is awaiting approval by the U.S. Food and Drug Administration of the New Drug Application it submitted for iDose TR in February 2023.

Treating glaucoma through sustained delivery of therapeutics has gained significant importance over time. The VitalDose Drug Delivery Platform offers a promising solution by enabling continuous dosing, which can effectively mitigate challenges related to patient compliance and adherence.

Celanese stated that its mission to enhance the health of individuals with chronic eye diseases in the field of ophthalmology is furthered by integrating the VitalDose Platform into Glaukos' iDose TR therapy. The company is also enthusiastic about assisting Glaukos in its efforts to introduce iDose TR to patients seeking a new alternative to glaucoma treatment.

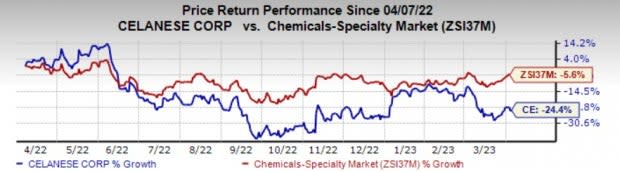

Shares of Celanese have lost 24.4% over a year compared with a 5.6% fall recorded by its industry.

Image Source: Zacks Investment Research

CE, on its fourth-quarter call, said that it expects growth in its quarterly earnings through 2023 on an improvement in demand and the synergies resulting from the Mobility & Materials acquisition. Factoring in all this, it expects its adjusted earnings to be in the range of $1.50-$1.75 per share for the first quarter of 2023.

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Zacks Rank & Key Picks

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Olympic Steel, Inc. ZEUS, Steel Dynamics, Inc. STLD and Linde plc LIN. LIN currently carries a Zacks Rank #2 (Buy), while ZEUS and STLD sport a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s shares have gained 35.6% in the past year. The Zacks Consensus Estimate for ZEUS’ current-year earnings has been revised 33.1% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

Steel Dynamic’s shares have gained 23.4% in the past year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 31% upward in the past 60 days. It topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 11.3% on average.

Linde’s shares have gained 11.8% in the past year. The company has an expected earnings growth rate of 8.1% for the current year. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

LIN topped the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 6% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report