Celanese (CE) Q3 Earnings Surpass Estimates, Sales Miss

Celanese Corporation CE reported earnings from continuing operations of $8.70 per share in third-quarter 2023, up from $1.76 in the prior-year quarter.

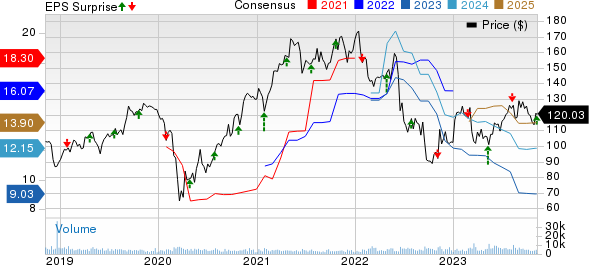

Adjusted earnings in the third quarter were $2.50 per share, down 36.5% from $3.94 reported a year ago. The bottom line beat the Zacks Consensus Estimate of $2.20.

Revenues of $2,723 million increased roughly 18.3% year over year. However, revenues missed the Zacks Consensus Estimate of $2,757.1 million.

Celanese implemented measures to lower expenses, synchronize production and inventory with market demand and boost cash flow generation in light of challenging demand conditions and competitive factors in the reported quarter.

Celanese Corporation Price, Consensus and EPS Surprise

Celanese Corporation price-consensus-eps-surprise-chart | Celanese Corporation Quote

Segment Highlights

Net sales in the Engineered Materials unit were $1,528 million in the reported quarter, up around 64% year over year. It beat our estimate of $1,461.6 million. The segment reported an operating profit of $691 million and an adjusted EBIT of $229 million in the third quarter.

The Acetyl Chain segment posted net sales of $1,220 million, down nearly 12.7% year over year. It lagged our estimate of $1,278.3 million. The segment generated an operating profit of $272 million and an adjusted EBIT of $310 million in the third quarter.

Financials

Celanese ended the quarter with cash and cash equivalents of $1,357 million, up roughly 5% sequentially. Long-term debt was down around 4.6% sequentially to $12,291 million.

Cash provided by operating activities was $403 million and free cash flow was $268 million in the reported quarter. Capital expenditures were $131 million in the quarter.

Outlook

Celanese expects adjusted earnings in the range of $2.10-$2.50 per share for the fourth quarter of 2023. The projection includes the expected roughly 30 cents impact from the M&M amortization. For the full year, Celanese anticipates adjusted earnings at the bottom end of the guidance range of $9-$10, which includes approximately $1.20 per share of M&M transaction amortization.

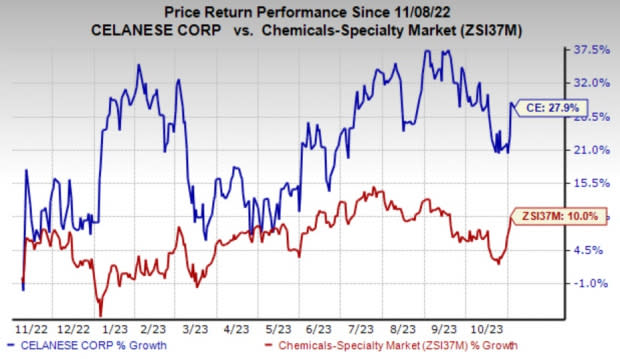

Price Performance

Celanese’s shares have gained 27.9% in the past year compared with a 10% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are The Andersons Inc. ANDE and Carpenter Technology Corporation CRS, each sporting a Zacks Rank #1 (Strong Buy) and Linde plc LIN, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANDE’s current-year earnings has been revised 3.3% upward in the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 41.2% in a year.

The consensus estimate for CRS’s current fiscal year earnings is pegged at $3.57, indicating year-over-year growth of 213.2%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have surged 71.7% in the past year.

The consensus estimate for Linde’s current fiscal year earnings is pegged at $14.08, indicating a year-over-year growth of 14.6%. LIN beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 5.7%. The company’s shares have rallied 24.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report