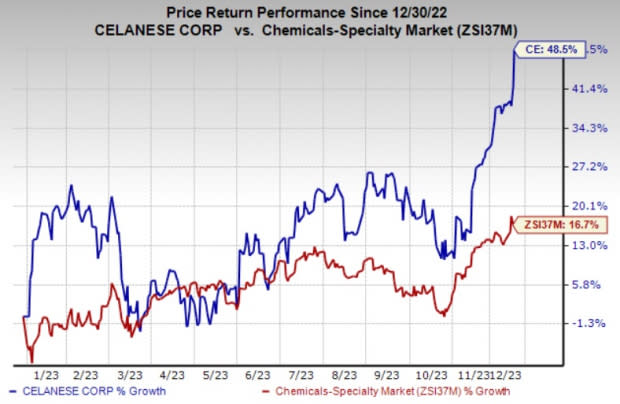

Celanese (CE) Rallies 48% YTD: What's Driving the Stock?

Celanese Corporation’s CE shares have shot up 48.5% year to date. The company has also outperformed its industry’s rise of 16.7% over the same time frame. Moreover, it has topped the S&P 500’s roughly 22.6% rise over the same period.

Let’s dive into the factors behind this Zacks Rank #3 (Hold) stock’s price appreciation.

Image Source: Zacks Investment Research

What’s Aiding CE?

Celanese is gaining from its investments in organic projects, strategic acquisitions and productivity measures amid challenges from weak demand and customer destocking in certain end markets.

The company is actively pursuing acquisitions, which are providing it opportunities for additional growth, investment and synergies. The acquisition of the majority of DuPont’s Mobility & Materials (“M&M”) business has allowed Celanese to enhance its growth in high-value applications. M&M contributed $125 million to the company’s operating EBITDA in third-quarter 2023, up 15% sequentially. Celanese sees a sequential increase in contribution in the fourth quarter.

The acquisitions of SO.F.TER., Nilit and Omni Plastics are also expected to contribute to earnings expansion in the company's Engineered Materials segment. The Elotex acquisition also strengthened the company’s position in the vinyl acetate ethylene emulsions space. Moreover, the purchase of Exxon Mobil's Santoprene business broadened the company’s portfolio of engineered solutions and enables it to offer a wider range of functionalized solutions to targeted growth areas, including future mobility, medical and sustainability.

Celanese also remains focused on executing its productivity programs that include the implementation of a number of cost reduction capital projects. Productivity actions are expected to support to its margins in 2023.

The company is proactively implementing strategic initiatives recognizing the volatility and unpredictability of the current market landscape and competitive environment. These actions involve strengthening its commercial teams, aligning production and inventory levels with prevailing demand, implementing cost-saving measures, and optimizing cash flow.

These endeavors are expected to result in robust cash generation and a continuation of earnings growth. The company's incremental cost actions are expected to deliver $60-$80 million in savings in the second half of 2023.

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and Hawkins, Inc. HWKN.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 57% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current-year earnings has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained around 32% in the past year.

Hawkins has a projected earnings growth rate of 21% for the current year. It currently carries a Zacks Rank #2 (Buy). Hawkins has a trailing four-quarter earnings surprise of roughly 27.5%, on average. HWKN shares have rallied around 86% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report